Insider Brief

- Data from The Quantum Insider’s Intelligence Platform shows quantum technology is decisively shifting toward industrial deployment, with countries and companies installing hardware, building networks and expanding large-scale facilities.

- Governments and corporations accelerated construction of quantum infrastructure — including national networks, regional hubs and room-temperature or photonic systems — signaling a move from laboratory research to real-world integration.

- Looking ahead, investors, companies and policymakers should prioritize quantum networking, global partnerships and infrastructure standards as the sector enters a deployment-driven phase.

Latest data from The Quantum Insider’s Intelligence Platform shows that quantum technologies are making a quiet but decisive shift, moving from a research-driven field into one defined by deployment, construction and commercial installation.

Across North America, Europe, Asia and the Middle East, governments and companies committed real money, broke ground on facilities, delivered machines to customers and expanded national networks. In November alone, activity points to a sector now defined less by laboratory milestones and more by industrial use, infrastructure, and regional competition.

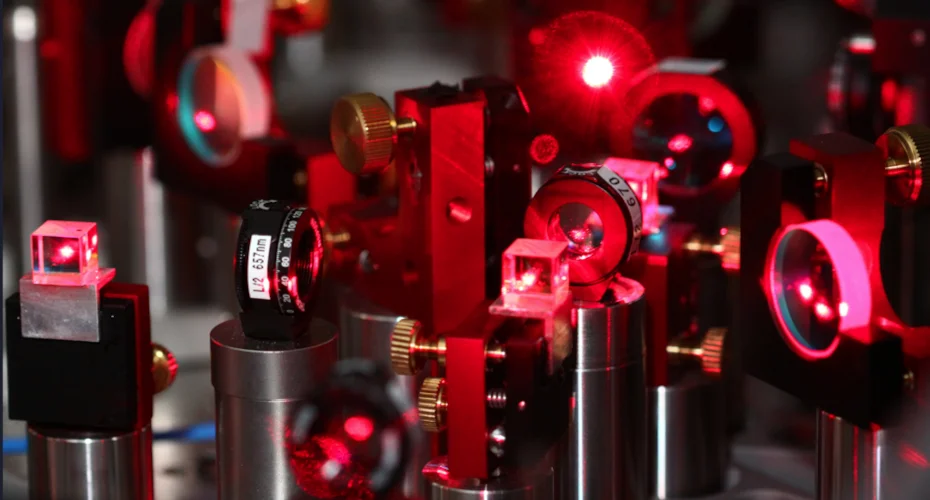

China’s Hanyuan-1 atomic quantum computer recorded its first commercial sales, including a delivery to a China Mobile subsidiary and an order from Pakistan valued at more than 40 million yuan. The system operates at room temperature, uses neutrally charged atoms steered by lasers and fits into standard server-rack configurations.

That combination — commercial sales, room-temperature operation and mass production — positions China as one of the first nations to push quantum hardware into the marketplace at scale. Chinese researchers framed the system’s value in pragmatic terms. Rather than chasing headline qubit counts, the scientists emphasized energy efficiency, low maintenance, and near-term applications such as logistics and financial modeling.

Global Industry-Government Partnerships

Other countries responded with moves of their own. Singapore announced an agreement with Quantinuum that will make the city-state the first market outside the U.S. to host the company’s Helios quantum computer. The partnership includes a new R&D and operations center, feeding into Singapore’s broader national quantum strategy.

In Saudi Arabia, a collaboration between Aramco and Pasqal delivered the kingdom’s first quantum computer, signaling a push into quantum-powered industrial optimization. In one of the clearest signs yet of the technology reaching new regions. South Africa launched a national center focused on quantum computing and technology at the University of KwaZulu-Natal.

Photonic Lights The Way

Photonic and room-temperature systems were especially prominent throughout the month. The French-German consortium of Quandela and attocube delivered Lucy, a 12-qubit photonic system integrated into the Joliot-Curie supercomputer in France. The system’s design will allow hybrid high-performance computing and quantum workloads to run side by side, reflecting one of the most practical forms of near-term quantum deployment.

In Canada and Europe more broadly, photonic systems continued gaining traction as a path toward modularity and lower operating costs. And in North America, several companies advanced on similar lines, including SkyWater Technology and Silicon Quantum Computing, which announced a partnership combining U.S.-based semiconductor manufacturing with Australia’s atomically engineered quantum processors.

The United States leaned heavily into large-scale infrastructure.

Illinois broke ground on the Illinois Quantum and Microelectronics Park, a 128-acre campus anchored by PsiQuantum. The project includes a cryogenic cooling facility, research labs, and spaces designed to support faculty, companies and national laboratories.

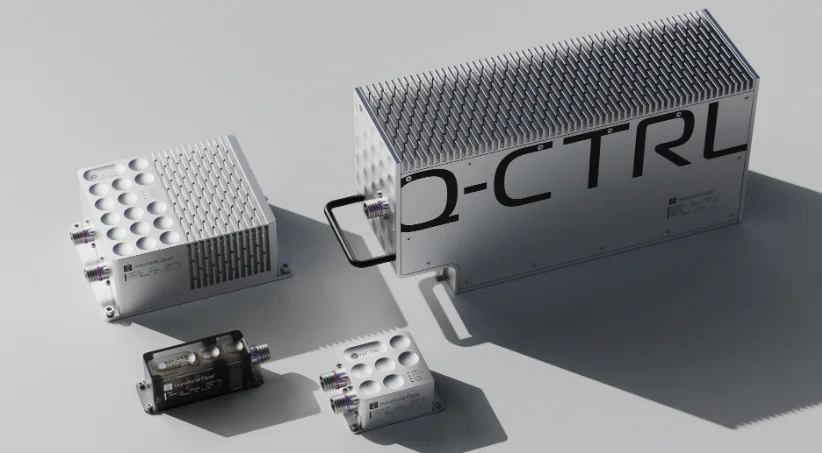

IonQ signed a major agreement with the University of Chicago to establish a new center on campus and deploy a next-generation system connected to an entanglement distribution network. And the Department of Energy renewed $625 million in funding for its five National Quantum Information Science Research Centers, extending the federal government’s multi-year effort to build a national quantum research structure.

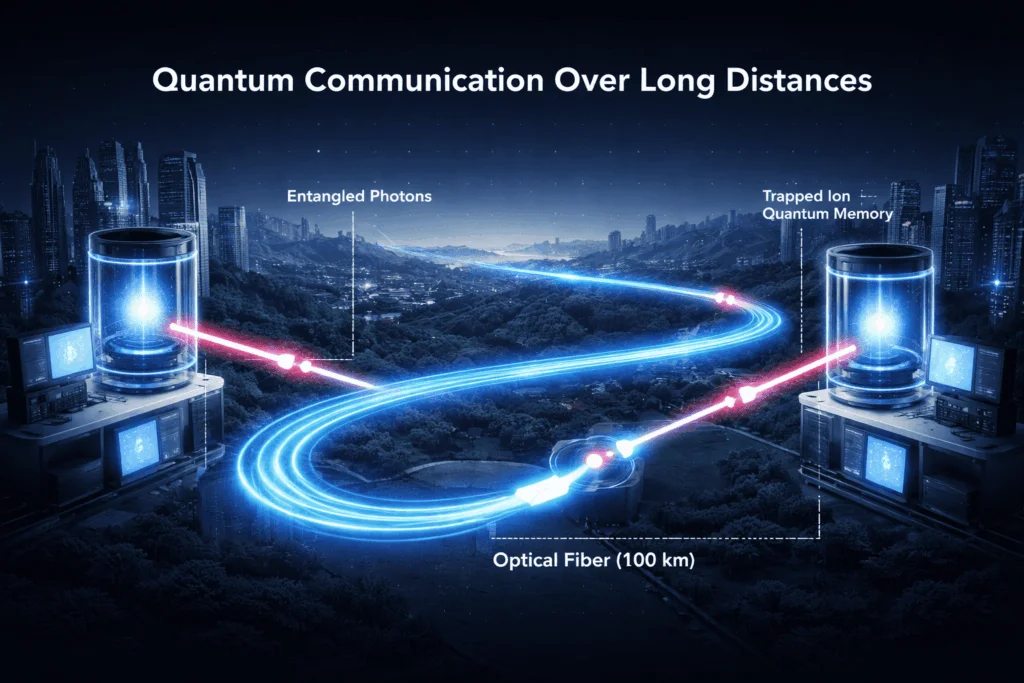

Quantum Networking Advances

Quantum networking — often a missing piece of the industry’s commercialization narrative — emerged as a second major theme.

IonQ and Swiss partners launched the Geneva Quantum Network, connecting institutions including CERN, Rolex and the University of Geneva using quantum key distribution over existing fiber.

New Mexico unveiled its own initiative, ABQ-Net, the state’s first quantum network and the first open-access quantum networking testbed in the United States.

Japan announced plans for a 600-kilometer quantum-encrypted network linking major cities, while the European Union allocated part of its €389 million digital-infrastructure package to cross-border quantum communication lines under the EuroQCI program.

IBM and Cisco also laid out plans to develop a network of large-scale, fault-tolerant quantum computers, supported by microwave-optical transducers and a new software stack designed for distributed computation.

Quantum Construction, Quantum Education

The month also marked an expansion in corporate quantum construction.

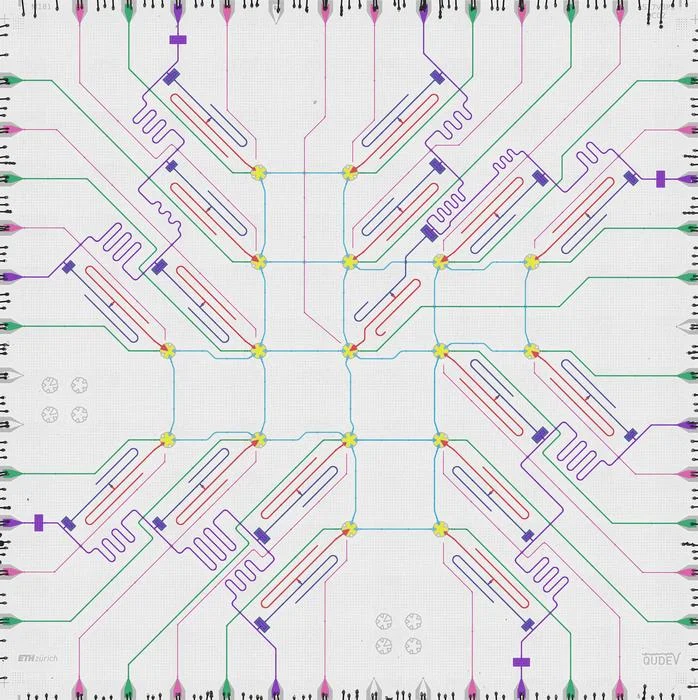

Microsoft completed a major expansion of its Denmark laboratory, now the company’s largest quantum site worldwide and the home of its topological-qubit fabrication work.

Jacobs was selected as the owner’s representative for PsiQuantum’s new Chicago facility, extending its global project portfolio in quantum infrastructure.

Quantum Exponential Group in the U.K. began fundraising for a £100 million venture fund focused on scaling domestic quantum technologies, signaling that venture capital is shifting from seed-stage bets to growth-stage commitments.

Education and workforce efforts mirrored the industrial push.

Palm Beach State College in Florida positioned itself as a training hub as part of a growing statewide interest in quantum, while Nebraska secured a Department of Energy EPSCoR grant to expand research and training in quantum materials. Singapore’s partnership with Quantinuum also includes a talent-development component embedded within its national quantum strategy.

What These Trends Signal for Investors, Companies and Policymakers

This recent activity points to a future in which quantum technology becomes an integrated industrial sector rather than a standalone research field.

The shift carries different implications depending on who is watching. Here is how we see these trends impacting the future and some ideas for investors, companies and policymakers to navigate these fast-moving events:

Investors: Look Beyond Processors — Networking and Infrastructure Are Becoming the Real Moat

The month’s developments suggest that value will increasingly accrue to companies building the connective tissue rather than those focused solely on processors. Quantum networking, cross-border communications infrastructure and hybrid quantum-HPC systems appeared in more announcements than qubit breakthroughs. Investors should watch for firms that can turn early networking deployments — like IonQ’s Geneva-based citywide network or New Mexico’s ABQ-Net — into recurring revenue models tied to secure communications, financial infrastructure or scientific collaboration.

Another signal is the growing importance of deployment pathways. Companies capable of operating at room temperature, integrating into existing data-center environments, or pairing with supercomputing systems showed distinct advantages. For investors, due diligence is shifting from speculative qubit potential to the more conventional metrics of industrial adoption: contracts, infrastructure commitments and multi-party partnerships.

Quantum Companies: Expect an Industry Defined by Alliances, Not Isolation

This month showed that the most competitive firms are those embedding themselves into global partnerships.

Quantinuum expanded into Singapore. QuEra deepened alliances in Asia. IonQ linked itself to Swiss research, Florida education, and U.S. national laboratories. Microsoft increased its fabrication footprint in Denmark. These moves indicate that future competitive advantages will come from geographic reach, supply-chain resilience and early positioning inside national or regional ecosystems.

Quantum companies should also track the speed at which governments are standing up new hubs.

Regions like Illinois, New Mexico, and Connecticut are rapidly building physical infrastructure meant to attract anchor tenants. Companies able to secure early roles inside these hubs may gain preferential access to funding, research partners and policy influence. The message seems to be that the next stage of the quantum race will not be won by isolated R&D but by networks of collaborators linking hardware, software, labs and end-users.

Policymakers: Industrial Quantum Will Require Roads, Not Just Research Grants

For governments, the month hinted at a shift from funding basic research toward building industrial-grade infrastructure. With multiple countries now deploying national quantum networks, establishing sovereign computing centers and integrating quantum-ready technology into their telecom and cybersecurity systems, policymakers face questions more familiar to energy, semiconductor and cloud-computing oversight.

The data suggests three policy priorities: First, invest in networking backbones — the infrastructure most nations once viewed as futuristic but that is now appearing in commercial pilots. Second, accelerate workforce development as quantum activity spreads into regions without existing talent pipelines. And third, coordinate standards. With alliances forming across Europe, Asia and North America, governments that fail to align early risk being locked out of cross-border communications frameworks and industrial-supply partnerships.