Insider Brief

- Quantum technology investment in the first five months of 2025 has already reached nearly three-quarters of 2024’s total, indicating a shift toward fewer but significantly larger and more strategic funding rounds.

- Commercial orders for quantum computers totaled $854 million in 2024 — up 70% from 2023 — with vendors selling more units at lower average prices, reflecting wider adoption across sectors and geographies.

- The growing prevalence of multi-year contracts, full-stack system sales and expanding buyer preferences signals that the industry is transitioning from experimental deployments to commercial-scale commitments.

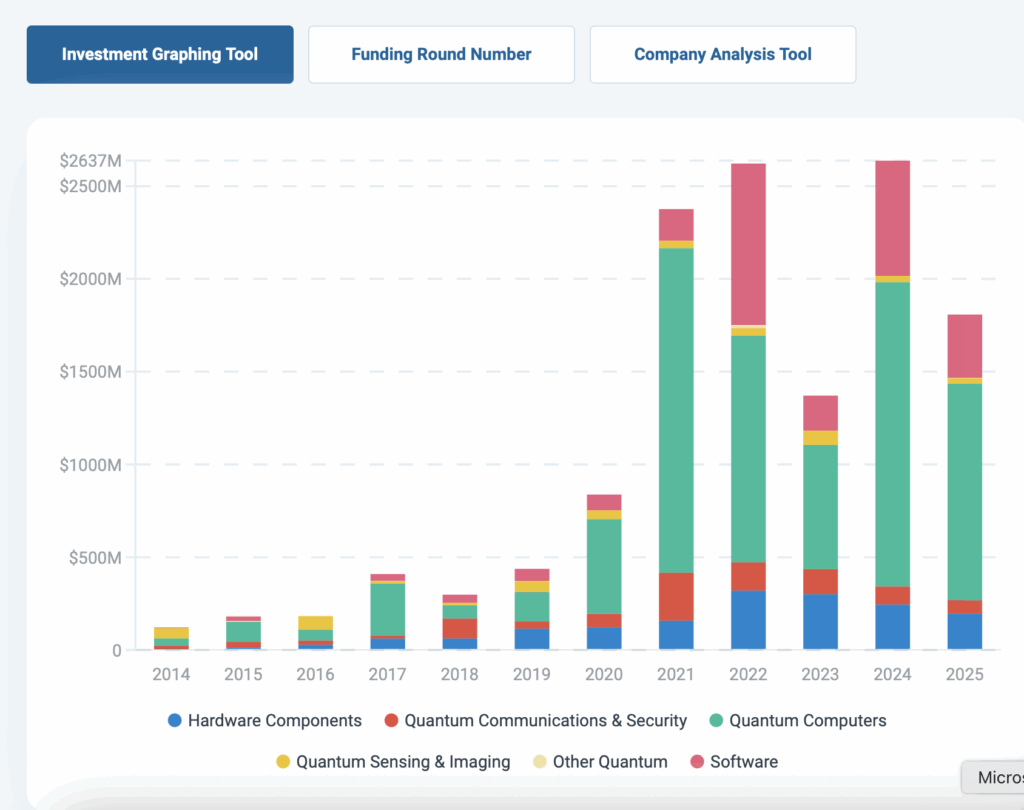

A surge of high-value investments, growing sales and climbing stock prices have marked a strong start to 2025 for the quantum technology industry, possibly suggesting that the industry — and the market — are entering a new phase of commercial maturity.

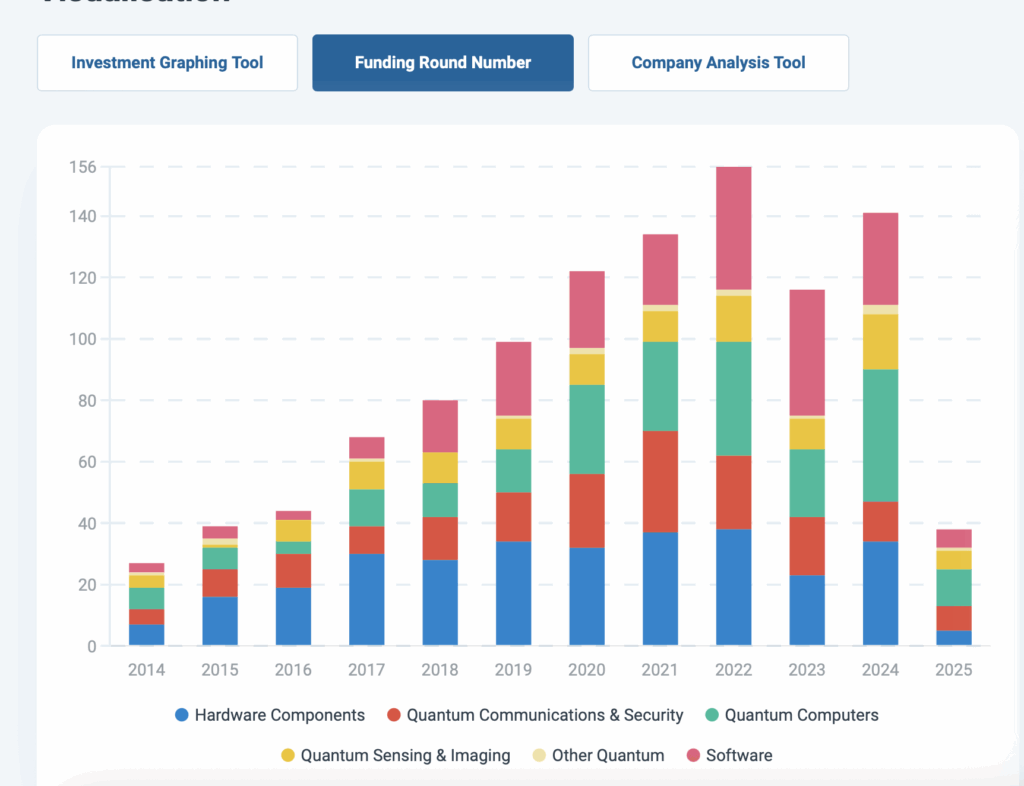

According to new data from The Quantum Insider’s intelligence platform, quantum funding in the first five months of 2025 has already reached 70% of 2024’s total, despite the number of funding rounds standing at only about a quarter of last year’s count. The implication is that the deals getting done are larger, targeted and potentially more strategic.

This rise in deal size echoes broader signs of optimism across the sector. A separate analysis of quantum computer sales compiled by Resonance and published in March shows sustained momentum from 2024 carrying into the new year, with 2024 setting records for both order volume and overall value.

Fewer Rounds, Bigger Bets

To break it down, the chart on funding round numbers shows a sharp increase in average deal size for 2025. While round volume has dropped significantly from its 2022 peak, the total capital raised remains robust. The composition of this year’s activity is skewing toward later-stage or growth-stage financings, a sign that investors may be concentrating capital on companies seen as closer to product delivery or revenue scale.

Sector leaders, such as Infleqtion and QuEra Computing, have attracted significant rounds recently, while companies operating in enabling hardware, photonics, and software layers are also benefitting from deep-pocketed investors making selective, high-confidence bets.

The Quantum Insider’s data show that quantum computers — once the domain of speculative research — are now attracting dollars with clearer commercial logic. Investors appear to be backing companies positioned to meet growing institutional demand.

2024 Was a Record Year for Sales — and 2025 Is Tracking Strong

In a review of commercial orders released this March, Resonance reported that 2024 saw 37 quantum computing orders totaling an estimated $854 million. That represented a 70% increase in order value compared to 2023 and nearly double the number of orders recorded just two years prior.

This growth, however, came with a shift in market dynamics: while more units were sold, the average order value declined, falling to $19 million in 2024 from a peak of $48 million in 2021. This trend suggests that vendors are selling more lower-qubit or demonstration systems and that buyers may be spreading risk across smaller deals.

According to The Quantum Insider’s recent vendor report, available for subscribers to the platform, the early months of 2025 continue to reflect strong activity. The pace of investment suggests that vendors are converting capital into contracts, pushing toward scalable deployments across industries like aerospace, pharmaceuticals, and national defense.

Larger Customers, Longer Commitments

One trend worth keeping an eye on: multi-year contracts and full-stack system sales are becoming more common. These include not only quantum processors (QPUs), but also supporting infrastructure, software, consulting, and training. Vendors such as IBM and Quantinuum are known to sign extended service agreements, sometimes bundling quantum access, hardware upgrades, and cloud-based services.

As The Quantum Insider reports, many of these contracts are not disclosed in real time, but rather filter into public view over quarters. Their internal database, updated regularly with vendor data and expert insights, suggests that nearly 55% of all quantum computer orders since 2012 have occurred in just the last two years—a sign of how rapidly commercial demand is evolving.

Modality Mix Shows Expanding Buyer Preferences

While superconducting systems still dominate in terms of revenue—accounting for around 60% of order value—they represent only about 40% of order volume, indicating that more customers are exploring alternative modalities. Resonance’s data show growing activity in trapped-ion, neutral atom, photonic, and NV diamond systems.

Some of this is driven by emerging markets and new entrants. Companies like IQM and XeedQ have delivered lower-qubit systems to institutions in countries that had previously seen little quantum activity, such as Colombia and Turkey. These “starter systems” may signal a shift in demand patterns, as budget-conscious institutions begin experimenting with smaller-scale deployments.

Stock Prices Reflect Rising Confidence

Public quantum companies have also seen upward movement in 2025. Though the broader tech market has fluctuated, many quantum-related stocks have outperformed expectations. This includes both pure-play quantum firms, such as IonQ and D-Wave, and large-cap companies with quantum divisions, such as Honeywell (which holds a majority stake in Quantinuum) and IBM.

Recent activity — such as acquisitions, new roadmaps, use case partnerships and research advances — show that public companies are tightening focus on commercializing their technology.

The rising investor interest suggests growing confidence that quantum will soon deliver commercial value. In other words, their investing timelines and quantum roadmaps are starting to converge. Vendors are also increasingly positioning themselves not just as hardware sellers but as integrated solution providers capable of solving industry-specific problems in logistics, simulation, materials discovery and secure communication. Quantum companies are also beginning to show that aspects of their technology — such as combining quantum computers with classical super computers and quantum-backed artificial intelligence methods — have the potential to stake claims in the most lucrative markets available today.

Finally, it’s not lost on some investors that quantum technology — which includes sensing, communications and computation — are important to national defense and national security. Because a robust commercial quantum ecosystem is central to the U.S. strategy to remain a leader in quantum techs, it’s not lost on investors that the government will continue to support public and private quantum companies during this transition from research and development to commercialization with grants and contracts.

What’s Driving the Acceleration?

To sum up, analysts point to a combination of factors driving the momentum:

- Strategic capital allocation. The concentration of capital into fewer, larger rounds suggests maturing investor due diligence and a focus on commercialization potential over scientific novelty.

- Supply-side readiness. Vendors have moved beyond prototypes to production, with dozens of systems now in commercial use or committed through signed contracts.

- Diversifying demand. Governments, corporations, and research institutions are no longer just exploring quantum—they’re deploying it. With over 100 quantum systems sold or committed since 2012, the customer base is expanding across geographies and sectors.

- Policy tailwinds. Continued government funding, especially through national quantum strategies in the U.S., Europe, and Asia, is de-risking early adoption and encouraging private-sector involvement.

Outlook: Fewer Bets, Bigger Impact?

If current trends hold, 2025 may surpass 2024 in total investment with far fewer transactions, which experts would suggest is a signal that the market is favoring consolidation and maturity over experimentation. As more enterprise buyers seek quantum solutions, vendors with proven systems and support models are likely to attract the lion’s share of funding.

Still, significant questions remain: Will prices per qubit continue to decline? Can vendors fulfill multi-system orders efficiently? And how will customer satisfaction shape repeat sales?

According to The Quantum Insider’s intelligence platform, the industry is approaching a new stage — less focused on proving quantum works and more concerned with showing how it delivers.

Key Numbers (as of May 2025):

- 70% of 2024’s total investment already reached, with only 25% of rounds completed.

- $854M in orders recorded for 2024, up from $494M in 2023.

- 41 quantum computers sold in 2024, more than double the count in 2021.

- Average order size dropped from $48M (2021) to $19M (2024), suggesting market diversification.

Sources: The Quantum Insider Intelligence Platform, Resonance Commercial Orders Database, March 2025 report.