Insider Brief

- Bloomberg is reporting that The Defiance Quantum ETF has experienced significant inflows for its exchange traded fund that focuses on quantum technologies.

- QTUM, designed to track stocks involved in quantum computing and related technologies, has attracted approximately $250 million in inflows so far in December.

- The inflows started in earnest after Google announced the impressive performance of the company’s new chip, dubbed Willow.

The Defiance Quantum ETF (QTUM), a niche fund tied to quantum computing, has experienced unprecedented inflows following Google’s recent announcement about the performance of its Willow chip, according to Bloomberg.

Cash Surge and Market Reaction

QTUM, designed to track stocks involved in quantum computing and related technologies, has attracted approximately $250 million in inflows — when investors buy shares in an investment vehicle — so far in December, according to Bloomberg. This surge dwarfs its previous net inflows of $164 million since its 2018 inception. The fund has gained 17% this month, spurred by Google’s announcement that its new Willow quantum chip solved a computational problem in five minutes — a task that would take a supercomputer an estimated 10 septillion years.

Stocks tied to quantum computing, including Google and quantum-focused players like Rigetti Computing Inc. and D-Wave Quantum Inc., have rallied, Bloomberg reports. D-Wave shares have climbed over 800% this year, while Rigetti has surged more than 1,000%. Google’s announcement has solidified investor enthusiasm, drawing comparisons to last year’s fervor around artificial intelligence.

“Quantum is having the same moment as AI did last year. Many of the quantum stocks aren’t held by ETFs broadly so QTUM is really the only pure play out there,” said Bloomberg Intelligence analyst Athanasios Psarofagis. “I wouldn’t be surprised to see more quantum-related filings soon.”

Understanding Quantum Computing and ETFs

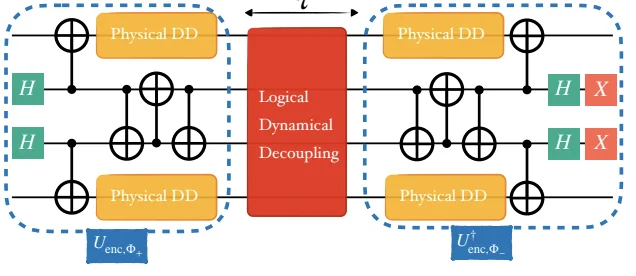

Quantum computing leverages principles of quantum physics to perform calculations that theoretically are far beyond the capabilities of conventional computers. These machines excel in solving certain complex problems with numerous variables, offering potential innovations in fields like drug discovery, climate modeling and financial forecasting.

ETFs, or exchange-traded funds, are investment vehicles that track the performance of an underlying index, sector, or asset class. QTUM tracks the BlueStar Quantum Computing and Machine Learning Index (BQTUM), which includes companies engaged in quantum computing, machine learning, cloud computing and advanced hardware. The index comprises 71 globally listed stocks, including tech giants Alphabet (Google’s parent company) and Nvidia, alongside smaller quantum-focused firms.

The ETF provides equal weight to its components, ensuring balanced exposure across firms regardless of size. It is reviewed semi-annually to adjust eligibility and weights based on liquidity.

Investor Implications and Market Context

Until Google’s Willow announcement, QTUM’s performance had been underwhelming, reflecting tepid interest in quantum computing as an investment theme. However, the recent surge highlights how advancements in the sector can quickly shift market dynamics. Analysts speculate that QTUM’s role as one of the few quantum-focused ETFs has amplified its appeal during this upswing.

Founded in 2018, the Defiance Quantum ETF underscores the growing demand for niche ETFs targeting transformative technologies. According to its website, QTUM offers exposure to companies advancing artificial intelligence, machine learning, and high-powered computing. These sectors are increasingly seen as interdependent, with quantum computing positioned to accelerate machine learning and AI applications.

While the recent cash influx suggests growing optimism, quantum computing remains a speculative area. Developing practical applications is complex, and widespread adoption may take years. Nevertheless, Bloomberg reports that Googlet’s milestone and rising interest in QTUM could spur more ETF launches and investments targeting quantum technologies.