Insider Brief

- Honeywell’s quantum computing unit, Quantinuum, could be valued at up to $20 billion, positioning it as a pivotal asset in the conglomerate’s potential restructuring, according to MarketWatch.

- Wolfe Research analyst Nigel Coe highlighted Quantinuum’s strategic value but noted Honeywell’s commitment to monetizing the unit within 18 months

- In addition to technology advances, Quantinuum has forged key partnerships and leads in quantum innovation, further enhancing its appeal in the burgeoning quantum computing market.

Honeywell International Inc.’s quantum computing unit, Quantinuum, could be valued at up to $20 billion, making it a standout asset as the conglomerate considers a potential breakup, according to MarketWatch. Following a steady stream of advances in quantum, news of Quantinuum’s rising valuation also underscores the growing significance of quantum computing in the tech and investment landscape.

Wolfe Research analyst Nigel Coe highlighted Quantinuum as a key part of Honeywell’s portfolio, even as the company focuses on its Aerospace division following pressure from Elliott Management, a $5 billion stakeholder. Honeywell has committed to monetizing Quantinuum within 18 months, with a potential initial public offering (IPO) rumored since July, as reported by Bloomberg.

In a November letter to Honeywell’s Board of Directors, the Elliott Management team mentions Quantinuum, but dismisses the unit’s value to the company.

The team writes: “In Honeywell’s case, its underlying business units not only compete with one another for investment allocation, but also have to compete against broader corporate initiatives. For example, consider Quantinuum. While we make no judgment on Quantinuum itself, it is reasonable to question whether Honeywell’s investing in quantum computing is a distraction – in either investment dollars or management mindshare – from its core businesses.”

Other corporations are now finding that quantum advances can improve valuations, however. For example, Google, which holds its own quantum computing unit — Google Quantum AI, saw its valuation rise 6 percent, or more than $100 billion, after the company received headlines for its “Willow” quantum chip debut, CNBC reports.

A $20 Billion Benchmark

In context, Quantinuum’s value has surged following a $300 million funding round in January, which pegged the company at $5 billion. Market comparisons with quantum rival IonQ Inc., whose stock price has jumped 226% this year, suggest Quantinuum’s valuation could quadruple, MarketWatch reports. IonQ’s market capitalization grew from $2 billion to $9 billion, and similar gains could position Quantinuum at $20 billion.

“One interesting part of the sum-of-the-parts jigsaw puzzle is Honeywell’s majority stake in Quantinuum” Coe said, as reported by MarketWatch. “Honeywell is one of the leading players in the quantum-computing field and is intent on realizing the value of its investment at the opportune time.”

The Quantum Landscape

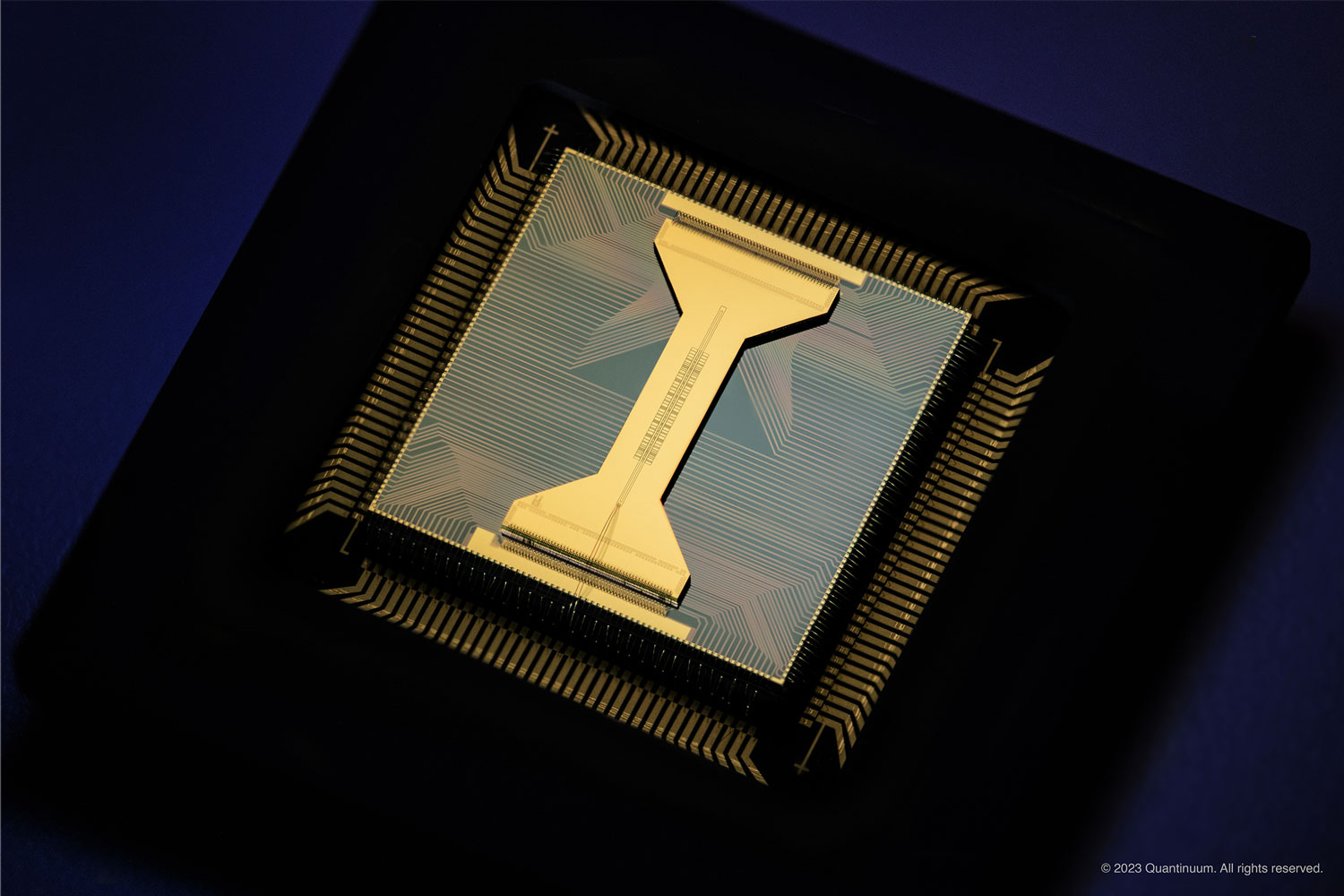

Quantinuum operates in a field that aims to revolutionize industries through quantum mechanics, which theoretically could generate processing power far beyond classical computing. Its potential applications span cybersecurity, drug discovery and optimization problems. Despite its promise, the sector remains in its infancy, with companies incurring high operating costs.

While the technology develops, most experts believe quantum companies must forge partnerships with academic and industrial partners to seize opportunities once the tech matures. Quantinuum has been successful at building collaborations, leveraging its position as the world’s largest integrated quantum company. The company has established partnerships with major firms like Microsoft Corp., Argonne National Laboratories and Google DeepMind. Adding to its credibility, investors include JPMorgan Chase & Co., Amgen Inc., and Mitsui & Co., add to its credibility. Quantinuum is also on the vanguard of organizations developing beyond leading edge technologies, such as quantum tokens (with Mitsui and NEC) and quantum natural language processing, which offers performance and transparency advantages compared to today’s artificial language systems.

Other quantum firms have also seen significant gains in 2024, reflecting broader market enthusiasm. D-Wave Quantum Inc. and Rigetti Computing Inc. have seen their stock prices surge 797% and 815%, respectively, as reported by MarketWatch.

Honeywell Weighs Options for Quantum Unit as Restructuring Looms

As Honeywell International Inc. considers a major corporate restructuring, its quantum computing unit, Quantinuum, offers the company a range of strategic paths to unlock its value.

One option is an initial public offering (IPO), a move that could position Quantinuum as a standalone leader in the rapidly growing quantum computing sector. As mentioned, Honeywell hinted at this possibility earlier this year, committing to a “path to monetization” for Quantinuum within 18 months. Such a move would not only highlight the unit’s capabilities but also attract direct investment, capitalizing on its advanced hardware and software solutions.

Another potential strategy could involve retaining Quantinuum within Honeywell’s portfolio while pursuing additional partnerships or investments to expand its capabilities. Collaborations, such as its ongoing relationship with Microsoft Corp., showcase Quantinuum’s ability to integrate with major technology ecosystems, a critical strength in the competitive quantum landscape.

With a potential valuation of $20 billion, Quantinuum stands out as one of the company’s most valuable assets. Alternatively, then, Honeywell could explore a partial spin-off or sale of a stake in Quantinuum, allowing it to benefit from the growing interest in quantum technology without fully relinquishing control. With a potential valuation of $20 billion, Quantinuum stands out as one of the company’s most valuable assets. Alternatively, then, Honeywell could explore a partial spin-off or sale of a stake in Quantinuum, allowing it to benefit from the growing interest in quantum technology without fully relinquishing control.

Quantinuum was created after the merger of Honeywell’s quantum computing division, and Cambridge Quantum. Honeywell is reported to own approximately 52% of Quantinuum and the founder, Ilyas Khan is reported to own approximately 20% of the company. Other shareholders include JSR Corporation, Mitsui, Amgen, IBM and JP Morgan.