Insider Brief

- The demonstration is the first successful delivery of quantum tokens using commercial QKD hardware, demonstrating fast transaction verification at the point of exchange – a crucial step toward quantum-enhanced financial security and a major advance for QKD.

- Quantum tokens are designed to provide unforgeability, privacy and fast settlement, in a single financial instrument. No previous technology can deliver these three combined benefits.

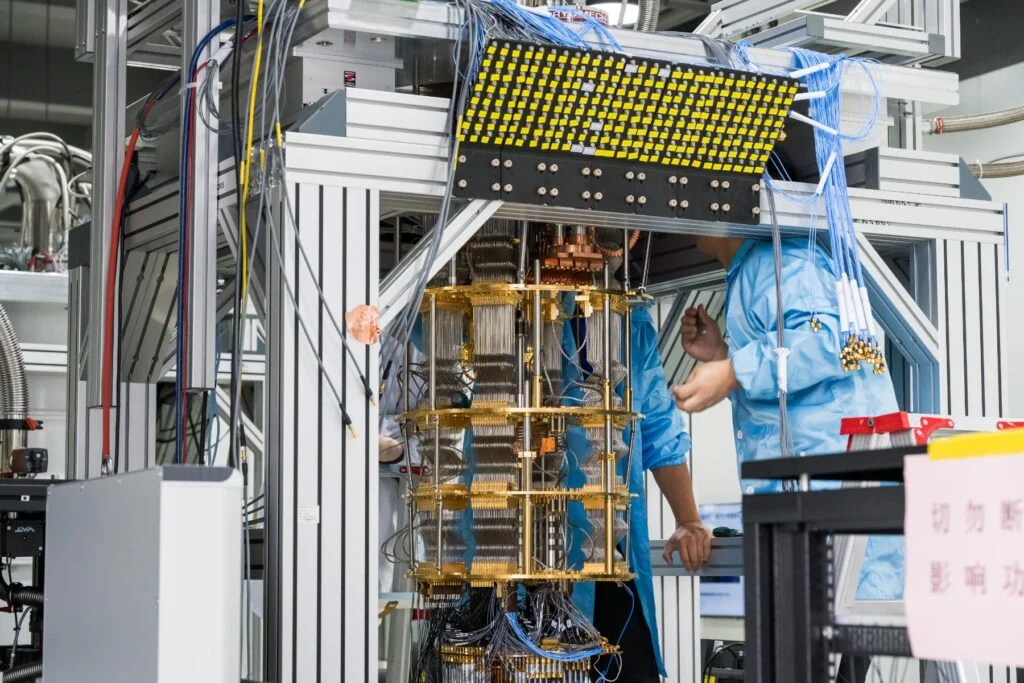

- In the world’s first implementation using off-the-shelf hardware, quantum tokens were transmitted across 10km of fibre in Tokyo, using commercial quantum key distribution (QKD) devices provided by NEC.

- This is a pivotal step towards the deployment of ultra-high-security quantum tokens in use cases such as tokenized asset security and high-speed trading.

PRESS RELEASE — In a long anticipated trial, Quantinuum, together with Mitsui & Co., Ltd. and NEC today announced the successful delivery of quantum tokens across a 10km fibre-optic network in Japan. This is the first time such a delivery has been accomplished.

Quantum tokens are a new financial instrument that take advantage of the properties of quantum physics to meet the robust demands of asset trading without the communication overheads required by traditional financial systems. Quantum tokens are transmitted across fibre-optic quantum key distribution (QKD) networks, which are rapidly expanding around the globe. Today’s announcement with Mitsui demonstrates growing industry recognition of quantum tokens’ potential in financial services.

Ilyas Khan, founder and chief product officer at Quantinuum, said: “The original motivation for quantum communications was the exchange of money, as envisaged by Stephen Wiesner. Today, we have demonstrated real-world security enhancements for financial systems using off-the-shelf quantum communications hardware. This opens the door to a new era in quantum-enhanced security with wide applicability, providing commercial organisations with something concrete to utilise.”

Koji Naniwada, Deputy General Manager, Quantum Innovation Dept. at Mitsui, said: “Quantum tokens will increase the security of digital assets, while improving transaction performance and maintaining privacy. These topics are critical for our customers and partners in the financial sector and this demonstration is a valuable outcome of our partnership with Quantinuum.”

Naoki Ishida, Director with the Trading and Service Solution Department at NEC, said: “We are the first to provide a platform for realizing a quantum token system using NEC’s quantum key distribution (QKD) devices. Based on the results of this trial between Mitsui & Co. and Quantinuum, we will continue to work towards the social implementation of quantum cryptography technology.”

Quantum tokens are designed to use quantum physics to prevent forgery, while ensuring transactions can be settled near-instantly, whereas traditional payments systems rely on double-entry bookkeeping to prevent double-spending of funds. This adds time, overhead and risk to every transaction, as digital systems are consulted to confirm funds are available and to settle transactions.

Quantum tokens instead rely on the no-cloning theorem of quantum physics to prevent forgeries and double-spending. Only the intended recipient will receive the correct token data, which can only be spent at one location in the future. This enables near-instant transaction settlement by removing the need to check multiple systems or wait for network confirmations.

As demonstrated in Quantinuum’s recent work with HSBC, securing digital assets in the quantum-age is growing in urgency. The financial sector is increasingly looking to quantum technology to solve these complex problems with the power of nature.

Learn more about the history and the potential of quantum tokens — What Are Quantum Tokens? QKD Enters New Era of Secure Networks, Next-Generation Applications