Insider Brief

- Rigetti Computing and Moody’s Analytics will focus on exploring the potential of quantum machine learning methods within the finance industry.

- The companies will explore how the distinctive capabilities of quantum computing can address financial challenges.

- Both companies believe quantum can achieve “narrow quantum advantage” with certain financial tasks.

Rigetti Computing, a pioneer in quantum computing, has recently announced a significant collaboration with Moody’s Analytics, a prominent player in financial intelligence. This partnership focuses on exploring the potential of quantum machine learning methods within the finance industry, relying on the distinctive capabilities of quantum computing to address complex financial challenges.

According to a company blog post, Rigetti’s strategic focus on achieving what is termed as “narrow quantum advantage.” This points to tasks that a quantum computer outperforms traditional computing methods in solving specific, operationally relevant problems, particularly in the finance sector, where Rigetti sees significant potential for quantum computing.

Rigetti has ambitious plans to expand their research in the first half of 2024 and built on last year’s achievements, the post states. Last April, Rigetti shared its initial results stemming from a collaborative effort with Moody’s and Imperial College London. The team’s approach involved employing cutting-edge machine learning techniques, integrating classical signature kernels with quantum-enhanced data transformations. The results from their noiseless quantum simulation suggested that these signature kernels, when used with quantum-enhanced data, could forecast economic recessions with greater accuracy than the prevailing industry-standard models.

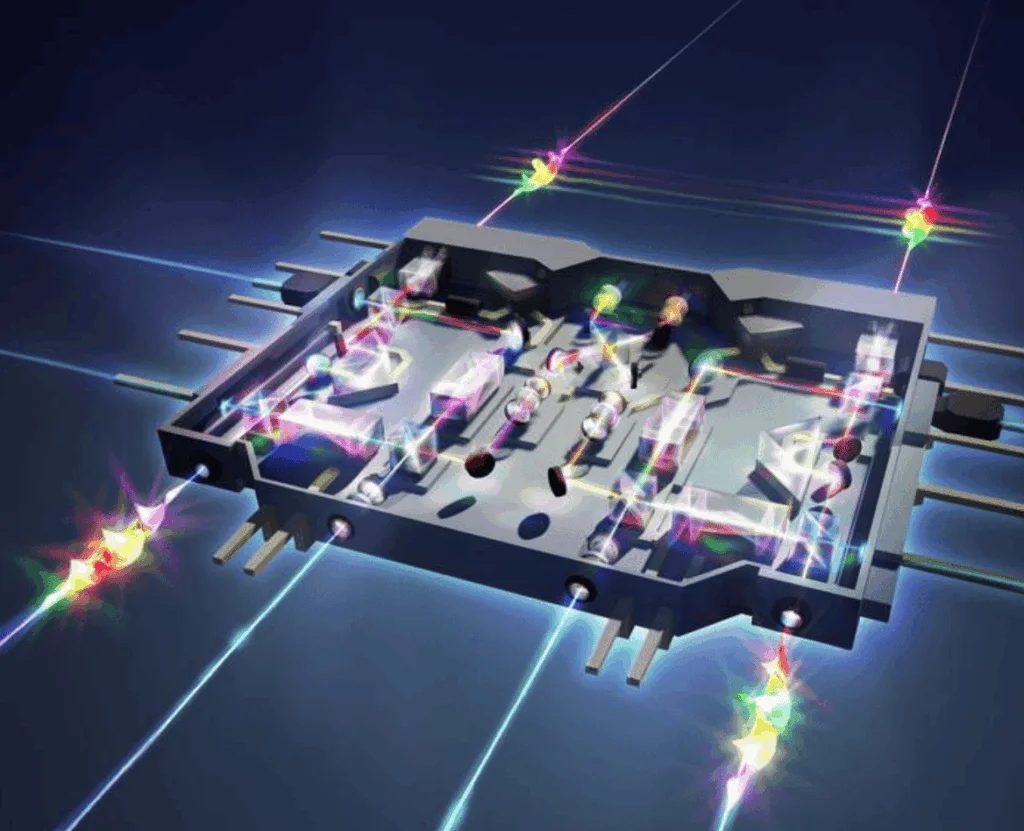

The company intends to work with more complex, higher-dimensional datasets from diverse macroeconomic sectors. This next phase of work, in contrast to the initial simulations, will be conducted on Rigetti’s advanced 84-qubit Ankaa™ system and will incorporate sophisticated error mitigation methods. The objective is to utilize a larger number of qubits for more intricate computations.

Sergio Gago, Moody’s Analytics’ MD of AI and Quantum Computing, reflected on the significance of their investment in quantum computing and the importance of this project.

“Moody’s is investing in quantum computing to better understand how it can provide an advantage over classical solutions,” Gago said. “By partnering with the algorithm and application teams at Rigetti, and leveraging their QPUs, we get access to the expertise needed to make meaningful progress in our quantum computing strategy.”

Rigetti also benefits from these industry collaborations, according to Dr. Subodh Kulkarni, Rigetti’s CEO.

He said, “We need to work hand in hand with industry experts who will be relying on hardware vendors like Rigetti to provide quantum computers capable of tackling their complex computational problems. Partnering with Moody’s to use quantum machine learning techniques to improve time series prediction gives us valuable insight into how we can continue to improve our quantum computing systems for real-world applications.”

Marco Paini, VP of Finance Solutions at Rigetti, highlighted the growing trend of financial institutions investing in quantum computing.

“The potential for quantum computing to have a transformative impact on the financial sector has led to increasingly more financial institutions building in-house teams dedicated to exploring quantum computing,” Paini said. “Achieving quantum advantage will require collaborating with end users who truly understand how to apply quantum computing to their business. This is why our work with Moody’s is so valuable — partnering with Moody’s quantum experts allows us to work on valuable problems and in turn feed improvements back into our hardware and software stack to enhance our capabilities.”

If you found this article to be informative, you can explore more current quantum news here, exclusives, interviews, and podcasts.