Odious Hackers

The banking system has never been under so much pressure to secure its business from outside threats, both at home and abroad. As more and more banks realize the threat is a real one, they are taking action that will keep them safe from odious hackers.

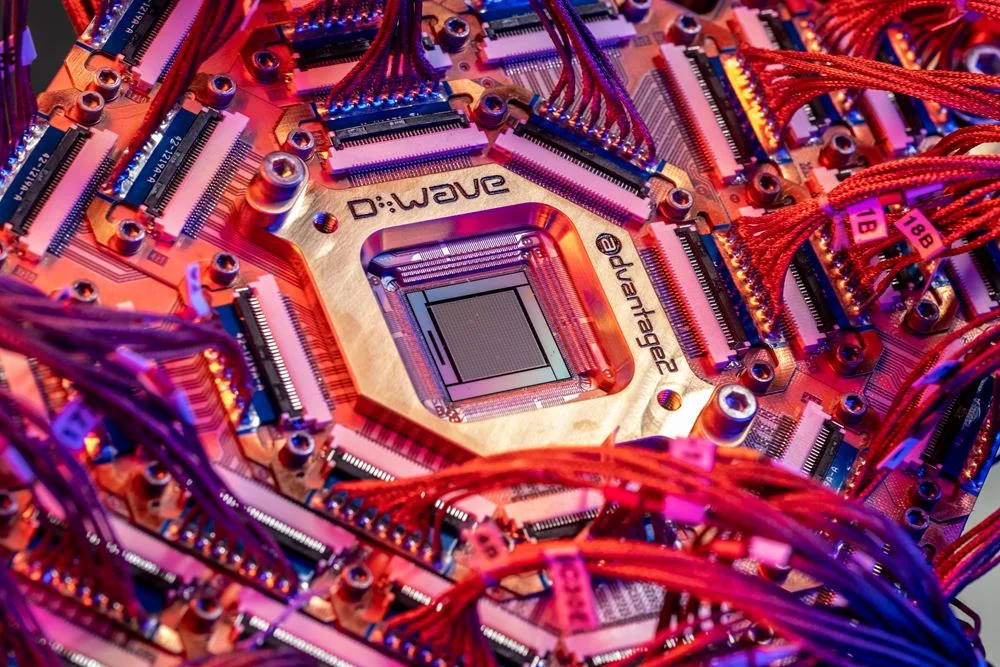

One of Europe’s most innovative banks, the Spanish concern CaixaBank, recognizes the potential that quantum computers can have for its industry. This foresight is set to put them ahead of the game in the banking sector. Recently, the bank announced the results of tests using the Qiskit opensource framework utilizing the IBM Q System One quantum computer, owned by industry behemoth IBM. The two tests, which they have claimed a success, focussed on treasury bonds and risk assessments of mortgage portfolios.

‘The first entity in Spain and one of the first in the world that incorporates quantum computing into its R&D activity.’

— CaixaBank

The Art of Persuasion

IBM managed to persuade the Spanish bank to conduct tests in these two specific areas to show quantum computers can have a significant advantage over classical models of computers.

The piloted project, using real data, was conducted by the bank’s R&D department. They ran two simulations to see if the proof of concept was viable in improving risk assessment measurements regarding treasury bond and mortgage portfolios.

‘Quantum promises pros but also cons, especially in respect to the cyber-security liabilities that its power gives rise to. Quantum computing will “redefine” banking’

— Elisabetta Zaccaria, Secure Chorus chairman

The algorithms were completed using calculations in both traditional and parallel systems, and a number of steps were done to test the validity of the architecture. The first one was to verify and collate the results of the test. In the second, the speed of the system was put under scrutiny. The conclusion was that the calculation time using a quantum computer could be cut from days to minutes.

These are obviously exciting findings.

Caveat

However, one caveat to the exercise was ‘quantum supremacy’, the theory that quantum computers potentially have the ability to resolve problems in which classical computers cannot, is still some way off. It is all right to say quantum computers can calculate such and such a problem, but when a conventional computer can also do it, there seems little use in adopting the technology.

More use cases, and successful ones at that, are needed before proof of concept becomes the reality within fintech and the wider financial world.

This has not stopped, and will not stop, CaixaBank from further developments in the space, however, as they see the QC technology can greatly improve upon the cryptographic systems and AI software they currently use.

‘Banks and financial institutions like hedge funds now appear to be mostly interested in quantum computing to help minimize risk and maximize gains from dynamic portfolios of instruments. The most advanced organizations are looking at how early development of proprietary mixed classical-quantum algorithms will provide competitive advantage.’

— Dr. Bob Sutor, vice president, IBM Q Strategy and Ecosystem

As the popularity of quantum key distribution (QKD) and quantum computers grows in importance, will we no doubt see more banks realizing how crucial the technology can be in shielding them from unwelcomed cyber breaches.

Let us all hope it is sooner rather than later.