Insider Brief:

- Quantum-safe security is moving from theory to near-term infrastructure decisions as governments set migration timelines and enterprises respond to “harvest now, decrypt later” risks, shifting focus from future potential to operational deployment.

- Early commercial leadership in post-quantum cryptography is emerging from smaller, agile, publicly accountable companies that can iterate quickly on evolving standards, integrate with legacy systems, and show verifiable traction.

- 01 Quantum models this execution-first model by delivering standards-aligned, deployable solutions that prioritize algorithm agility, integration with existing security stacks, and measurable progress through pilots and commercial engagements.

- The first wave of quantum-security winners will be defined by fit rather than scale, with investors prioritizing evidence of real demand, operational readiness, and disciplined execution over long-term market-size narratives.

Early-stage winners in quantum security are typically smaller, publicly traded companies with specialized focus rather than large incumbents. These first-wave leaders demonstrate three key advantages: rapid decision-making cycles (weeks vs. quarters), ability to integrate evolving NIST standards before market consensus, and focused product mandates that enable faster iteration than diversified competitors. The early days of cloud security, endpoint protection, and zero-trust architectures followed this pattern. Post-quantum cryptography (PQC) appears to be doing the same.

As governments accelerate migration timelines and enterprises confront the reality of “harvest now, decrypt later” threats, quantum-safe security is shifting from theoretical concern to near-term infrastructure decision. But while the market narrative often centers on large defense primes, telecom incumbents, or hyperscalers, much of the actual implementation work is being driven by smaller companies designed to move faster than the standard procurement cycle.

This is where investors increasingly see asymmetry.

Why Do Smaller Companies Lead Early-Stage Quantum Security Adoption?

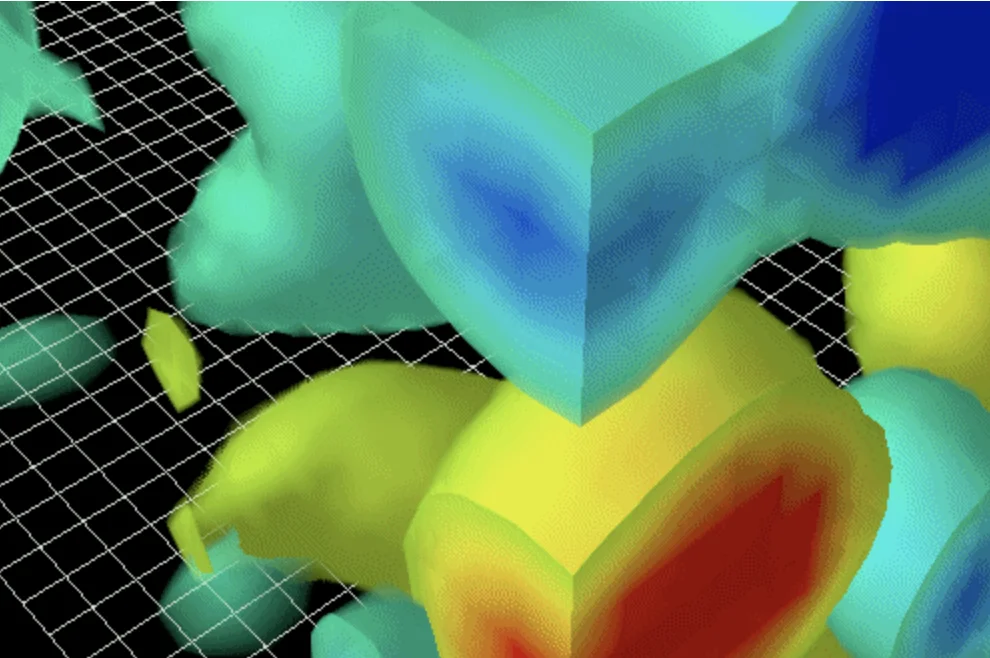

Large incumbents excel at three areas: infrastructure scale, regulatory compliance, and multi-year deployment cycles. However, they face structural disadvantages during standard stabilization periods because their multi-layered approval processes, legacy system dependencies, and quarterly roadmap commitments slow adaptation to evolving cryptographic specifications like NIST’s post-quantum standards (finalized August 2024). PQC remains in flux. While NIST’s selections have provided an anchor, real-world deployment raises practical questions around algorithm agility, hybrid cryptographic stacks, performance tradeoffs, and integration with legacy systems. These are engineering problems that demand iteration, not committee consensus.

Smaller public companies, particularly those with vertically integrated teams, are often better positioned in this phase. They can make architectural decisions quickly, align product development tightly with evolving standards, and pivot based on customer feedback without multi-year roadmap inertia. For investors, this agility matters more in early adoption cycles than market share alone.

Public-market exposure adds a layer of discipline. Companies operating under disclosure requirements must show traction beyond intent. That transparency often includes contracts signed, pilots deployed, and partnerships announced, all signals that private-market narratives often obscure.

What Signals Indicate Post-Quantum Cryptography Has Reached Commercial Deployment?

Post-quantum cryptography has shifted from future-focused research to active deployment phase. The U.S. National Security Agency mandates quantum-safe cryptography migration by 2035, the European Union requires quantum-resistant algorithms for critical infrastructure by 2030, and China’s cryptographic standards authority issued PQC guidelines in 2023, creating concrete compliance timelines across major economies. Financial institutions are beginning crypto-inventory audits. Critical infrastructure operators are evaluating hybrid classical-quantum approaches to avoid single-point cryptographic failure. Alongside this change, export controls and geopolitical uncertainty are pushing nations toward sovereign cryptographic capabilities.

This convergence has shifted PQC from “R&D adjacent” to operational. The market is no longer asking whether quantum-safe cryptography will be needed, but how it will be deployed, managed, and updated over time. That shift favors companies already building for production environments rather than proof-of-concept demonstrations.

01 Quantum as a Case Study in Early-Phase Execution

01 Quantum sits squarely within this emerging cohort of execution-first players. Rather than positioning itself as a broad, abstract “quantum security platform,” the company has focused on deployable, standards-aligned cryptographic solutions designed for near-term adoption. Its strategy emphasizes integration by working within existing enterprise and government security stacks rather than requiring wholesale infrastructure replacement.

This approach reflects a clear reading of buyer behavior. Most organizations do not want to bet on a single cryptographic future. They want algorithm agility, migration pathways, and assurance that today’s investments will not become tomorrow’s liabilities. 01 Quantum’s architecture is designed around those constraints.

Equally important is pace. As a publicly listed company with a narrow mandate, 01 Quantum has been able to respond quickly to regulatory signals, customer requirements, and partnership opportunities. That responsiveness translates into tangible traction, such as pilot programs, commercial engagements, and ecosystem collaborations. These are not only operationally meaningful, but structurally verifiable. Public-market disclosure requirements, audited reporting, and fiduciary accountability reduce ambiguity around performance and adoption, giving customers and partners greater confidence that progress reflects real demand rather than forward-looking signals alone.

For investors watching the space, these are the signals that matter most at this stage: not total addressable market projections, but evidence of real demand and operational readiness.

From Emerging Player to Reference Point

The transition that defines this phase of the market is subtle but consequential. Companies move from being “one of many” to becoming reference points, names that analysts, journalists, and buyers cite when explaining how quantum-safe security is actually being implemented.

That transition is driven by narrative control grounded in evidence: clear positioning, consistent execution, and the ability to articulate why a given approach is viable now, not just in a fully fault-tolerant quantum future.

01 Quantum’s opportunity lies precisely here. By continuing to anchor its story in deployment, standards alignment, and measurable progress, the company positions itself not as a speculative quantum bet, but as an early benchmark in a market that is only beginning to form.

| Region | Agency | Deadline | Scope |

|---|---|---|---|

| United States | NSA | 2035 | National security systems quantum-safe migration |

| European Union | ENISA | 2030 | Critical infrastructure quantum-resistant algorithms |

| China | State Cryptography Administration | 2023 (guidelines issued) | National cryptographic standards |

What Characteristics Define First-Wave Quantum Security Winners?

In most technology transitions, scale dominates eventually – but rarely at the start. The first wave of quantum-security winners will be defined less by size than by fit: fit with regulatory timelines, fit with enterprise constraints, fit with the reality that cryptographic transitions happen incrementally.

Smaller, agile, publicly accountable companies are often best suited to that reality. They can build, test, adjust, and deploy while larger players prepare for scale. As PQC moves from policy discussion to procurement reality, the market’s early leaders are likely to emerge from this cohort. For investors watching closely, the question is no longer whether quantum-safe security will matter, but which companies are already behaving like it does.

Frequently Asked Questions

What is post-quantum cryptography?

Post-quantum cryptography refers to cryptographic algorithms designed to secure data against attacks from both classical and quantum computers using mathematical problems like lattice-based cryptography that remain computationally hard even with quantum capabilities. NIST finalized the first three PQC standards in August 2024 for immediate implementation.

Why are smaller companies leading early quantum security adoption?

Smaller quantum security companies lead early adoption because they can make product decisions in weeks rather than quarters and integrate evolving NIST standards before larger incumbents complete multi-year roadmap approvals. Public-market disclosure requirements also provide verifiable traction metrics that reduce adoption risk for early enterprise customers.

What is the “harvest now, decrypt later” threat?

“Harvest now, decrypt later” describes adversaries collecting encrypted data today to decrypt once quantum computers become powerful enough, targeting long-lived sensitive information like financial records and classified communications. This threat drives immediate post-quantum migration despite quantum computers remaining 5-10 years from breaking current encryption.

What government timelines exist for quantum-safe cryptography migration?

The U.S. NSA requires quantum-safe migration for national security systems by 2035, while the European Union mandates quantum-resistant algorithms for critical infrastructure by 2030. China issued national PQC guidelines in 2023, creating concrete compliance deadlines across major economies.

What is algorithm agility in quantum cryptography?

Algorithm agility enables organizations to switch between multiple post-quantum cryptographic algorithms without rebuilding infrastructure by maintaining modular, standards-based interfaces. This approach protects against future vulnerabilities discovered in specific PQC algorithms while NIST standards continue evolving.

How does 01 Quantum differ from larger quantum security competitors?

01 Quantum focuses on NIST-compliant, deployable cryptographic solutions that integrate with existing enterprise security stacks rather than requiring infrastructure replacement. As a smaller public company, it demonstrates faster adaptation to evolving standards and publicly verifiable commercial traction through disclosed pilots and partnerships.

What are hybrid classical-quantum cryptographic systems?

Hybrid cryptographic systems combine traditional encryption algorithms with post-quantum methods to provide defense-in-depth security during the migration period. This approach protects against both current classical threats and future quantum attacks while organizations gradually transition to fully quantum-resistant infrastructures.

Why does public-market status matter for quantum security companies?

Public-market companies face disclosure requirements and fiduciary accountability that provide verifiable evidence of commercial traction through audited contracts, pilot programs, and partnership announcements. This transparency reduces adoption risk compared to private companies where progress claims lack independent verification.

What NIST post-quantum standards were finalized in 2024?

NIST finalized three post-quantum cryptographic standards in August 2024: CRYSTALS-Kyber for general encryption, CRYSTALS-Dilithium for digital signatures, and SPHINCS+ as a signature backup. These standards provide the foundation for immediate quantum-safe implementation across government and enterprise systems.

When will quantum computers threaten current encryption methods?

Current estimates suggest cryptographically relevant quantum computers capable of breaking RSA and elliptic curve encryption will emerge between 2030-2035, though the “harvest now, decrypt later” threat requires migration to begin immediately. Organizations with data requiring 10+ year confidentiality must implement post-quantum cryptography now to protect against retroactive decryption.