Guest Post by Michael Baczyk

Investor | Heartcore Capital

The Global Race Is On

One hundred years after quantum mechanics was born, 2025 ends on a radically different footing. The International Year of Quantum Science was supposed to be a celebration of science. Instead, it became the year quantum went industrial.

November 2025 wasn’t about any single announcement. It was about all of them happening at once. The US, Europe, China – each made decisive plays within weeks.

The US is accelerating. On November 6, DARPA selected 11 companies to enter Stage B of its Quantum Benchmarking Initiative, aiming to verify whether any quantum computing approach can achieve utility-scale operation – computational value exceeding cost – by 2033. On November 18, the U.S.-China Economic and Security Review Commission urged Congress to adopt a “Quantum First” national goal by 2030. The language is stark: “Whoever leads in quantum (and AI) will control the encryption of the digital economy, enable breakthroughs in materials, energy, and medicine, and gain asymmetric and likely persistent advantage in intelligence and targeting.” That same week, the Pentagon elevated quantum to a central priority, framing “Quantum and Battlefield Information Dominance” as essential for communications and navigation that can withstand jamming on contested terrain. On November 25, President Trump launched the Genesis Mission, a DOE-led initiative linking supercomputers, AI, and quantum systems to accelerate discovery and national security.

Europe’s push came fast and coordinated. I was at the European Quantum Technologies Conference in Copenhagen in November, where Commissioner Henna Virkkunen opened the event and made it unmistakably clear: quantum is the chance for Europe regarding her priorities on tech sovereignty, security, and democracy. Earlier this year, the Commission unveiled the Quantum Europe Strategy to turn scientific strength into economic scale. The Strategy aims to deliver: six quantum chip pilot lines under the Chips Joint Undertaking; the EuroQCI secure communication network across all member states by 2030, including the Eagle 1 satellite in 2026; a European Quantum Skills Academy launching in 2026; and supply-chain risk mapping across the quantum stack. The EU Quantum Act, set for adoption in 2026, targets three structural problems: fragmented research, industrial capacity gaps, and supply-chain vulnerabilities (Open call for evidence deadline: December 15). Last but not least, the EuroHPC Quantum Grand Challenge Call was announced (deadline: January 8, 2026) that invites European startups to develop quantum solutions with clear market perspectives, with successful participants advancing to European Investment Bank financing.

And China? The 14th Five-Year Plan (2021-2025) positions quantum as a central pillar of China’s deep tech ecosystem. Compared to the previous plan, quantum references tripled – expanding from communications to include computing and sensing, signaling a shift from experimentation to deployment. China’s quantum communications infrastructure remains unmatched: the Micius satellite (launched August 2016) later enabled the world’s first integrated space-ground quantum network established in 2020, now in 2025 stretching over 10,000 kilometers across 17 provinces and 80 cities. In computing, Chinese quantum firms increased from 93 in 2023 to 153 in 2024 – a 40% rise.

The message is clear: this is no longer about quantum science. It’s about the quantum industry.

From Physics to Factories

Here’s a pattern that has repeated throughout history: humanity uncovers new laws of physics, then engineers them into civilization-shaping industries.

Mechanics gave us clocks and precision instruments. Thermodynamics powered the Industrial Revolution through steam engines. Electrodynamics gave birth to motors and the electrical grid. Quantum mechanics already transformed our world once – through the transistor which enabled the chip revolution. Now, after a century of probing deeper into quantum physics, we’re entering a second quantum revolution: building machines that don’t just rely on quantum physics – they directly run on it.

Here’s a useful filter though: if the conversation lingers on quantum jargon like superposition and entanglement, you’re likely not talking to someone serious about the industrial opportunity. First of all, there is no simple, direct way to map superposition onto speedup (for more details see my LinkedIn post). More importantly, it doesn’t matter. The real question isn’t what makes quantum “spooky” – it’s what makes it useful.

The semiconductor industry offers a blueprint. Today’s chip ecosystem didn’t emerge from building better transistors alone – it emerged from building an entire value chain. According to the OECD, semiconductor production has among the highest R&D margins across industries. The value is distributed across specialized segments: design software (Synopsys, Cadence, Siemens EDA), IP cores (Arm), chip architects (Nvidia, Apple, Qualcomm), wafer suppliers (Shin-Etsu, SUMCO), fabrication materials (photoresists, photomasks), lithography equipment (ASML – sole EUV supplier), deposition and etching tools (Applied Materials, Lam Research, Tokyo Electron), foundries (TSMC, Samsung, Intel), assembly and test (ASE, Amkor, Advantest, Teradyne), and EMS providers (Foxconn). Each segment represents billions in market value. No single player captures the whole chain.

John Martinis, 2025 Nobel Prize winner and co-founder of Qolab, wrote in the Financial Times that quantum computing’s next breakthroughs will come from factories, not physics labs. A general-purpose quantum computer requires at least a million physical qubits – far beyond today’s devices. The bottleneck? “The complexity of the plumbing completely overwhelms the quantum device itself.”

Right now, we’re seeing consolidation as players race to build full-stack capabilities – acquiring across computing, communications and sensing. But in the long term, we believe the quantum stack will segment, just as the semiconductor value chain compartmentalized. The money won’t only be in QPUs – the segment where everyone is crowding in, while the real value chain quietly forms around them. The opportunities will emerge in packaging, modular quantum networking, integrated software platforms, and manufacturing infrastructure.

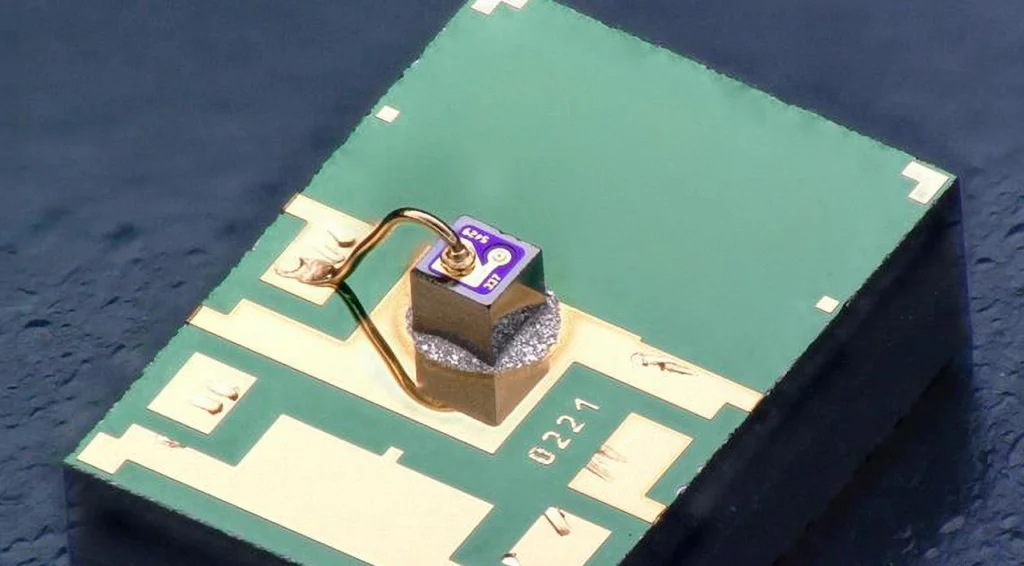

This is why Heartcore led the €7.5M round for Isentroniq. The French startup breaks the wiring bottleneck blocking superconducting quantum computers from scaling. Beyond ~100 qubits, current systems hit thermal and spatial limits. A million-qubit machine today would require ten football fields and tens of billions of euros. Isentroniq’s technology enables 1,000× more qubits in existing refrigerators, potentially bringing million-qubit systems down to €50M.

This is the work that matters now. “The plumbing”. The boring infrastructure that actually scales.

Europe’s Hand

Here’s something the narrative often misses: in quantum, Europe is very competitive.

The Harvard Belfer Center’s Critical and Emerging Technologies Index measures national capability across AI, biotechnology, semiconductors, space, and quantum. While the US leads overall (84.3) and China follows (65.6), with Europe at 41, the quantum breakdown tells a different story: US 4.2, China 3.8, Europe 3.6. Compare that to AI (US: 22.7, Europe: 11.6) or semiconductors (US: 26.4, Europe: 8.3), and quantum emerges as Europe’s most competitive deep tech frontier.

The McKinsey Quantum Technology Monitor 2025 reinforces this. National investments total ~$54 billion globally: Germany ~$5.2B, UK ~$4.6B, France ~$2.2B, Netherlands ~$1B. Germany, France, Italy, and the Netherlands contribute 27% of global quantum patents – matching the US share. One-third of the world’s quantum companies are EU-based, and European firms supply nearly half of hardware and software components used globally.

A new wave of momentum is building. According to the Monitor, after years of decline, startup creation increased 46%, with eight of nineteen new quantum startups originating in the EU. Europe produces 110,000+ STEM graduates annually and has world-class expertise in precision electronics, optics, photonics, and cryogenics – the exact supply chain quantum requires.

At Heartcore, we see this as one of the clearest asymmetric opportunities in European tech. The foundations are there – talent, public funding, precision manufacturing, and increasingly aligned policy. What’s needed now are companies that can turn this into industrial reality.

The quantum race isn’t about counting qubits anymore. It’s about building the factories that will manufacture them at scale. And in that race, Europe has more cards to play than most people realize.

Heartcore invests in ambitious European founders building the sovereign tech stack.

Isentroniq is a Heartcore portfolio company.