Insider Brief

- Honeywell confirmed Quantinuum has raised $600 million in equity funding at a pre-money valuation of $10 billion.

- New investors including Quanta Computer, NVentures, and QED Investors joined existing backers such as JPMorgan, Mitsui, Amgen, and Honeywell, with Honeywell and Cambridge Quantum remaining the largest shareholders.

- The capital will support expansion of commercial systems, R&D, and the upcoming launch of Quantinuum’s Helios quantum computer, while reinforcing its global collaborations in the US, UK, Asia, and the Middle East.

In a historic fund-raising announcement during a historic week in the quantum industry, Honeywell confirmed in a news release that Quantinuum has raised $600 million in equity capital in a Series B, giving the quantum computing company a pre-money valuation of $10 billion, which may be the highest so far of a privately owned quantum computing or quantum technologies company based on publicly released information. The raise is also one of the largest in the sector to date and signals continuing investor confidence in scaling quantum technologies.

The SEC filing reported on last week indicates that the announcement today may be a first closing with further news to follow.

According to the release, the round drew participation from a mix of new and returning backers. Quanta Computer, NVentures — the venture arm of NVIDIA — and QED Investors joined as new investors, alongside Morgan Private Ventures, Mesh Ventures and Korea Investment Partners. They add to a roster of existing shareholders that includes JPMorgan Chase, Mitsui, Amgen, Cambridge Quantum Holdings, Serendipity Capital and Honeywell, all of which have made follow-on investments after participating in the February 2024 fund raise.

Following this fund raise Quantinuum’s major shareholders remain unchanged in the form of Honeywell (with an estimated 53% stake) and Cambridge Quantum, controlled by founder Ilyas Khan (with an estimated 36% stake).

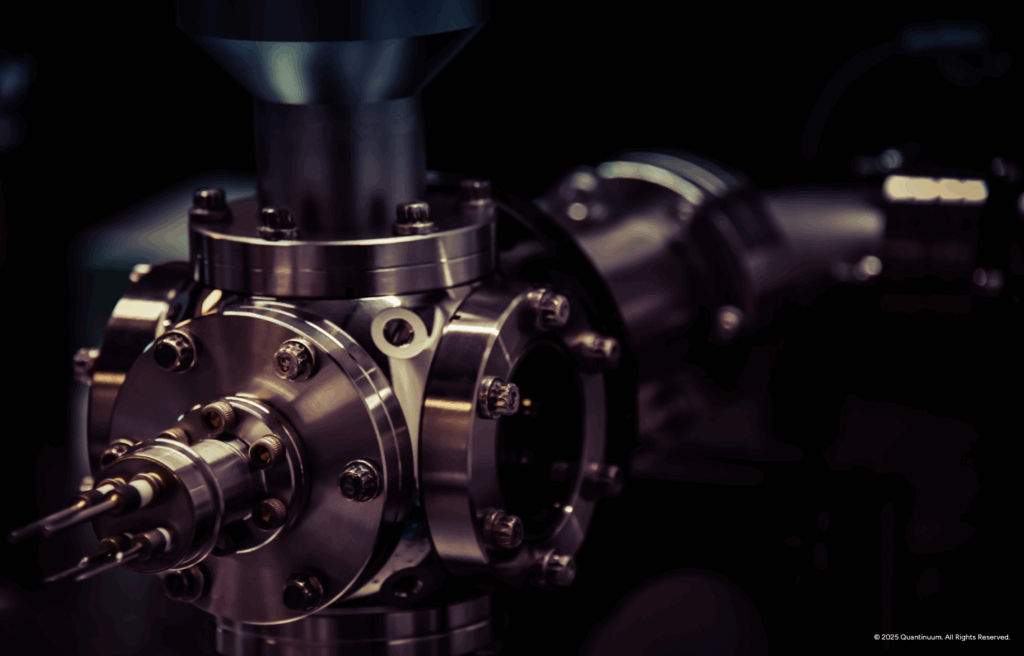

Quantinuum said the fresh capital will fund expansion of its commercial systems, research and manufacturing capabilities. A near-term priority is the launch of Helios, the company’s next-generation quantum computer expected later this year. The company has also set its sights on universal fault-tolerant computation, a milestone that many in the field view as the threshold for unlocking practical and scalable applications.

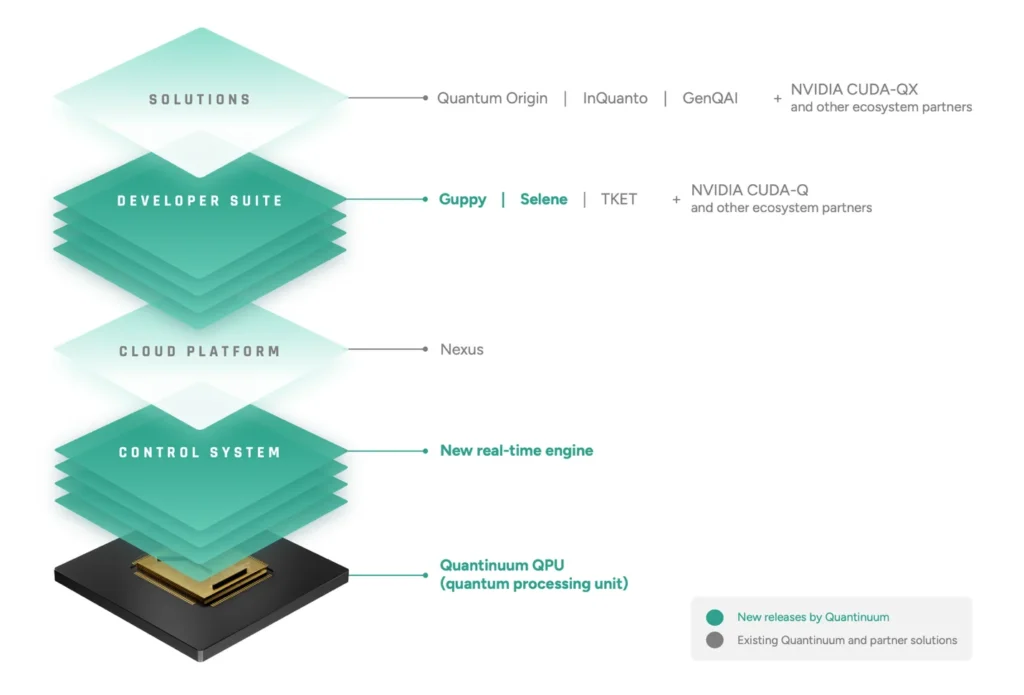

As one of the few full-stack providers in the industry, Quantinuum combines hardware, software and developer tools. Its offerings include the InQuanto platform for computational chemistry and other applications. The company maintains that broad availability of high-performing quantum machines, coupled with software that enables domain-specific use cases, will accelerate adoption across industries ranging from pharmaceuticals to energy.

The funding comes as Quantinuum steps up its global presence through collaborations and regional initiatives, according to the release. The company is working with NVIDIA as a founding partner in the newly created Accelerated Quantum Research Center. It also disclosed recent partnerships with RIKEN, SoftBank, Infineon, and the UK’s STFC Hartree Centre. Internationally, it has expanded into New Mexico, Qatar, and Singapore. In Qatar, a joint venture was selected to provide advanced infrastructure as part of the country’s $1 billion investment in quantum over the next decade. In Singapore, Quantinuum is working with partners on computational biology and other quantum use cases.

The company is also advancing initiatives in Colorado, Minnesota and New Mexico as part of its commitment to building quantum capacity across the United States.

WIth its unique US-UK heritage, Quantinuum remains a strategically important example of transatlantic collaboration, maintaining dual headquarters in Colorado and Cambridge to anchor its US-UK presence.

“This $10 billion valuation from global investors is a vote of confidence in quantum’s transformative potential, and the speed of progress in putting quantum to work, here in the UK,” said UK Science Minister Lord Vallance. “This significant investment will accelerate the adoption of this technology, so more businesses across sectors from financial services to AI can harness it to their advantage. As host to Quantinuum’s European headquarters, the UK stands to reap the rewards from the economic growth that this kind of investment brings, and the scientific discoveries that it helps to generate.”

With the new capital, Quantinuum has secured the backing of leading financial, industrial, and technology investors, strengthening its position as one of the best financed players in the global quantum sector.

Last year, Honeywell revealed a plan to split the company into three publicly traded companies focused on aerospace, automation and advanced materials. In a July earnings call, Honeywell Chairman and CEO Vimal Kapur said Quantinuum’s planned fundraising is intended to capitalize the business ahead of a potential initial public offering, which could take place as early as 2027, Bloomberg reports.

J.P. Morgan Securities LLC served as exclusive placement agent to Quantinuum in connection with the financing. Freshfields LLP acted as external legal counsel.

What Leaders Are Saying

In the statement, leaders from Honeywell and Quantinuum, along with its investors, are expressing that the funding round is far more than a normal capital raise, it represents a vote of confidence for Quantinuum’s technology and business strategy, as well as broadly demonstrates an understanding for quantum’s potential.

Vimal Kapur, Chairman and CEO of Honeywell: “Quantinuum continues to meet and exceed our stated objectives — strategically, technically and commercially. We have complete confidence in Quantinuum’s ability to continue to lead the quantum revolution and create long-term value for its investors and customers.”

Scot Baldry, Chief Technology Officer of JPMorganChase: “As both an investor and a collaborator, we’ve seen firsthand the transformative potential of Quantinuum’s technology. We are looking forward to continuing our work together to help accelerate innovation and move closer toward solving real-world problems through quantum applications.”

Dr. Rajeeb Hazra, President & CEO of Quantinuum: “We are proud to partner with investors who share deep conviction in our vision for the future of quantum and AI. With the continued support of our customers and supply chain partners, this new funding will further extend our leadership, accelerate our roadmap and strengthen the entire quantum ecosystem.”

Who Are The Investors?

The roster of new and returning investors offers a clear view of who is placing bets on quantum – in more ways than one. Many of Quantinuum’s backers are not just financial stakeholders but also potential end users, reflecting both capital support and demand for real-world applications.

New Investors Include (but are not limited to):

Quanta Computer

Quanta Computer is a Taiwanese electronics manufacturer and one of the world’s largest producers of notebook computers and cloud hardware. It supplies major brands such as Apple, Dell, and HP. By investing in Quantinuum, Quanta positions itself within the emerging quantum supply chain. Its expertise in large-scale precision manufacturing and system integration makes it a strategically important partner as quantum systems move beyond prototypes toward scalable deployment.

NVentures (NVIDIA)

NVentures is the venture capital arm of NVIDIA, the semiconductor and AI company best known for its GPUs. NVIDIA has been building tools for hybrid quantum-classical computing, including its CUDA Quantum platform, and recently launched the NVIDIA Accelerated Quantum Research Center. Through NVentures, NVIDIA’s stake in Quantinuum reflects its strategy to position quantum within broader AI and high-performance computing ecosystems. Of the 27 privately held startups in its current portfolio, Quantinuum would be the first identified as a quantum computing venture. The investment signals confidence that Quantinuum’s systems can become integral to hybrid workflows, where NVIDIA’s hardware dominates and also suggests how AI and quantum are converging.

QED Investors

QED Investors is a U.S.-based venture capital firm focused on fintech and early-stage technology companies. It has backed high-profile financial technology firms including Credit Karma, Nubank, and Remitly. Its investment in Quantinuum underscores expectations that quantum computing will impact finance through risk modeling, encryption and portfolio optimization. As a new investor, QED seems to reinforce a strategic link between quantum systems and one of the most computation-heavy industries in the economy: financial services.

Morgan Private Ventures

Morgan Private Ventures is the private investment arm of J.P. Morgan’s leadership and select partners, operating separately from the bank’s institutional business. The fund typically takes long-term stakes in disruptive companies with transformative potential. Its participation in Quantinuum builds on JPMorgan’s broader research and investment in quantum computing. This stake illustrates conviction at the highest levels of the financial industry that quantum computing will be central to the next generation of computational infrastructure.

Mesh Ventures

Mesh Ventures is a Singapore and Taiwan-based venture capital firm focused on early-stage deep tech, blockchain and computing companies.Mesh’s strategy centers on bridging global innovation with Asia’s fast-growing digital economy. By investing in Quantinuum, Mesh gains exposure to one of the most advanced quantum computing platforms worldwide, as well as signals the growing role of smaller, specialized funds in connecting frontier technologies with Asian markets.

Korea Investment Partners

Korea Investment Partners (KIP) is South Korea’s largest venture capital and private equity firm, with over $3 billion under management. It invests across healthcare, IT, consumer, and advanced technologies. KIP’s decision to join the round signals both South Korea’s rising interest in quantum computing and its broader industrial strategy to capture benefits from next-generation digital infrastructure.

Returning Shareholders

Honeywell

Honeywell is a U.S.-based industrial conglomerate with operations spanning aerospace, building technologies, materials, and automation. Honeywell is one of the world’s largest defence contractors. Quantinuum was created when Honeywell Quantum Solutions, adivision of Honeywell, was combined and merged with Cambridge Quantum in 2021. Honeywell continues to maintain an ownership in Quantinuum of more than approximately 53%. The Chairman of the board of directors of Quantinuum is Vimal Kapoor, the Chairman and CEO of Honeywell.

Cambridge Quantum Holdings

Cambridge Quantum Holdings (CQ) was a UK-based quantum software company founded in 2014 following a spin out from the University of Cambridge. It merged with Honeywell Quantum Solutions in 2021 to form Quantinuum. Cambridge Quantum Holdings is controlled by the founder of Cambridge Quantum and Quantinuum, Ilyas Khan, who was also Quantinuum’s founding CEO. CQ has an estimated stake in Quantinuum of approximately 37%. CQ contributed much of the company’s software and applications backbone, including the TKET compiler and the InQuanto quantum chemistry platform. As a shareholder, its legacy is foundational, ensuring that Quantinuum is not just a hardware company but a full-stack provider. Its continued equity position reflects the importance of integrating software innovation into quantum hardware development, giving Quantinuum a unique position in the industry.

JPMorgan Chase

JPMorgan Chase is the largest bank in the United States and a global financial leader. It has been active in quantum research for years, focusing on risk analysis, optimization, and encryption. As an early investor in Quantinuum, JPMorgan continues to reinvest in the company’s growth. Beyond capital, its importance lies in validating quantum applications for the financial sector — one of the most data- and computation-intensive industries.

Mitsui & Co.

Mitsui & Co. is one of Japan’s largest general trading and investment companies, with a global portfolio spanning energy, logistics, healthcare, and advanced technology. The company has identified quantum computing as strategically relevant to industries ranging from materials to pharmaceuticals.

Amgen

Amgen is a leading U.S. biotechnology firm and one of the world’s largest independent biopharmaceutical companies. Quantum computing holds promise for accelerating drug discovery and molecular modeling, areas that require massive computational power. Amgen’s reinvestment in Quantinuum underscores how major pharmaceutical companies are monitoring and shaping access to advanced computing tools. Quantinuum and Amgen continue to have a close working relationship on the research side.

Serendipity Capital

Serendipity Capital was a legacy investor in Cambridge Quantum, and has also continued to invest in Quantinuum since 2021. It is a Singapore-based investment firm with a focus on financial services, climate solutions, and deep technology. The firm often backs technologies with transformative potential and long-term societal impact. Its follow-on investment in Quantinuum highlights the recognition of quantum computing as strategically important both economically and geopolitically.

What’s Coming For Quantinuum?

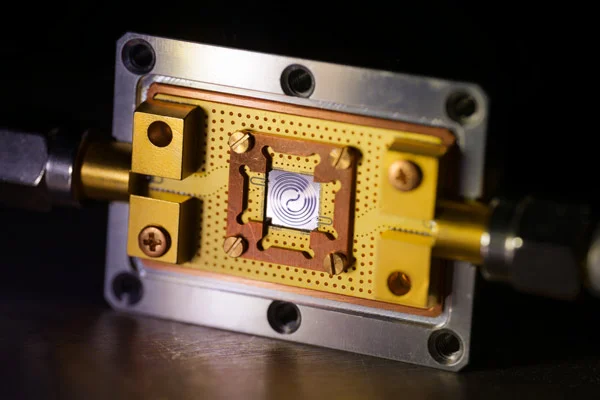

Quantinuum’s $10 billion valuation reflects more than investor confidence in its hardware — it likely also speaks to the company’s push to deliver a complete, full-stack platform. The strategy is designed to make quantum programming more accessible for developers while moving steadily toward fault-tolerant computation, the point at which systems can reliably scale. At the center of this effort is the upcoming Helios system, which the company describes as the backbone of its next generation stack.

Helios brings new layers intended to address two of the industry’s persistent challenges: the complexity of coding for quantum systems and the limited access to reliable hardware. The system incorporates Guppy, a new programming language embedded in Python, and Selene, an emulator that reproduces Helios’s runtime behavior. Together, they are meant to allow developers to move beyond gate-by-gate coding and into structured, dynamic workflows. Features such as loops, conditionals, and real-time feedback — common in classical computing but difficult to implement in quantum systems — are being introduced directly into the workflow.

Quantinuum says Guppy departs from conventional circuit construction, enabling flexible approaches to error correction. Developers can test advanced protocols such as magic state distillation and teleportation, while integration with NVIDIA’s CUDA-Q platform provides out-of-the-box error correction decoders. A redesigned control system also brings real-time adaptability, allowing quantum operations to respond dynamically as measurements are made — a requirement for scaling systems from thousands to millions of qubits.

On the accessibility side, Selene functions as a “digital sister” to Helios. It extends beyond traditional simulators by modeling runtime behaviors unique to Quantinuum’s architecture, giving developers a low-risk environment to test Guppy programs on classical machines before deploying to quantum hardware. Selene supports multiple backends, including GPU-accelerated simulations, allowing experimentation at larger scales.

These capabilities are tied together through Nexus, which now supports the Quantum Intermediate Representation (QIR). This provides compatibility with programming frameworks such as Microsoft’s Q#, NVIDIA’s CUDA-Q, and Oak Ridge’s XACC. Quantinuum positions the Helios stack as both a practical tool for today’s developers and a foundation for the universal fault-tolerant systems it aims to deliver. The launch is expected later this year, with a public demo of the stack scheduled in a few week’s time.