Insider Brief

- IonQ exceeded second-quarter revenue expectations and expanded its quantum roadmap through acquisitions, while appointing CEO Niccolo de Masi as Chairman.

- The company reported $20.7 million in revenue—15% above guidance—and strengthened its cash reserves to $1.6 billion after a $1 billion equity raise to support deals including a proposed $1.075 billion acquisition of Oxford Ionics.

- IonQ advanced technical milestones through partnerships with AstraZeneca, AWS, and NVIDIA, achieved quantum simulation breakthroughs with the University of Washington, and added high-profile leaders from finance, government, and research to its executive team.

IonQ beat revenue expectations in the second quarter of 2025 and unveiled an ambitious M&A strategy while promoting CEO Niccolo de Masi to Chairman of the Board.

The appointment marks a shift in board leadership as Peter Chapman, the company’s former Executive Chairman and CEO, officially departs the board, according to a statement from the company. IonQ said the move reflects de Masi’s “exceptional leadership” since taking over in February.

“I am humbled by this further vote of confidence in me by the Board,” de Masi told The Quantum Insider. “I look forward to working closely with my fellow Board members to enhance shareholder value and extend IonQ’s leadership position in both quantum computing and quantum networking. I also want to thank Peter for his seminal work in building the Company over the last six years and our collaboration over the last few months.”

The company pointed to his success in advancing both commercial and technical milestones in the months following his appointment.

“We are delighted to name Niccolo as Chairman of the Board. Since he became CEO in February 2025,” Inder Singh, Lead Independent Director of IonQ, said in the statement “Niccolo has excelled in leading the business forward. We are confident that he is the right person to guide our Board as we continue to oversee the execution of the Company’s strategic priorities and the incredible momentum they are driving. We are grateful to Peter for his long-standing service to IonQ and wish him well.”

Tops Guidance by 15%

For the quarter ended June 30, IonQ reported $20.7 million in revenue, topping the high end of its prior guidance by 15%.

“I am pleased to report that we beat the top end of guidance for Q2 revenue by 15%, and strengthened our balance sheet via the largest equity investment from a single institution in the quantum industry,” said de Masi. “We also made very tangible progress towards delivering our #AQ64 application performance benchmark, with strong indications that it will be achieved in the near term.”

The result was accompanied by a series of strategic announcements, including a proposed $1.075 billion acquisition of U.K.-based Oxford Ionics and the completed acquisitions of Lightsynq and Capella. Together, the transactions are designed to strengthen IonQ’s roadmap to large-scale quantum computing and build out a quantum networking architecture, including space-based infrastructure.

Cash Position Improves

The company posted a net loss of $177.5 million and an adjusted EBITDA loss of $36.5 million. However, its cash position improved significantly following a $1 billion equity raise, bringing pro forma cash and investments to $1.6 billion as of July 9. IonQ framed the capital injection as the largest single equity investment yet disclosed in the quantum sector.

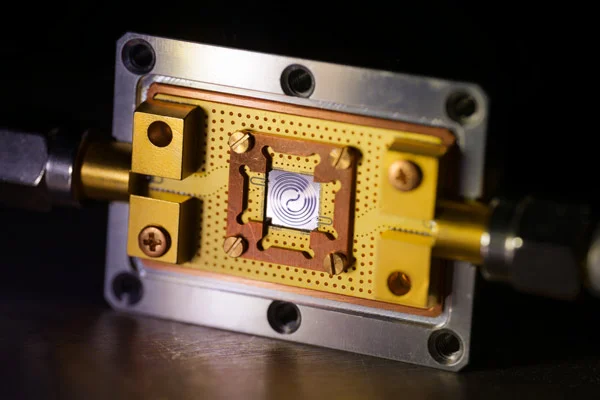

The Oxford Ionics deal, if approved, would give IonQ access to integrated ion-trap-on-chip technology, an innovation aimed at boosting scalability in quantum systems. IonQ described the combination of its hardware platform with Oxford’s chip-level architecture as critical to achieving 800 logical qubits by 2027 and scaling to 80,000 by 2030. These figures represent orders of magnitude beyond today’s operational machines and are widely viewed in the industry as a necessary threshold for practical applications.

Lightsynq, whose acquisition was completed earlier this year, brings advanced photonic interconnect capabilities to IonQ’s hardware. Capella, which closed in July, adds space-based quantum key distribution infrastructure to the company’s growing portfolio. Together, the acquisitions signal IonQ’s intention to lead not just in quantum computing but also in building the foundation of a global quantum internet.

“Via our closed acquisition of Lightsynq, along with our proposed acquisition of Oxford Ionics, we have created the most advanced and powerful quantum computing and networking roadmap in the world,” said de Masi in the statement. “The combination of IonQ hardware and software expertise and Oxford’s implementation of ion-trap-on-a-chip provides the team, IP, technology, and momentum to achieve 800 logical qubits in 2027 and 80,000 logical qubits in 2030. The close of our acquisition of Capella in July expands our quantum networking vision to include a space-based QKD network,” de Masi continued. “Our networking products are production-grade and are used by many of the world’s household-name financial services, telecom, and government agencies. IonQ quantum networking offers the ultimate in communication security, protecting even from the looming threat of quantum decryption.”

Technological Advances

Beyond hardware and infrastructure, IonQ announced progress in hybrid quantum-classical workflows. Working with AstraZeneca, AWS, and NVIDIA, the company said it achieved a 20-fold speedup in quantum-accelerated drug development applications. The demonstration was described by IonQ as the largest of its kind and a proof point for pharmaceutical use cases that benefit from quantum-enabled simulation and optimization.

In another technical advance, IonQ and the University of Washington jointly simulated a process tied to the matter–antimatter asymmetry in the universe. The simulation, conducted on a quantum computer, modeled nuclear dynamics at yoctosecond time scales—equivalent to one septillionth of a second. The company said this work opens new possibilities in fundamental physics and showcases the potential of quantum processors to address high-complexity problems beyond classical reach.

Partnerships and Advocacy

On the commercial front, IonQ highlighted partnerships and expansion across Asia-Pacific and Europe. In South Korea, it signed a memorandum of understanding with the Korea Institute of Science and Technology Information (KISTI) focused on infrastructure access, workforce development, and ecosystem growth. In Japan, it initiated an AI-focused collaboration with AIST, a national research institute. In Sweden, IonQ is working with freight logistics company Einride to optimize routing and supply chains using quantum algorithms. And in Australia, it formed a strategic alliance with Emergence Quantum, bolstering its presence in the region and drawing on decades of experience in trapped-ion platforms.

IonQ cited its support for the Texas Quantum Initiative and a $22 million agreement with EPB, a utility provider in Tennessee, to develop what the company calls the first commercial quantum hub in the United States. The deal signals deeper inroads into energy and infrastructure sectors, which are increasingly viewed as near-term use cases for quantum technologies.

In parallel with its commercial growth, IonQ has continued to expand its leadership team. Marco Pistoia, former head of quantum research at JPMorgan Chase, joined as Senior Vice President of Industry Relations. Rick Muller, former Director of IARPA, was named Vice President of Quantum Systems. Paul Dacier, a veteran legal executive, stepped in as Chief Legal Officer, while IonQ co-founder and leading quantum physicist Chris Monroe transitioned to Chief Scientific Advisor. The company said the additions represent a strategic consolidation of scientific, regulatory, and business expertise as it scales.

IonQ also provided updated financial guidance, projecting full-year 2025 revenue between $82 million and $100 million, and Q3 revenue in the range of $25 million to $29 million.

The company emphasized its focus on talent as a long-term indicator of strength, noting that the recent leadership hires underscore IonQ’s attractiveness to both scientific and executive talent. It also reaffirmed its commitment to building a global leadership position in both quantum computing and secure communications through networking technologies.

“We’ve also attracted world-class leaders who are choosing to build the future at IonQ,” de Masi said in the statement. “From the world of finance, Dr. Marco Pistoia has joined us after leading global applied research and quantum computing at JPMorgan Chase. From the highest levels of government, we welcomed Dr. Rick Muller, former Director of IARPA, the intelligence community’s advanced research agency. To guide our corporate growth, veteran technology counsel Paul Dacier has taken the helm as Chief Legal Officer, and to sharpen our scientific core, our co-founder Dr. Chris Monroe has assumed the vital role of Chief Scientific Advisor. As I have said before, I believe talent is the proverbial Warren Buffett weighing machine most relevant to any company’s long-term prospects, and it is tremendously validating to have such towering figures in the quantum industry become our colleagues at IonQ.”