Insider Brief

- IBM is prioritizing business-to-business startups in AI and quantum computing that can integrate into its enterprise ecosystem, according to guidance shared by Emily Fontaine in Fortune.

- The $500 million IBM Ventures fund has made 23 investments focused on AI tools, data organization, quantum error correction and security software, with several companies also supporting IBM’s internal operations.

- IBM’s quantum investment strategy emphasizes software and “quantum-safe” security tools, driven in part by demand from financial institutions preparing for future cryptographic risks.

Could your startup be the next IBM investment?

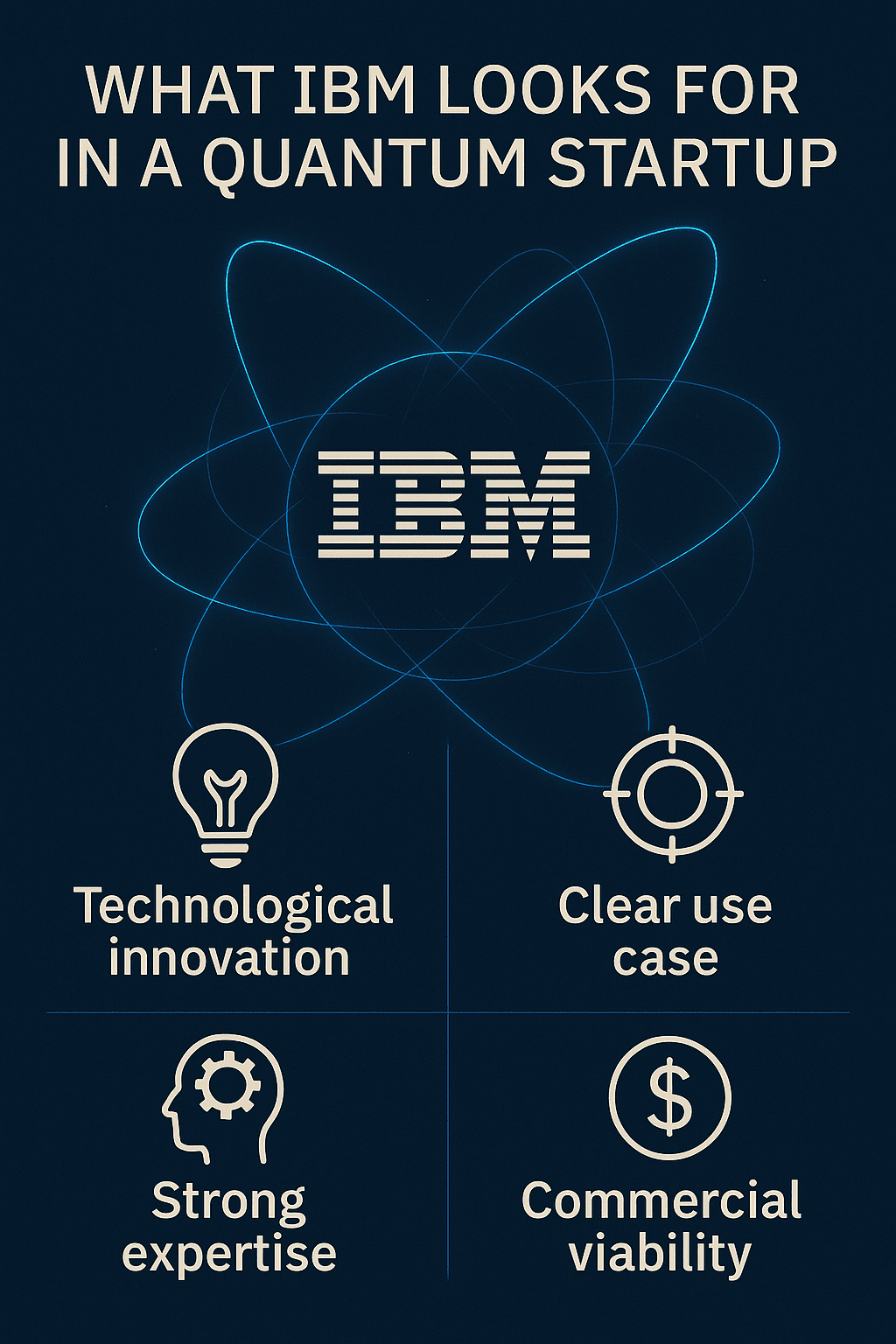

IBM is looking for businesses in the quantum space as it sharpens its investment strategy around startups that can plug directly into the company’s growing focus on artificial intelligence (AI) and quantum computing, according to Emily Fontaine, the company’s global head of venture capital.

Fontaine told in Fortune that IBM Ventures, a $500 million corporate venture fund, is concentrating on business-to-business startups that can fit into IBM’s existing network of enterprise clients. The approach is designed to give portfolio companies a built-in path to customers while extending IBM’s long-term technology roadmap.

Fontaine told Fortune the fund has made 23 investments to date across AI tools, data-preparation software, quantum error-correction firms and security platforms.

A Corporate VC Built for Enterprise Buyers

The investment strategy centers on companies building tools for organizations rather than consumer products.

“We look at three key areas for every one of our investments,” Fontaine told Fortune. “The first, products or capabilities. The second being: Are they an ecosystem partner? Generally, they fall within those two categories. The third being: Are they very disruptive to industry? And we work very closely with IBM Research on those ones that are totally disrupting the industry and doing something incredibly novel.”

Fontaine said this gives IBM an advantage that traditional venture firms lack: the ability to connect startups immediately with IBM’s existing enterprise clients. For many young companies, a first wave of customers is often the hardest to secure, and IBM’s enterprise footprint offers early traction at scale.

Several investments support internal IBM initiatives as well.

The company’s AI-enabled HR assistant, AskHR, is one example of how software developed by portfolio companies can become part of IBM’s own operations. Fontaine said IBM is on track to save $4.5 billion in operating expenses this year through internal adoption of AI systems, illustrating a feedback loop in which investments both support and are supported by IBM’s enterprise overhaul.

Focused on Software, Banking

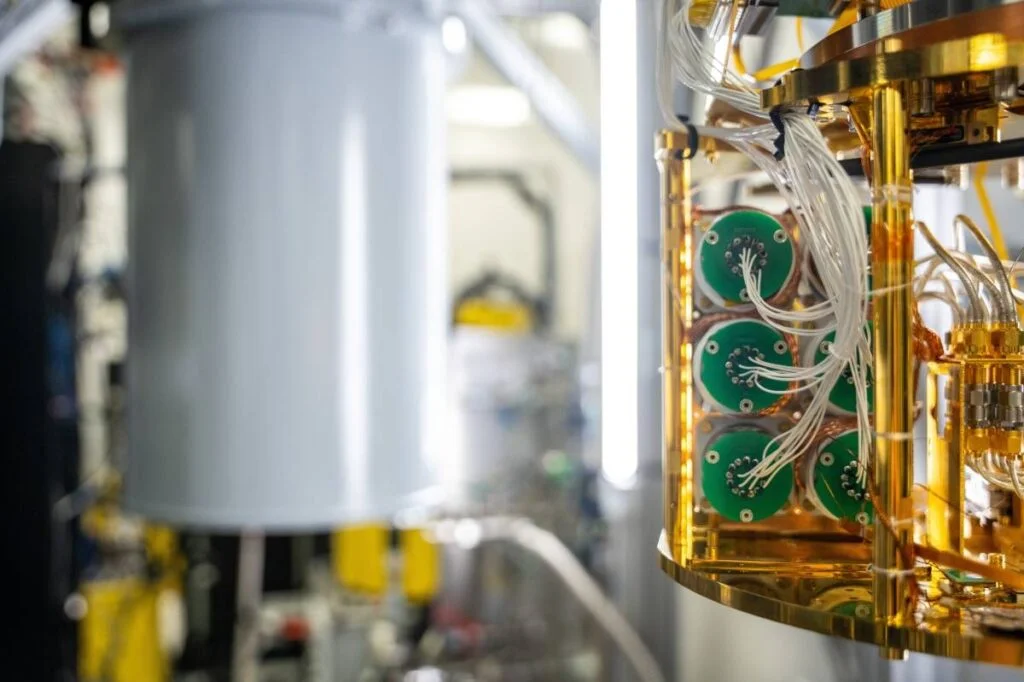

Although IBM is one of a handful of companies building and deploying quantum processors, its early-stage investments in quantum lean toward software, algorithms and tools that help make the machines more usable. Fontaine highlighted QEDMA, an Israeli startup that builds error-correction software to clean up the noisy signals produced by today’s quantum chips. Quantum devices operate in fragile states that produce unreliable outputs, and software-based techniques are essential to turning raw results into stable, useful information.

IBM’s quantum focus is shaped in part by financial institutions. Banks depend on encryption that quantum computers may be able to break in the future. That threat drives demand for “quantum-safe” defenses, an area where both IBM and its portfolio companies are trying to position themselves.

“The banks are at the forefront of wanting quantum strategy,” Fontaine said, as reported by Fortune. “The banking industry is really leaning in, saying, what’s our strategy around quantum? You need to be quantum safe, is what you need to be doing.”

Fontaine did not detail the fund’s financial performance but said she was satisfied with the returns so far. Four companies have exited, including Gem Security, bought by Wiz at a reported $350 million valuation, and Lightspin, acquired by Cisco for an estimated $200 million to $250 million.