Insider Brief

- France’s state investor Bpifrance warned that Europe risks falling behind in quantum computing and deep tech due to private capital’s reluctance to take risks, CNBC reports.

- Nicolas Dufourcq highlighted the funding gap between Europe and the U.S., noting that American venture-backed firms raised nearly four times more capital in the first half of 2025.

- Bpifrance has invested in several French quantum startups, including Quandela, Quobly, C12 Quantum Electronics, Alice & Bob, Welinq, and PASQAL, but scaling remains constrained by limited private investment.

France’s top state investor has issued a blunt warning: Europe risks falling behind in the race for quantum computing and other deep technologies because its private capital is unwilling to take risks. CNBC reports that Nicolas Dufourcq, head of Bpifrance, said at the IPEM private capital conference in Paris that Europe is “doubly colonized” — industrially by China and digitally by the United States, a phrase that captured the unease among European investors.

“It’s not in the future; the consequences are now,” said Dufourcq at the private capital conference, according to CNBC.

His remarks point to a growing mismatch between Europe’s ambitions in future-critical industries and its appetite for funding them.

At the heart of the problem is how European savings are deployed. Despite the continent’s deep pools of institutional and private wealth, much of it goes into real estate and other conservative assets, or flows to American tech when investors seek higher returns, according to CNBC’s reporting. The pattern is leaving European startups underfunded even in sectors where they have a technological edge.

“The savings of Europe, when they are invested in risk-taking assets, they go to the U.S.,” Dufourcq said, as reported by CNBC. He contrasted Europe’s cautious stance with what he called the “Californian culture” of risk-on investing, where backing unproven but promising startups is seen as both duty and opportunity.

Struggle to Scale

One of Dufourcq’s examples was Quandela, a Paris-based quantum computing startup developing photonic processors. CNBC reported that the company has raised about €62 million, with Bpifrance participating in three rounds.

Quandela’s chips, he argued, outperform some American rivals, but the company continues to struggle to secure the kind of private capital that U.S. quantum firms regularly attract. American peers such as IonQ and PsiQuantum have raised hundreds of millions of dollars, often with strong participation from both venture capital and corporate investors. Quandela’s reliance on state-backed funds illustrates a wider problem: public support can help sustain research and early development, but scaling into globally competitive businesses requires the deeper private capital pools Europe has not mobilized.

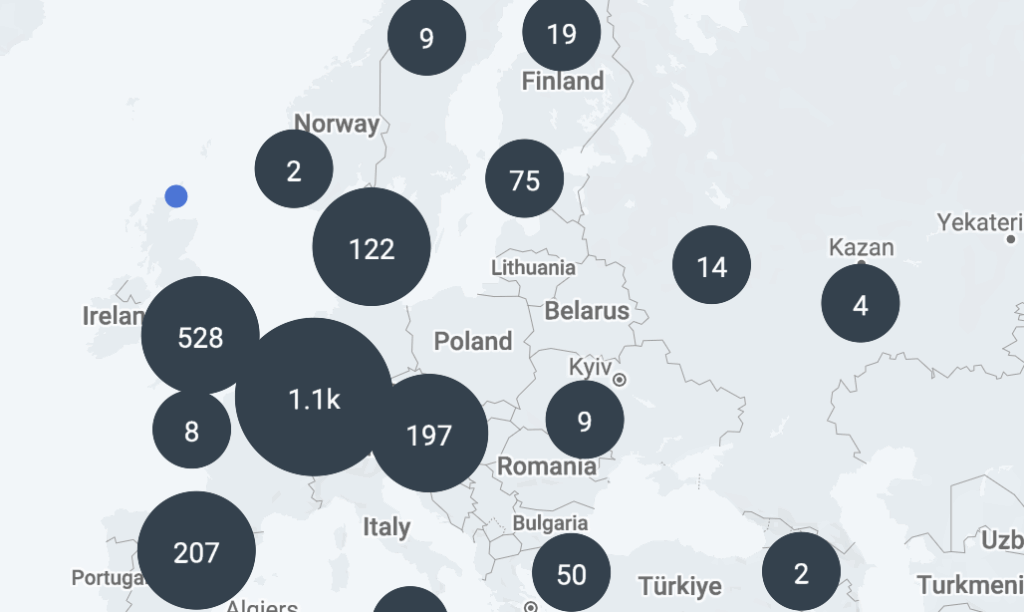

According to The Quantum Insider’s Intelligence Platform, Bpifrance is one of the most active investors in the deep tech space and has invested not only in Quandela but also in quantum and quantum-related startups such as Quobly, C12 Quantum Electronics, Alice & Bob, Welinq and PASQAL.

According to the article, the capital gap is stark with U.S. venture-backed companies raised nearly four times as much money as their European counterparts in the first half of 2025. The imbalance extends beyond quantum to all deep tech sectors. While France and the EU have unveiled ambitious plans to fund quantum research — including France’s €1.8 billion Plan Quantique — these programs cannot fully substitute for growth-stage capital. For hardware-heavy fields such as quantum computing, the sums required before commercialization often reach into the hundreds of millions, sometimes billions, of dollars.

Risk-Off vs. Risk-On

Europe’s investors remain risk-averse, preferring stable returns and asset preservation to long-term bets on disruptive technologies, Dufourcq suggests. By contrast, Silicon Valley thrives on a risk-on mindset, where investors expect many failures but bank on the outsize returns of the few winners.

“If you don’t have that culture in Europe, you will continue to invest in tourism, wine, real estate, and U.S. tech,” Dufourcq said.

Harry Stebbings, the U.K.-based venture capitalist behind 20VC, told CNBC’s Squawk Box Europe that most of his $850 million raised came from U.S. investors, meaning most of the gains will flow back across the Atlantic.

Quantum as a Strategic Test Case

Europe continues to produce world-class science and early-stage companies, particularly in quantum. Europe’s strengths aren’t just centered in quantum computing, but, arguably, are even stronger across the industry, including quantum sensors and communications systems.

The stakes for quantum technology are particularly high because they are expected to have sweeping implications for national security, energy, and healthcare. The United States has coordinated support through the National Quantum Initiative and the CHIPS Act, while China has embedded quantum goals into its Five-Year Plans, CNBC reports. France is home to a handful of serious quantum players — Pasqal in neutral atoms, Quandela in photonics, Alice & Bob in cat qubits — but they remain capital-constrained compared to U.S. and Chinese rivals. Without stronger private support, Europe risks becoming a supplier of talent and intellectual property rather than hosting its own globally dominant companies.

The economics of quantum make the challenge more acute. Unlike software startups, which can scale with relatively low capital, quantum hardware demands expensive infrastructure: clean rooms, cryogenics, advanced optics and fabrication capacity. Industry experts estimate that scaling a competitive quantum platform can cost between $100 million and $500 million before meaningful revenues are achieved. American and Chinese firms benefit from either deep venture ecosystems or direct state industrial strategies. Europe’s reliance on state-backed funds like Bpifrance fills part of the gap but does not match the magnitude required.

A Broader European Dilemma

The debate over quantum funding reflects Europe’s wider struggle with deep tech. From semiconductors to artificial intelligence to clean energy, the continent often fails to translate breakthroughs into scaled companies. Policymakers warn of a “valley of death” between lab discoveries and commercial deployment, a space where U.S. and Chinese systems are far more effective at mobilizing capital.

Dufourcq acknowledged that state intervention is not enough, according to CNBC. Bpifrance manages around €100 billion — about $117 billion USD, but without private investors taking greater risks, the effort cannot close the funding gap. He called for a shift toward “aggressivity” in capital allocation — a mindset that aligns European money with European interests. His comments come as geopolitical tensions sharpen the importance of technological sovereignty.

Although Dufourcq’s warning is stark, Europe does have strengths it can lean into. For example, unlike some regions, Europe does not face a talent shortage in quantum and deep tech. Its universities and startups consistently prove their quality. However, if Europe cannot sustain its own champions in quantum and other strategic fields, it could risk long-term dependence on foreign technologies.