Insider Brief

- Serendipity Capital reported a 31.6% rise in net asset value per share in the first half of 2025, driven by strong performances from portfolio companies, especially quantum computing leader Quantinuum.

- Quantinuum was selected for DARPA’s Quantum Benchmarking Initiative, announced a $1 billion joint venture with Al Rabban Capital, and achieved key milestones in computational power and error correction.

- Serendipity Capital focuses on critical technologies, including quantum computing, in Five Eyes and allied nations, and has expanded its leadership team to support growth.

Serendipity Capital’s bet on quantum computing paid off in the first half of 2025, with portfolio company Quantinuum delivering major technical and commercial milestones that helped propel the Singapore-based investment firm ahead of sector benchmarks, the firm reported.

For the six months ended June 30, Serendipity reported a 31.6% rise in net asset value per share and a 31.5% internal rate of return, according to a statement released on the firm’s LinkedIn site. The firm’s multiple on invested capital climbed from 2.4x to 3.1x, driven largely by advances in critical technologies — especially quantum computing.

Rob Jesudason, CEO and Founder of Serendipity Capital, said in the statement: “This has been an exceptionally strong period for us, with numerous highlights amongst our portfolio companies and a continued clear outperformance against the venture capital sector. Our second half is off to a strong start and we look forward to continuing to build on this progress over the course of this year and beyond.”

Quantinuum Callout

Quantinuum, one of Serendipity’s flagship holdings, earned a specific callout in the announcement due to a series of high-profile achievements. In early 2025, the U.S. Defense Advanced Research Projects Agency (DARPA) selected the company for its Quantum Benchmarking Initiative, a program designed to set measurable standards for quantum computing performance. The selection put Quantinuum alongside a small group of global leaders working on validating the capabilities of the emerging technology.

Shortly afterward, Quantinuum announced a $1 billion joint venture with Qatari investment group Al Rabban Capital. The deal aims to speed adoption of quantum computing in the Middle East, combining Quantinuum’s hardware and software capabilities with regional infrastructure investment. The venture underscores the company’s growing reach beyond Western markets and into regions seeking technological diversification.

Quantinuum’s performance has helped validate that strategy at a time when venture markets remain turbulent, the Serendipity team indicated.

Major Technical Milestones

The first half also brought what Serendipity described as “major technical milestones” in computational power and error correction for Quantinuum. The firm also reported that improvements in error correction — a core challenge in building scalable quantum computers — are seen as critical steps toward fault-tolerant systems capable of tackling commercially valuable problems.

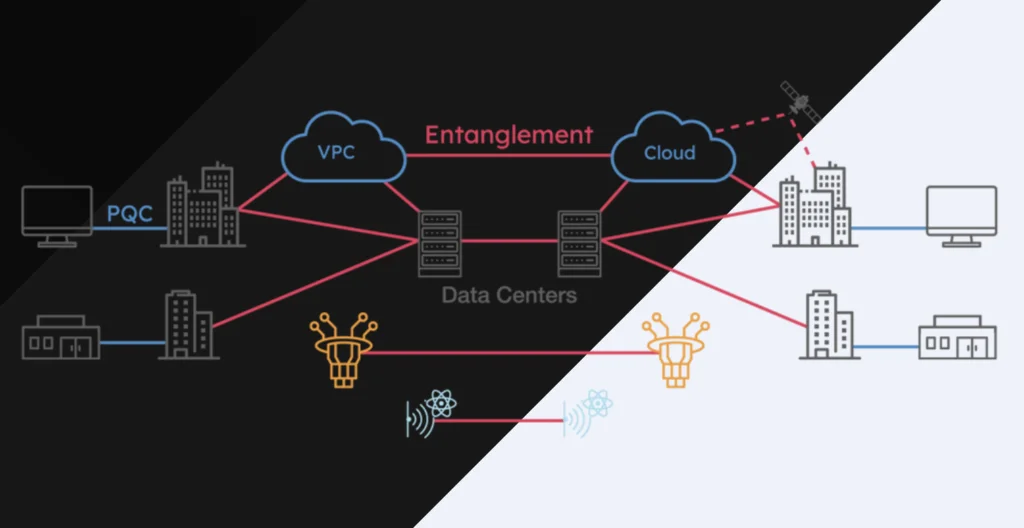

Serendipity’s focus on critical technologies spans artificial intelligence, semiconductors, cybersecurity, advanced manufacturing and quantum computing, with investments concentrated in Five Eyes — an intelligence-sharing alliance comprising Australia, Canada, New Zealand, the United Kingdom and the United States — and allied nations.

The firm’s strong quantum position comes as governments and private investors expand funding for the sector. National initiatives, such as the U.S. National Quantum Initiative and comparable programs in Europe and Asia, have intensified competition among quantum companies. DARPA’s benchmarking program reflects a shift from pure research toward comparative, application-driven evaluation of quantum hardware and algorithms.

Serendipity’s other holdings, including AI security company Deep Labs, also posted gains. The venture capital firm has been expanding its capacity to manage growth, adding senior figures with backgrounds in both technology and public service, including Palantir adviser Laurence Lee CMG as a board member.

Ewen Stevenson, Chair of Serendipity Capital, said in the statement, “The volatility and uncertainty of the recent years has only amplified over the past six months, creating obstacles to navigate but also significant opportunities for those who understand the critical technology space. We are increasingly well positioned to benefit from the growing national and private interest in the sector, and we are determined to further capitalise on this momentum.”