Insider Brief

- HSBC successfully trialled quantum-secure technology for buying and selling tokenised physical gold, marking a major step in protecting critical applications from future quantum computing attacks.

- HSBC used post-quantum cryptography (PQC) to safely move digital assets across distributed ledgers and enhance interoperability with other digital platforms and wallets.

- Partnering with Quantinuum, HSBC demonstrated holistic protection against “store now, decrypt-later” cyber incidents, ensuring sensitive data remains secure even against future quantum threats.

PRESS RELEASE — HSBC announced today that it has successfully trialled the first application of quantum-secure technology for buying and selling tokenized physical gold. This achievement marks the latest step by HSBC in pioneering the protection of critical applications from potential future quantum computing attacks.

Last year, HSBC was the first global bank to offer tokenized physical gold to institutional investors using distributed ledger technology (DLT). This year saw another first, with the launch of HSBC Gold Token for retail investors in Hong Kong, allowing them to acquire fractional ownership of physical gold. Both launches use the technology of the HSBC Orion digital assets platform.

HSBC also tested the interoperability of its gold tokens using post-quantum cryptography (PQC) to move digital assets safely across distributed ledgers via secure networks, addressing clients’ evolving needs and regulations. This included the capability to convert HSBC’s gold tokens into ERC-20 fungible tokens, thereby enhancing distribution and interoperability with other DLTs and digital wallets.

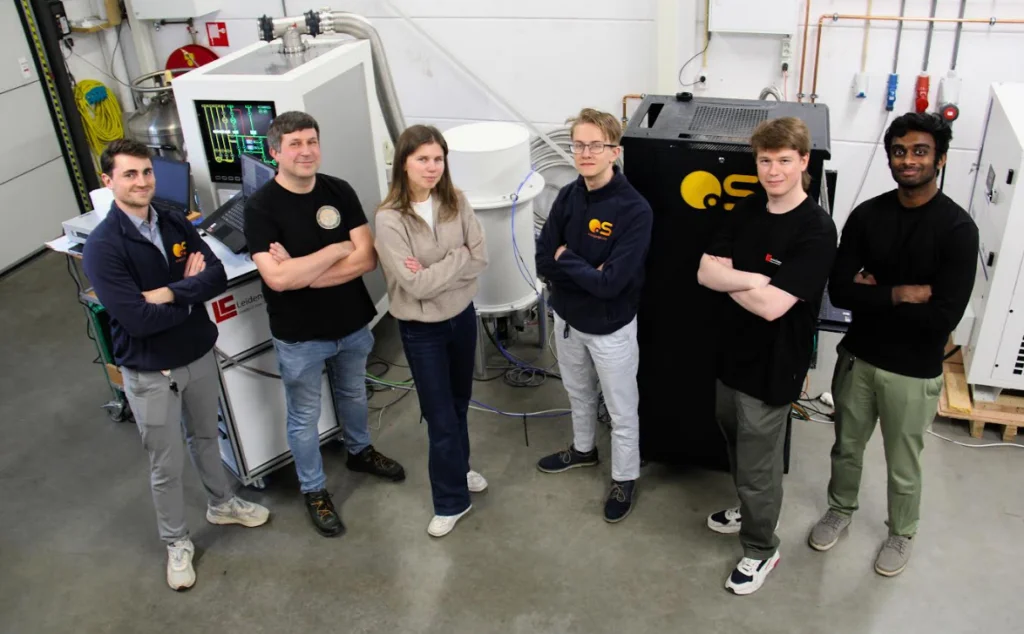

As part of the quantum pilot, Quantinuum, the world’s largest integrated quantum computing company, used PQC algorithms and its Quantum Origin quantum randomness technology to demonstrate holistic protection of digital assets such as HSBC gold tokens from a quantum computing attack, and prevent “store now, decrypt-later” (SNDL) cyber incidents. SNDL is a cyber-technique that has the aim of stealing sensitive data now and then storing it to decipher that data later, using powerful quantum computers in the future.

Philip Intallura, Global Head of Quantum Technologies, HSBC, said: “HSBC was the first international bank to offer tokenised physical gold and is now building on that innovation with cutting-edge cybersecurity protection for the future. This pilot successfully demonstrated the viability of deploying these advanced technologies for a real-world business environment.”

Ilyas Khan, Quantinuum founder and Chief Product Officer, said: “As long-time partners in exploring commercial quantum applications, HSBC and Quantinuum are together building the next generation of financial services featuring quantum-hardened defences harnessing the power of today’s quantum computers to safeguard sensitive data now and into the future.”