Insider Brief

- D-Wave reported a 28% year-over-year revenue increase in Q2 2024, driven by growing adoption of its quantum computing solutions.

- The company’s backlog grew by 64%, providing strong visibility into future earnings and revenue streams.

- D-Wave’s strategic partnerships and expanding customer base, including major government and Forbes Global 2000 clients, underscore its leadership in the quantum computing market.

D-Wave Quantum reported its Q2 2024 earnings, highlighting steady progress in both financial and operational areas, according to the company’s earnings call with analysts. The company continues to position itself as a leader in the quantum computing space, particularly in the commercial application of annealing quantum computers.

Revenue and Bookings

D-Wave reported revenue of $2.2 million for the second quarter, marking a 28% increase from $1.7 million in the same period last year. The company also saw bookings rise to $2.7 million, a 6% increase from Q2 2023. This quarter marks the ninth consecutive quarter of year-over-year growth in bookings.

“Our revenue growth is a testament to the increasing adoption of our quantum computing solutions across multiple sectors,” said John Markovich, CFO of D-Wave.

The company’s backlog also saw significant growth, increasing by $3.1 million, or 64%, from $5 million at the end of 2023 to $8.1 million at the end of Q2 2024. When companies refer to backlog, they mean orders that have been signed but not recognized as revenue. Because the statistic represents orders or contracts that will generate revenue once fulfilled, it can give investors an idea of potential future earnings as i.

Markovich told the analysts, “This backlog growth, particularly in our Quantum Computing as a Service (QCaaS) contracts, provides greater visibility into future revenue and gross margins.”

Operational Highlights

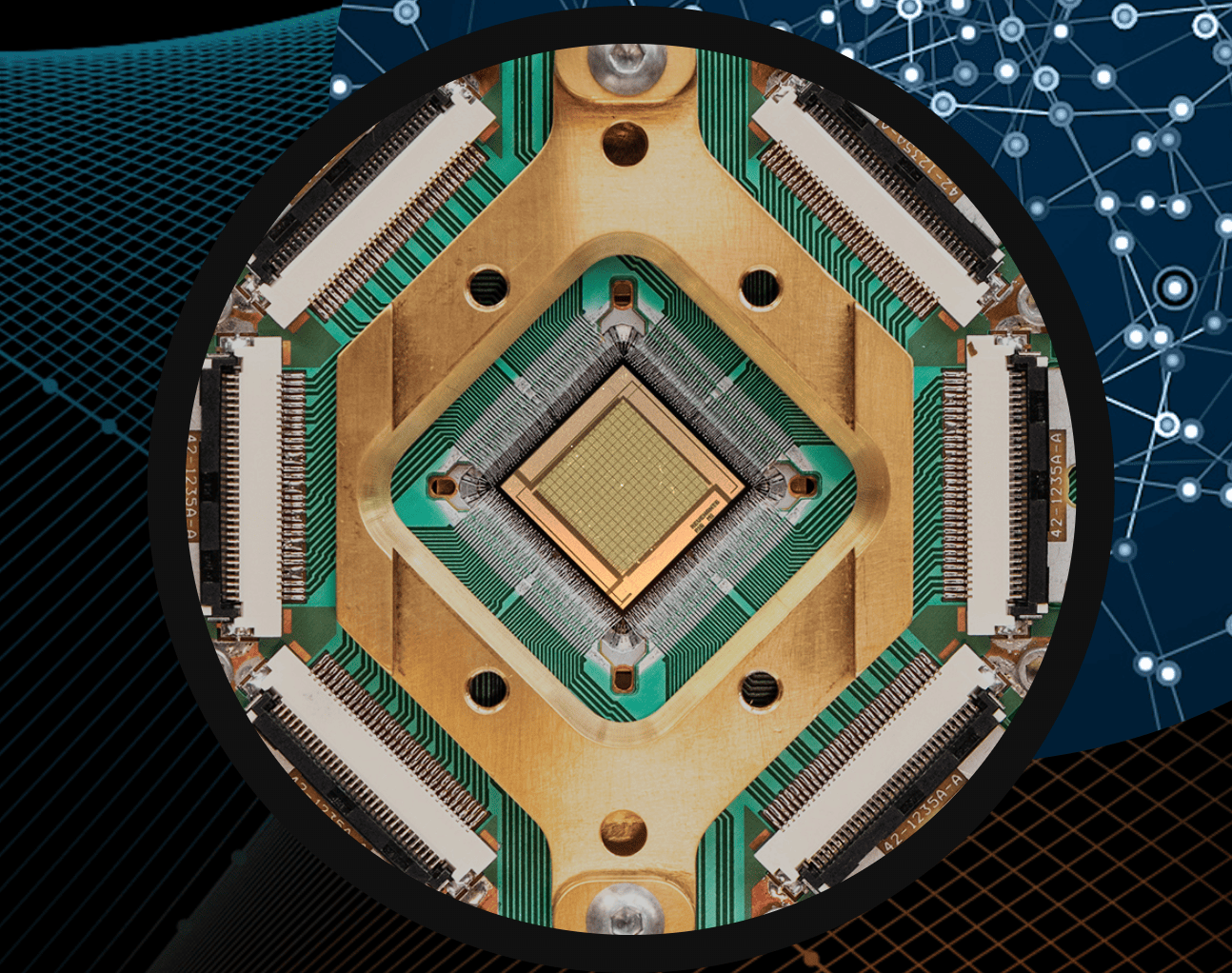

The company announced several key advances during the call, including the near completion of a 4800+ qubit Advantage2 processor, following the launch of a 1200+ qubit prototype earlier this year. The quick progress on these devices are part of D-Wave’s ongoing effort to deliver scalable, production-grade quantum solutions.

Alan Baratz, CEO of D-Wave, told analysts that the company has a unique position in the market.

“The world is waking up to the fact that annealing quantum computing is here now, and it’s driving measurable outcomes for our commercial, government, and research customers,” said Baratz. “We believe that D-Wave is single-handedly creating the market for commercial quantum computing.”

D-Wave also announced an expansion of its partnership with Zapata AI, aimed at accelerating the development of integrated quantum and generative AI solutions. This collaboration is expected to address growing customer demand for more efficient AI/ML solutions, leveraging quantum computing’s ability to solve complex optimization problems.

Commercial and Government Partnerships

D-Wave’s customer base continues to grow, the executives revealed, with the company now serving 130 customers, up from 114 in the previous year. Of these, 77 are commercial customers, including 26 Forbes Global 2000 companies, which represent 33% of D-Wave’s commercial customer base and 26% of its total revenue.

Baratz said these partnerships were important to the company’s future.

“We’re hearing from more and more customers, both private and public, that they’ve tried quantum computing solutions but need to work with D-Wave, the quantum vendor that has real, scalable, and production-grade commercial solutions today,” Baratz said.

In the government sector, D-Wave announced the placement of a second Advantage quantum computer in the U.S., to be housed at Davidson Technology’s new global headquarters in Huntsville, Alabama. This move is part of D-Wave’s strategy to accelerate quantum computing adoption among government agencies, particularly in areas of national security.

Financial Performance and Outlook

D-Wave’s GAAP gross profit for Q2 2024 was $1.4 million, a 97% increase from $700,000 in Q2 2023. Non-GAAP gross profit also saw a significant rise to $1.6 million, up 61% from $1 million in the previous year. The company achieved a GAAP gross margin of 63.6%, improving by 22.3% compared to Q2 2023, while the non-GAAP gross margin was 73.1%, up by 15% from the same period last year.

Operating expenses decreased by 6% to $20.2 million, driven by a reduction in third-party professional services and non-cash stock-based compensation expenses. The company reported a net loss of $17.8 million, or $0.10 per share, a significant improvement from a net loss of $26.2 million, or $0.21 per share, in Q2 2023.

Looking ahead, D-Wave executives told analysts the company remains focused on expanding its market presence and continuing its innovation in quantum technology. The company’s inclusion in the Russell 3000 Index is expected to increase visibility among global investors, further solidifying its position in the market.

Baratz concluded, “We are clearly witnessing growing awareness and interest in our solutions in the commercial sector. But that’s not all. We’re also seeing similar traction in the government sector. This quarter has been a solid one with impressive product innovations and customer adoption of these new products.”

Things to Watch For

While the earnings call did show D-Wave’s progress financially and commercially, executives pointed out a few areas of concern and investors should pay careful attention to some statistics in the report that are less-than-optimal for a company.

The ongoing transformation of D-Wave’s sales organization under new leadership is acknowledged to be affecting near-term sales productivity, the company told analysts.

“The entire go-to-market organization has been intimately involved with the organizational up leveling, which has had some impact on near-term sales productivity,” Markovitch said. “We are planning on completing this transformation by the end of this year.”

Although revenue grew by 28%, the increase in bookings was only 6%. That might suggest a slowdown in new order momentum — something investors should monitor.

Finally, despite a decrease in operating expenses, D-Wave’s expenses seem relatively high compared to the revenue that was reported. This is contributing to the net loss. This ongoing gap between revenue and expenses may be a concern if it continues without a clear path to profitability.