Insider Brief

- Researchers report that quantum computers may play a role in developing effective strategies to mitigate systemic risk.

- The team developed a two-stage optimization algorithm: partitioning the financial network into modules of highly interconnected banks and developing a methodology to optimize the connections within each module.

- Quantum hardware improvements would be needed to scale this system for the global financial system.

The failure of a single financial institution can cause a domino effect of additional bank failures, resulting in systemic risk. As we’re seeing right now with the Silicon Valley Bank saga and as demonstrated by the 2008 financial crisis, this risk can threaten the entire global economy, which is an intimate and complex network of financial institutions.

A team of researchers from New York University and the University of Toronto, in what might be the most timely research discovery in recent times, report that quantum computers may play a role in developing effective strategies to mitigate systemic risk.

The team of researchers, who published their findings in Scientific Reports, report that one approach to mitigating risk is to optimize the connections between institutions in financial networks, such as adjusting loans, holding shares, and other liabilities that connect the banks. However, this task is challenging due to the complexity of the financial system and the nonlinear and discontinuous losses that can occur.

Offering some idea of that complexity, the researchers write: “The total number of decision variables grows quadratically with the size of the network. In general, the complexity of optimization problems grows drastically with the number of decision variables, which again grows quadratically in the size of the network. Accordingly, this problem could become intractable using the one-stage optimization algorithm when the size of the interbank network is large, which is often the case for real life banking networks. For instance, there are around 5,000 commercial banks currently in North America according to the FDIC quarterly report by the Federal Deposit Insurance Corporation.”

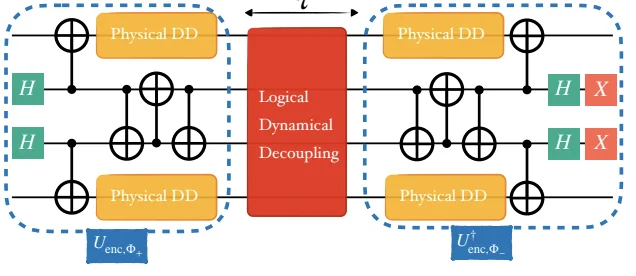

To address this challenge, the researchers have developed a two-stage optimization algorithm. In the first stage, the financial network is partitioned into modules of highly interconnected banks, an approach improves scalability, as it is much easier to optimize smaller modules of banks than the entire network. To partition the network, the researchers developed new algorithms for both classical and quantum partitioning for directed and weighed graphs.

In the second stage, the researchers developed a new methodology for solving Mixed Integer Linear Programming problems with constraints for the systemic risk context. This methodology is used to optimize the connections within each module of banks while ensuring that the entire system remains stable.

According to the researchers, who used a variety of D-Wave quantum devices and relied on an quantum annealing approach, quantum computers are particularly promising for solving these types of problems. The devices offer significant advantages in terms of computational power and efficiency for solving complex optimization problems, the team added.

The team studied one-stage and two-stage solutions to the problems, as well as a mixture of classical and quantum approaches. In the end, the researchers said the two-stage quantum partitioning performed best.

They wrote: “Two-stage with quantum partitioning outperforms both of the classical methods. It beats the two-stage with classical partitioning because it is able to find better partitions that are able to mitigate cascades more effectively. It surprisingly beats the one-stage optimization, demonstrating that appropriate network partitioning actually results in better cross-holdings optimization than with global one-stage optimization, as with accurate network partitioning, two-stage optimization is optimizing more important cross-holdings and confining the source of the cascade more accurately.”

These experimental results suggest that the two-stage optimization approach with quantum partitioning is more resilient to financial shocks. It delays the cascade failure phase transition and reduces the total number of failures at convergence under systemic risks, all while reducing time complexity.

By optimizing the connections between banks and using advanced algorithms for partitioning and optimization, then, policymakers could reduce the likelihood of cascading failures and protect the global economy from financial shocks, the researchers add.

Critically, the team could only able to test up to 50 organizations due to quantum hardware limitations. Boosts in quantum hardware and quantum technology, in general, then would be important to developing tools, such as this financial crash suppression system.

In their own study, the researchers saw an increase in performance when they upgraded from a 2,000-qubit system to a 5,000-qubit one.

The researchers used synthetic data and real-world data to assess the algorithms and show the benefits of the approach and the computational benefits.

“The real-world results aligned with our synthetic results and we demonstrated that our two-stage quantum algorithm is more resilient to financial shocks and delays the cascade failure phase transition under systemic risks with reduced time complexity,” they write.

If you found this article to be informative, you can explore more current quantum news here, exclusives, interviews, and podcasts.