Insider Brief

- Vertical Research Partners, an equity market analyst firm, see a path for Quantinuum to reach a discounted equity value of circa $37 billion within a decade.

- Taking into account of Honeywell’s 54% ownership, that would mean a value of about $29 per share of Honeywell.

- The firm sets out several limitations in their analysis. Quantinuum would need to both experience growth in accordance with its projections while avoiding pressure from competing firms.

An equity market analyst firm estimates that Quantinuum could offer a significant return for Honeywell investors, with a valuation that could reach well into the billions.

In a paper acquired by The Quantum Insider, Vertical Research Partners reported that, based on their assumptions and projections, the discounted equity value of Quantinuum could reach circa $37 billion within a decade. Taking into account of Honeywell’s 54% ownership, that would mean a value of about $29 per share of Honeywell, a figure, the analysts added, that would equal to about 15% of Honeywell’s total equity.

In a decade, the analysts who authored the paper — Jeffrey T. Sprague, Nick Lipinski and Jeremy Ziobron — point out that the undiscounted terminal value of $95 billion would match the higher level of some of Honeywell’s valuation comments, which range upwards to $150 billion.

There are cautions, however. The analysts say that any valuation estimates of Quantinuum, which is the recent result of a merger between Cambridge Quantum and Honeywell Quantum Solutions, at this point are speculative and that the company would need to both experience growth in accordance with its projections while avoiding pressure from competing firms. The assumptions are based, in part, on Honeywell’s comments in recent company investor conferences and modelled on the growth of post-IPO performances of companies, such as Google, Apple and Microsoft.

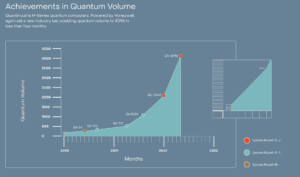

The analysts also call attention to Quantinuum’s steady technological progress, pointing out the Quantum Volume of 4096 on their H1-2 computer the total Qubit count from 12 to 20 on their H1-1 computer in June. The company released also news on its error-correction advance just recently.

The analysts also call attention to Quantinuum’s steady technological progress, pointing out the Quantum Volume of 4096 on their H1-2 computer the total Qubit count from 12 to 20 on their H1-1 computer in June. The company released also news on its error-correction advance just recently.

Still, while critics of current valuation estimates for quantum startups are derived from perhaps overly optimistic venture capitalists, this analyst valuation exercise offers a degree of credibility to the future potential of quantum technology and quantum technology firms. Sprague is Vertical Research Partner’s managing partner and is well-respected financial analyst who has been covering Honeywell for decades.

$1 Trillion Worth of Use Cases

The valuations are heady but the projections are based on what could be an addressable market that would be worth trillions spread over a number of industries.

By 2050, Honeywell expects a $1 trillion in use cases for quantum and Quantinuum could address more than half — $550 billion — of that total addressable market. That TAM comprises:

- Fertilizer Production — $200 billion

- Pharmaceuticals & Healthcare– $110 billion

- New Material Design–$170 billion

“Past 2030, Honeywell projects their products and the technology itself to be transformational to every industry vertical.”

The analysts also see Quantinuum’s cybersecurity unit offering significant revenue-generating services.

According to the report, the value of quantum computing rests in the premise that if quantum can lead to just a fractional savings for pharmaceuticals, the resulting payoff would be substantial. For example, if Pfizer could use quantum computers to reduce research and development by 1%, they would lead to savings of about ~$7.5 million, according to the analysts.

The report states: “Scaling this to all companies within the three industries explains the high revenue potential. HON emphasized cybersecurity as an early adopter as Quantinuum has already been entering the vertical through their current service offerings. In the mid-to-late 2020s Honeywell expects Quantinuum’s technology to transform these industries and others including finance, energy, automation, and transportation. Past 2030, Honeywell projects their products and the technology itself to be transformational to every industry vertical.”

Quantinuum IPO?

Vertical Research Partners offers a few ideas on exit strategies for Honeywell’s Quantinuum investment including IPO or spin-out opportunities. The analysts say that Honeywell clearly will monetize the asset, however the timing is not clear. Future monetization opportunities will likely occur when and if Quantinuum is successful in addressing the above markets to secure a larger revenue base, according to the analysts.

Stages of Market Penetration

Quantinuum’s business model progress in three stages: penetration, incubation and scaling. It is well into its market-penetration phase.

The report states: “The market penetration stage includes integrating their hardware with cloud providers like Microsoft Azure and releasing services to increase initial adoption. For example Quantum Origin currently provides encryption services that are non-deterministic, or unable to be hacked with current technologies. This has already led to a partnership with PureVPN to generate encryption keys for users.”

The current phase, the incubation stage, will include establishing more partnerships with Fortune 500 companies. Quantinuum already lists partnerships with Samsung, Nippon Steel, and BMW to solve problems within material sciences, supply chains and logistical optimization. It also partners with several companies, including JSR Corporation, on quantum chemistry, using the quantum software platform, InQuanto.

Rei Sakuma, principal researcher of the Materials Informatics Initiative at JSR Corporation, said in a recent statement about InQuanto: “JSR entered into a close partnership with Quantinuum very early on. We participated in the beta testing of InQuanto (formerly EUMEN) and have used it primarily for research and development on novel materials and property prediction. InQuanto is very easy to use, even for researchers and engineers without a deep knowledge of quantum computing. In the future, we would like to use InQuanto not only in research and development but also in actual manufacturing sites, based on the premise of further performance improvement of quantum computers.”

During the scaling stage — which Vertical Research Partners expect to happen from 2022 to 2027 — Quantinuum would offer a wider rollout of their Software-as-a-Service (SaaS) model, “integrating their offerings with other hardware, and making their products available to a wider and public consumer base.”

You can learn more about Quantinuum and its partners on TQI’s Intelligence Platform.

For more market insights, check out our latest quantum computing news here.