PRESS RELEASE — (Reuters) — GlobalFoundries Inc has filed confidentially with U.S regulators for an initial public offering (IPO) in New York that could value the chipmaker at around $25 billion, people familiar with the matter said on Wednesday.

The move is the clearest sign yet that GlobalFoundries, which is owned by Abu Dhabi’s sovereign wealth fund Mubadala Investment Co (MUDEV.UL), is not eager to accept a potential tie-up with Intel Corp (INTC.O), which the Wall Street Journal reported last month was in talks to acquire the U.S. chipmaker.

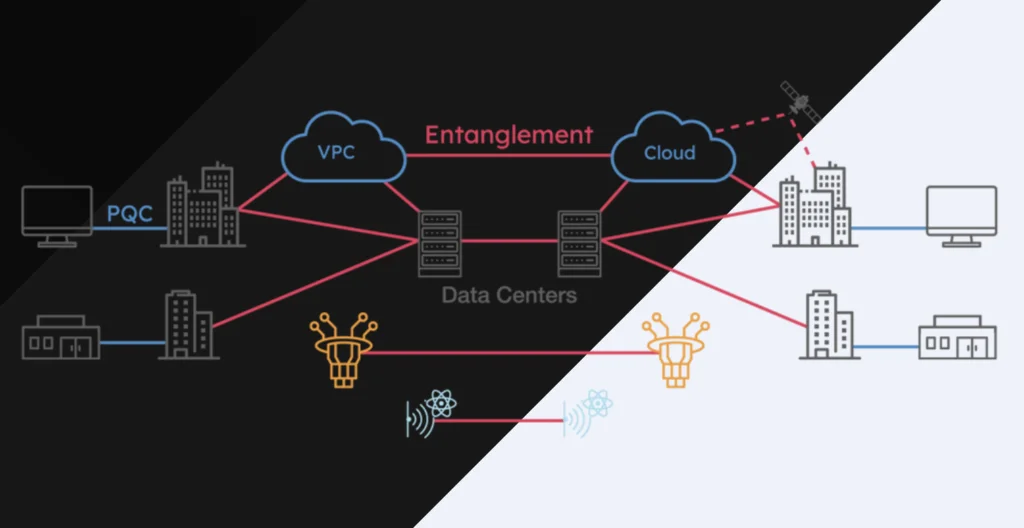

PsiQuantum, a photonic quantum computing player that recently raised significant funding, has a partnership with GlobalFoundries. The two companies are now manufacturing the silicon photonic and electronic chips that form the foundation of the Q1 system, the first system milestone in PsiQuantum’s roadmap to deliver a commercially viable quantum computer with one million qubits (the basic unit of quantum information) and beyond.

GlobalFoundries is expected to reveal its IPO filing in October and go public by the end of the year or early next year, depending on how quickly its application is processed by the U.S. Securities and Exchange Commission (SEC), the sources said.

The sources, who requested anonymity because the deliberations are confidential, cautioned that the chipmaker’s plans were subject to market conditions and that the timing could change.

Intel has yet to make a formal offer for GlobalFoundries and may not do so, according to the sources. GlobalFoundries is concerned that such a combination would upset some of its key customers that compete with Intel, such as Advanced Micro Devices Inc (AMD.O), the sources said. It could also face intense antitrust scrutiny from U.S. President Joe Biden’s administration, which has become more hostile to transformative mergers, the sources added.

Mubadala, GlobalFoundries and Intel declined to comment. The banks, the SEC, Advanced Micro Devices and the White House did not immediately respond to requests for comment.

GlobalFoundries’ IPO filing comes amid a boom in capital markets, with other high-profile names such as Robinhood Markets Inc (HOOD.O), Coinbase Global (COIN.O) and Roblox Corp (RBLX.N) already taking advantage with public listings this year.

GlobalFoundries manufactures radio-frequency communications chips for 5G, automotive, and other specialized semiconductors, and has emerged as a major resource for companies such as Intel and Advanced Micro Devices that have outsourced parts of their chip production. It was created when Advanced Micro Devices spun off its manufacturing facilities in 2009 and Mubadala later merged it with Singapore’s Chartered Semiconductor Manufacturing Ltd.

GlobalFoundries CEO Tom Caulfield told Reuters in July the chipmaker was planning to go public in 2022. The chipmaker has pledged to boost output to meet robust demand and announced plans to build a second factory near its Malta, New York, headquarters to address the global chip shortage.

Source: Reuters

If you found this article to be informative, you can explore more current quantum news here, exclusives, interviews, and podcasts.