Marking a significant step in the roadmap for quantum advantage for financial applications, Goldman Sachs and QC Ware researchers have designed new, robust quantum algorithms that outperform state-of-the-art classical algorithms for Monte Carlo simulations and can be used on near-term quantum hardware expected to be available in 5 to 10 years.

Monte Carlo methods, used to evaluate risk and simulate prices for a variety of financial instruments, involve complex calculations and consume significant time and computational resources. Typically, these calculations are executed once overnight, which means that in volatile markets, traders are forced to use outdated results. Providing traders, who are always looking for an additional edge in the markets, with a quantum computing approach to perform these risk assessments with far greater speed means that simulations could be executed throughout the day and could transform the way financial markets worldwide operate.

“Quantum computing could have a significant impact on financial services, and our new work with QC Ware brings that future closer. To do this, we introduced new extensions to a core technique in quantum algorithms. This exemplifies the fundamental contributions that our group looks to make in the field of quantum technology.”

“Our team at Goldman Sachs is focused on developing the best technology for the firm and our clients,” said William Zeng, Head of Quantum Research, Goldman Sachs. “Quantum computing could have a significant impact on financial services, and our new work with QC Ware brings that future closer. To do this, we introduced new extensions to a core technique in quantum algorithms. This exemplifies the fundamental contributions that our group looks to make in the field of quantum technology.”

The research community has known for some time of quantum algorithms that can perform Monte Carlo simulations 1000x faster than classical methods. However, these algorithms require error-corrected quantum hardware projected to be available in 10 to 20 years. Current quantum devices have very high error rates and can only perform a few calculation steps accurately before returning incorrect results.

The research community has known for some time of quantum algorithms that can perform Monte Carlo simulations 1000x faster than classical methods. However, these algorithms require error-corrected quantum hardware projected to be available in 10 to 20 years. Current quantum devices have very high error rates and can only perform a few calculation steps accurately before returning incorrect results.

For the past year, Goldman Sachs and QC Ware researchers have been working to answer this question: “How can we cut the current timeline in half yet still get a significant speed-up?” By successfully sacrificing some of the speed up from 1000x to 100x, the team was able to produce Shallow Monte Carlo algorithms that can run on near-term quantum computers expected to be available in 5 to 10 years. Technical details of the new algorithms are outlined in a recently released research paper.

Reducing the Quantum Hardware Timeline for Monte Carlo Simulations

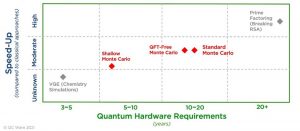

The graph below illustrates how Shallow Monte Carlo algorithms compare with previous Monte Carlo algorithms across two dimensions:

- the speed-up provided by the quantum algorithms when compared to classical approaches, and

- the expected timeline for quantum hardware capable of executing the algorithms

The graph also shows the comparative position of two often cited quantum algorithms and their use cases, prime factoring and the variational quantum eigensolver (VQE) algorithms.

While the Shallow Monte Carlo algorithms show more moderate speed-ups than Quantum Fourier Transformation Free Monte Carlo (QFT-free Monte Carlo) and Standard Monte Carlo algorithms, they have far less onerous hardware requirements, and therefore are anticipated to reduce the timeline to usability in half.

“At QC Ware, we focus on designing useful quantum algorithms that significantly reduce quantum hardware requirements yet achieve provable performance speed-ups over classical algorithms,” said Iordanis Kerenidis, Head of Algorithms – International, QC Ware. “The Goldman Sachs and QC Ware research teams took a novel approach to designing quantum Monte Carlo algorithms by trading off performance speed-up for reduced error rates. Through rigorous analysis and empirical simulations, we demonstrated that our Shallow Monte Carlo algorithms could result in the ability to perform Monte Carlo simulations on quantum hardware that may be available in 5 to 10 years.”

About Goldman Sachs

The Goldman Sachs Group, Inc. is a leading global investment banking, securities and investment management firm that provides a wide range of financial services to a substantial and diversified client base that includes corporations, financial institutions, governments and individuals. Founded in 1869, the firm is headquartered in New York and maintains offices in all major financial centers around the world.

About QC Ware

QC Ware is a leading quantum-as-a-service company focused on the development of applications for near-term quantum computing hardware. With a team composed of some of the industry’s foremost experts in quantum computing, QC Ware is growing rapidly and generating substantial revenue from global enterprise and government sector customers including Aisin Group, Airbus, BMW Group, Equinor, Goldman Sachs, and Total. QC Ware Forge, the company’s flagship quantum computing cloud service, is built for data scientists with no quantum computing background. It provides unique, performant, turnkey implementations of quantum computing algorithms. QC Ware is headquartered in Palo Alto, California and supports its European customers through its subsidiary in Paris. QC Ware also organizes Q2B, the largest annual gathering of the international quantum computing community.

–For more market insights, check out our latest quantum computing news here.