Maryland-based IonQ has entered into a definitive merger agreement with dMY Technology Group III (NYSE: DMYI.U), according to a company statement.

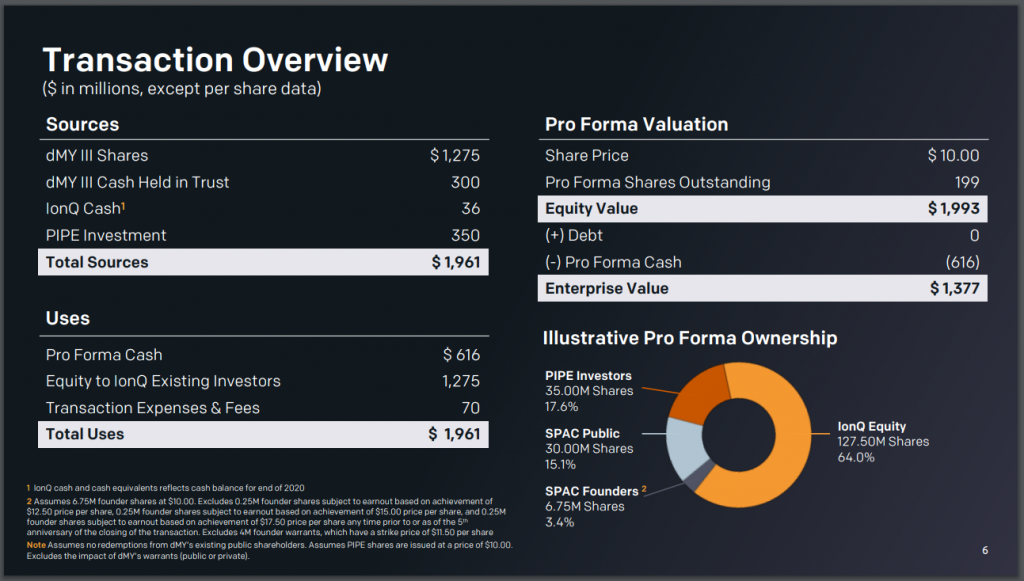

The Transaction will result in $650 million in gross proceeds, including a $350 million fully committed PIPE with participation from Fidelity Management & Research Company LLC, Silver Lake, Breakthrough Energy Ventures, MSD Partners, L.P., Hyundai Motor Company and Kia Corporation, and key institutional investors.

Pro forma implied market capitalization of the combined company is approximately $2 billion (Implied Enterprise Valuation of $1.4bn). We have provided a more detailed analysis at the end of this piece.

IonQ, Inc., (“IonQ”) announced today that it has entered into a merger agreement with dMY Technology Group, Inc. III (NYSE: DMYI.U), a publicly-traded special purpose acquisition company (“dMY III”). Upon closing of the transaction, IonQ shares will trade on the NYSE under the symbol “IONQ” as the first publicly traded pure-play hardware and software company in the quantum computing space.

In the statement, the company writes, “Throughout human history, we have witnessed technological breakthroughs that dramatically transformed society. In the nineteenth century, it was the industrial revolution, powered by scientific advances that brought us steam-powered machines, electricity, and advanced medicine. In the twentieth century, computing—arguably the greatest of all human inventions—leveraged human intelligence to run complex calculations, thereby paving the way for profound advances in virtually every realm of human experience. IonQ believes the twenty-first century will be defined by quantum computing and that this technology will have an even greater impact than classical computing had over the last 100 years.”

According to The Quantum Insider, IonQ uses trapped ion technology to deliver quantum computations. Prior to the merger, it had about $84 million in total funding.

The company states that, in addition to producing the first and only quantum computer available via the cloud on both Amazon Bracket and Microsoft Azure, IonQ believes its technology is the best path forward to scaling quantum computing power. By 2023, IonQ plans to develop modular quantum computers small enough to be networked together, which could pave the way for broad quantum advantage by 2025.

“This transaction advances IonQ’s mission, to solve critical problems that impact nearly every aspect of society,” said Peter Chapman, CEO & President of IonQ. “With our key strategic partners, such as Breakthrough Energy Ventures, Hyundai Motor Company and Kia Corporation, we look forward to leveraging the power of quantum computing in the fight against climate change and to solve vexing problems from materials design to logistics that impact the transportation industry.”

“IonQ’s quantum computers are uniquely positioned to capture a market opportunity of approximately $65 billion by 2030. Quantum computers will create value across thousands of new applications, and IonQ is poised to be the first company able to fully exploit this massive opportunity,” said Niccolo de Masi, CEO of dMY III.

The transaction has been unanimously approved by the Board of Directors of dMY III, as well as the Board of Directors of IonQ, and is subject to the satisfaction of customary closing conditions, including the approval of the stockholders of dMY III.

The combined entity will receive approximately $300 million from dMY III’s trust account, assuming no redemptions by dMY III’s public stockholders, as well as $350 million in gross proceeds from a group of strategic and institutional investors participating in the transaction via a committed private placement investment (“PIPE”). In addition to Fidelity Management & Research Company LLC, Breakthrough Energy Ventures, Hyundai Motor Company and Kia Corporation, new investors include Silver Lake, MSD Partners, L.P., and TIME Ventures, the investment fund for Marc Benioff. The PIPE includes additional investment by existing investors including, New Enterprise Associates, GV, and Mubadala Capital.

Additional information about the proposed transaction, including a copy of the merger agreement and investor presentation, will be provided in a Current Report on Form 8-K and in dMY III’s registration statement on Form S-4, which will include a document that serves as a prospectus and proxy statement of dMY III, referred to as a proxy statement/prospectus, each of which will be filed by dMY III with the Securities and Exchange Commission (“SEC”) and available at www.sec.gov.

About IonQ, Inc.

IonQ, Inc. is the leader in quantum computing, with a proven track record of innovation and deployment. IonQ’s 32 qubit quantum computer is the world’s most powerful quantum computer, and IonQ has defined what it believes is the best path forward to scale. IonQ is the only company with its quantum systems available through both the Amazon Braket and Microsoft Azure clouds, as well as through direct API access. IonQ was founded in 2015 by Chris Monroe and Jungsang Kim based on 25 years of pioneering research at the University of Maryland and Duke University. To learn more, visit www.IonQ.com.

About dMY Technology Group, Inc. III

dMY III is a special purpose acquisition company formed by dMY III Technology Group, Harry L. You and Niccolo de Masi for the purpose of effecting a merger, capital stock exchange, asset acquisition, stock purchase, reorganization, or similar business combination with one or more businesses or assets.

TQD Analysis – our first take

This announcement represents a pivotal step in the quantum technology industry. IonQ has raised a record amount of funding to go and further develop its offering. The investor presentation offers a fascinating insight into the investment thesis for quantum technology companies. The below attempts to provide a no-nonsense summary of the key slides.

Transaction overview

- IonQ has gone public through a merger with a firm which raised capital with the sole purpose of acquiring a private operating company, in the case IonQ. These “blank cheque” companies are known as Special Purpose Acquisition Companies (SPACs).

- The merger will provide IonQ with gross proceeds of $650 million and is comprised of $300m of cash from the SPAC and $350 million from a consortium of private equity firms.

- The deal was done at an implied market capitalisation (number of shares x price per share) of $2bn (implying an Enterprise Value (EV) of ~$1.4bn). EV is typically used as the metric to compare to underlying operating metrics such as revenue and EBITDA (see further below).

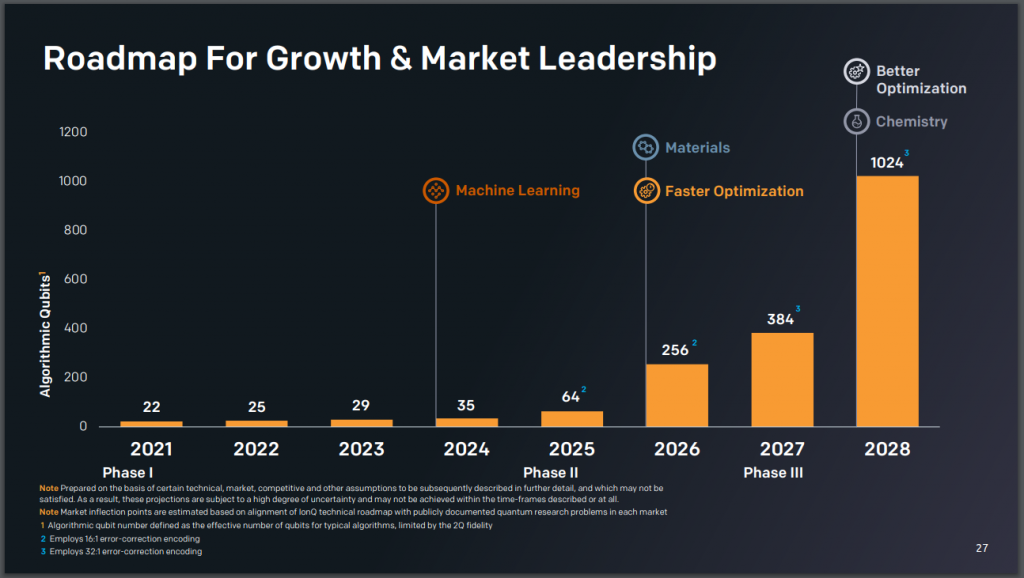

Technical development

- Core to IonQ’s plan is to scale up the number of “algorithmic qubits” that it can useful offer as part of its systems. Algorithmic qubits is an “effective” number of qubits which factors in that many qubits in a system will be required to facilitate “error correction”.

- IonQ are effectively suggesting that they will be able to build Quantum Computers which can solve useful problems for their customers from about 2024 onwards

- There are a number of technological hurdles to overcome to achieve this and so this diagram is used for guidance purposes only.

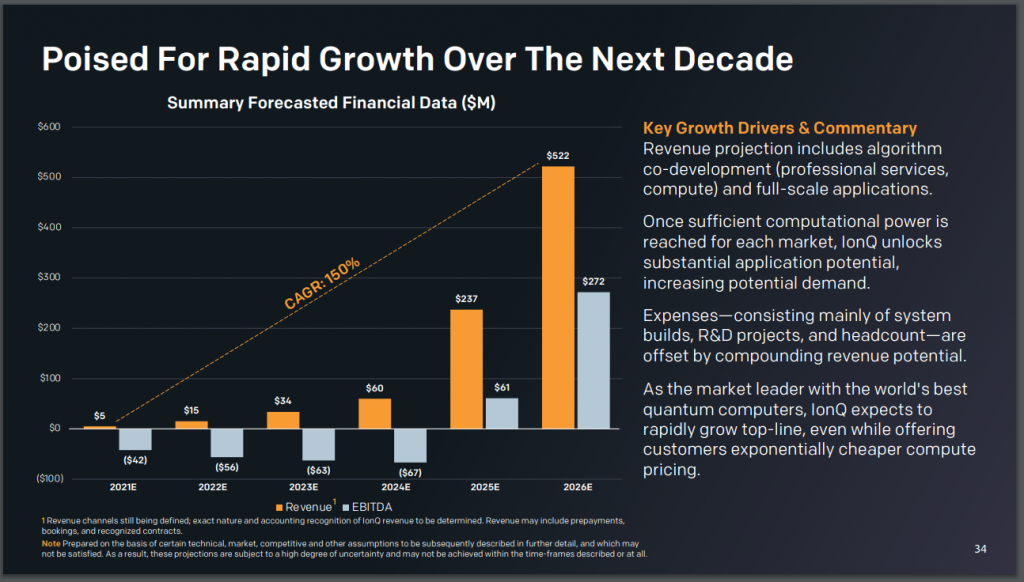

Financial forecasts

- IonQ is expecting to be unprofitable until an inflexion point in 2025E (based on the above technical developments).

- Over this period the business expects to make $40-60m of loss per annum, despite growth in revenue over the period. This loss will be driven by significant spend on operating costs (system builds, R&D and staff).

- This in addition to spend on capex (e.g. hardware) will mean that the business burns through a significant amount of its >$600m of cash in the coming years.

Revenue model

- The Business is not precise about exactly how it will generate revenue however it expects to drive this from access to its quantum systems over the coming years.

- We anticipate it will generate revenue from large contracts with first-mover customers in the short term. This will scale up to providing larger-scale access to its systems in the Cloud (e.g. through cloud providers such as Amazon and Microsoft) as its technology can offer real uses cases for business

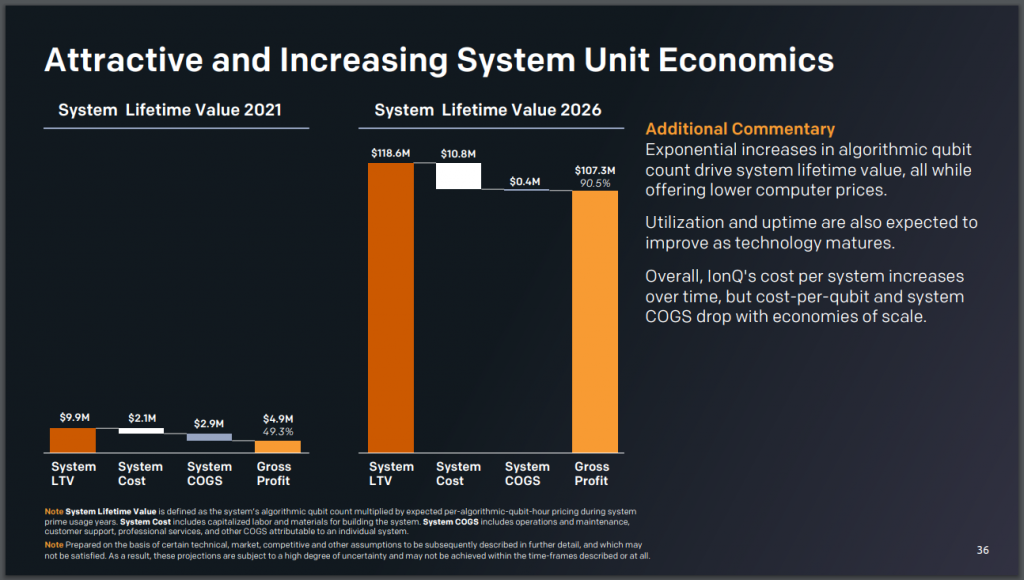

- IonQ expects to generate ~$120m from each quantum computer over its lifetime (system life time value) by 2026, and is forecasting ~$16m revenue on average from each of its 33 systems by this point.

Valuation

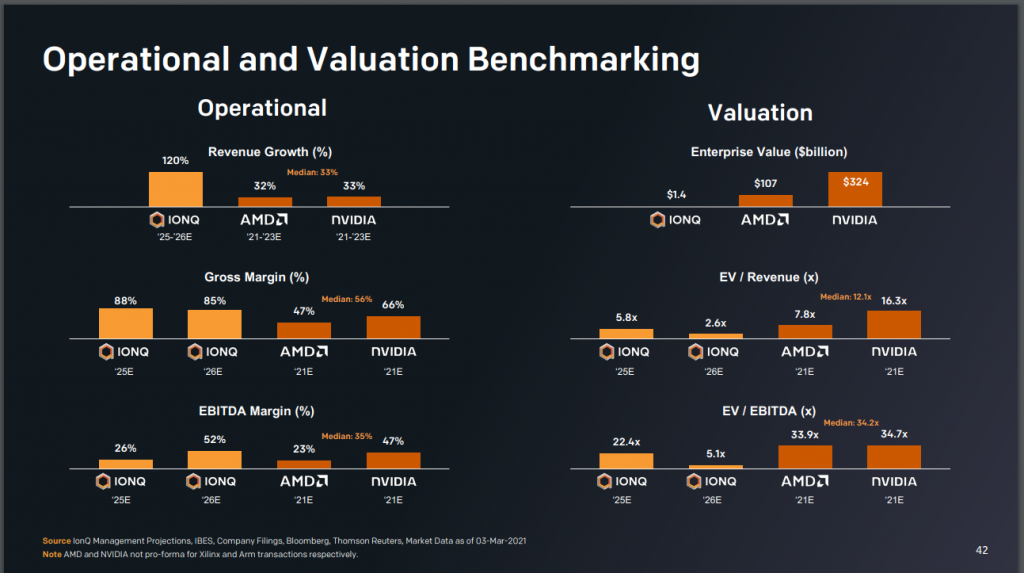

- IonQ is compared to chip makers in its valuation summary. There are a number of key points to flag here:

- Firstly, IonQ metrics are based on its forecast performance in 4-5 years time (compared to AMD and NVidia today). These should be treated with caution as are fundamentally based on predicting an uncertain future.

- We think comparing to chip makers is not necessarily the right way to look at the business. If it generates revenue from providing cloud access to its system, it may make more sense to look at Microsoft (Azure) and Amazon (AWS) as comparable companies.

- The investor pres argues that IonQ is valued at a significant discount to its future potential. This again, whilst logically fine, is based on a number of assumptions around the future profile of the business.

- Those familiar to the IPO / finance industry will be familiar with the highly illustrative models that drive these charts. Small changes in assumptions will drive enormous differences in outputs.

Is IonQ a good investment?

- We had a look at D-Wave a while back and fundamentally our view is the same here.

- Firstly you should do your own research before investing your hard earned money.

- Secondly, the evolution of IonQ as a business will fundamentally depend on technological progress in quantum technologies.

- It is not the only player looking to develop quantum computers (see The Quantum Insider for more) and there is no guarantee that it will be successful in developing useful quantum computers on an attractive investment timeline

- With that said, it now is the most well funded quantum technology company in the world, and is one of only a few opportunities for a retail investor to get exposure to quantum technologies.

Disclaimer: writers for The Quantum Daily may hold securities discussed in content published on the website. This article is not a recommendation to buy or sell securities.