College Park, Maryland-based IonQ may be the first US-based pure-play quantum company to go public through a SPAC.

Bloomberg is reporting that the company is in talks to merge with a special purpose acquisition company, or SPAC, DMY Technology Group Inc. (NYSE:DMYI). A SPAC is a company that is formed strictly to raise capital through an initial public offering (IPO) for the purpose of acquiring an existing company. SPACs have become an increasingly popular way to take companies public and avoid the lengthy IPO process.

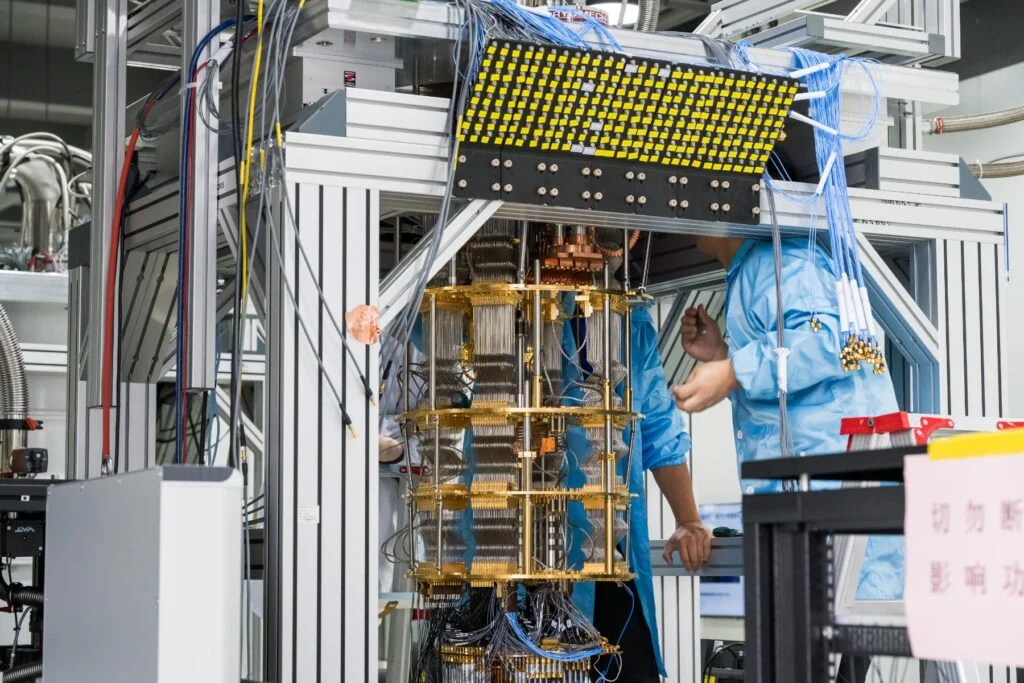

IonQ, which revealed a 32-qubit version of its quantum computer in October, was founded in 2015 by Chris Monroe and Jungsang Kim and is led by CEO Peter Chapman.

According to The Quantum Insider, IonQ’s investors include A&E Investments, Airbus Ventures, Amazon, Cambium VC, Correlation Ventures, G Ventures, Hewlett Packard Pathfinder, Lockheed Martin, New Enterprise Associates, OUP (Osage University Partners), Robert Bosch Venture Capital, Samsung Catalyst Fund and Tao Capital Partners. The company’s disclosed funding is set at $84 million (U.S.).

Existing IonQ investors would most likely roll their equity into the transaction, according to Bloomberg’s sources.

IonQ uses trapped ion quantum technology. The company lists several advantages with its approach to quantum computing, including high expected quantum volume — 4,000,000 according to its latest news release — and low gate errors. All of these measures help address significant roadblocks to quantum, namely noise and environmental interference that can alter a quantum computer’s delicate status when performing computations.

Chairman Harry You and Chief Executive Officer Niccolo De Masi lead the SPAC, which raised $300 million in the fall to pursue a target in consumer technology, according to Bloomberg. Silver Lake, MSD Partners, Bill Gates’ Breakthrough Energy and an affiliate of Hyundai Motor are reported to be part of a potential deal. Silver Lake is particularly interesting; whilst it is a leader in tech investing it typically has focussed on later stage deals and one of only a few Private Equity players (as opposed to VCs) involved in investing in quantum technologies.

Bloomberg reports that, should the deal come through in the next few weeks, the combined company would be worth about $2 billion. The financial media service added that their sources suggest the SPAC is discussing raising additional equity from institutional investors and new equity raised from strategic and institutional investors is set to total around $300 million.

It’s necessary to point out that there is no guarantee that this deal will happen and negotiations can fail.

TQD knows of two other quantum technology companies that retail investors can get exposure to. Investors can get exposure to D-Wave (provider of quantum annealers) through investing in a listed holding company or can invest directly in Quantum Computing Incorporated.

This article should in no way be construed as investment advice and members of TQD may have holdings in securities mentioned.

If you found this article to be informative, you can explore more current quantum news here, exclusives, interviews, and podcasts.