D-Wave Systems saw its valuation cut by more than half after it undertook a refinancing effort this year, according to a report in the Globe and Mail.

D-Wave is a pioneer in quantum computing which attracted funding from investors including the U.S. Central Intelligence Agency’s venture capital arm, Amazon CEO Jeff Bezos and fund giant Fidelity Investments, the paper reports.

The paper stated that their sources report US $40-million of the financing came as part of a capital restructuring that cut D-Wave’s valuation to less than US$170-million before the receipt of funds, down from about US$450-million. The funding includes US $10-million from new investor NEC Corp.,

The Globe and Mail said it is not disclosing their identities as they are not authorized to speak on the matter.

Several existing investors who participated maintained their relative stakes, – including Montreal-based Public Sector Pension Investment Board (D-Wave’s top shareholder, with $100-million-plus invested to date), Business Development Bank of Canada and Goldman Sachs, limiting the writedown of their holdings. Those that didn’t, including the CIA’s In-Q-Tel arm, Mr. Bezos and Fidelity, saw their stakes significantly devalued, by upward of 85 per cent in some cases.

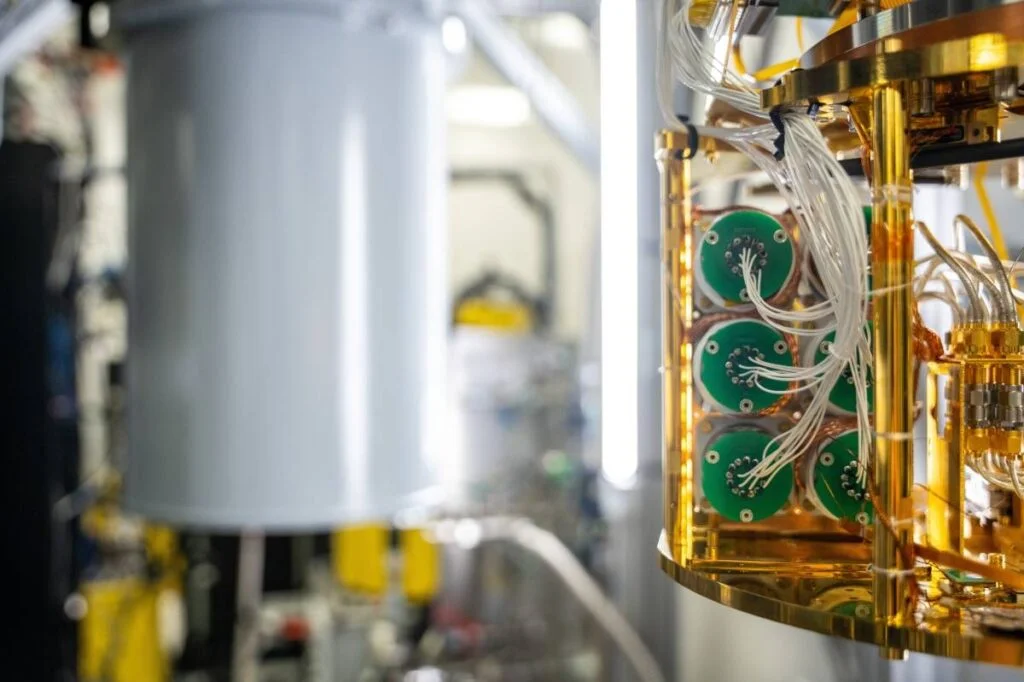

D-Wave finds itself in an increasingly competitive space. The Burnaby, B.C.based company faces increased competition not just from alternative forms of quantum computers, but also from rapidly rising startups and huge industry giants that are creating their own quantum computers, such as Microsoft, Google, and IBM.

The Globe and Mail reports that D-Wave has been addressing this increasingly competitive space with personnel moves. It reports that, this year, D-Wave promoted Alan Baratz to chief executive officer to step up efforts to commercialize its technology. Other top executives, including its chief financial officer and senior vice-president responsible for applications and technology, have left the company. Long-time board members Steve Jurvetson, a Silicon Valley venture capitalist, and ex-Cisco executive Don Listwin also left, the newspaper reports.

Baratz is credited with shifting D-Wave’s strategy away from selling computers, which listed for US$15-million, in favor a model that offers cloud-based access to the machines.

D-Wave says these moves put the company in a place where their technology can help companies solve real-world business problems and deliver business value.

Other investors agreed with D-Wave’s new direction and are confident in the company’s future.

“The company has never looked better,” Rick Nathan, managing director with Kensington Capital Partners, a D-Wave investor, told the Globe and Mail. “After all this time, it now feels like [D-Wave] has achieved real product market fit and is scaling with its customers. This is new, and as a long-time investor, it is great to see.”

For more market insights, check out our latest quantum computing news here.