Insider Brief

- The UK’s new Vision 2035 minerals strategy aims to secure lithium, rare earths and other critical materials to support advanced industries including clean energy, defense, semiconductors and emerging quantum technologies.

- By expanding domestic refining, midstream processing and recycling capacity, the plan reduces reliance on concentrated global supply chains that also underpin superconducting, photonic and trapped-ion quantum hardware.

- The strategy’s diversification targets, investment tools and defense-sector resilience measures position the UK to stabilize upstream inputs for future quantum processors, sensors and networking systems while strengthening broader industrial security.

The UK government laid out a sweeping plan to secure critical minerals through 2035, aiming to shield its high-tech industries from global supply-chain shocks while building domestic mining, refining and recycling capacity. The strategy, published as Vision 2035: Critical Minerals Strategy, targets sectors ranging from clean energy and advanced manufacturing to defense, digital infrastructure and, while not mentioned specifically, the quantum technology industry.

In essence, the policy outlines an effort to increase domestic production, expand midstream processing, diversify imports and create a circular economy for minerals essential to modern hardware.

The strategy places significant emphasis on lithium, rare earth elements, nickel, copper and a new category of “growth minerals,” which the UK expects will be central to economic expansion. Quantum technologies — like superconducting processors, trapped-ion systems, photonic chips and quantum sensors — depend heavily on many of the same materials. That overlap positions the quantum industry to be involved in a minerals policy crafted primarily with smart phones, batteries and clean energy in mind.

Supply Chains for Tomorrow’s Hardware

The government’s roadmap anticipates dramatic increases in demand for materials across advanced industries, adding that lithium demand, for example, could increase more than tenfold. The plan warns that concentrated global supply chains — especially in rare earths and midstream processing — have created strategic vulnerabilities that now ripple into sectors beyond electric vehicles or renewable energy. Quantum computing and sensing would likely fall into this category because they depend on ultra-pure metals, semiconductor feedstocks and rare-earth dopants used in photonics, superconducting circuits and precision measurement devices.

The UK’s experience with lithium, nickel, tin and rare-earth recycling highlights why the strategy could matter to quantum firms. Quantum processors require high-purity aluminum, copper, niobium, silicon and rare-earth elements used in optical amplifiers or quantum memories. Quantum sensors rely on specialty alloys, doped crystals and diamond substrates. As quantum prototypes scale toward commercial hardware, the industry faces the same upstream risks that challenge battery and semiconductor manufacturers. The minerals plan could be seen as a way to place the UK on a path to relieve some of those pressures.

The most immediate connection to the quantum sector lies in the government’s push to expand the country’s midstream processing — transforming mined or recycled materials into high-purity feedstocks suitable for manufacturing. The strategy singles out this stage of the value chain as a national competitive advantage, citing the country’s refining expertise, research institutions and industrial clusters in Cornwall, Wales, the North East and Northern Ireland.

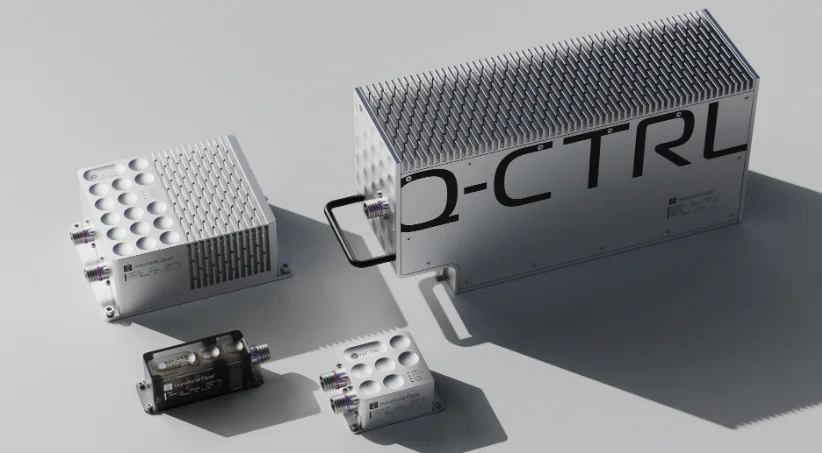

Quantum hardware companies have struggled with midstream vulnerability, particularly in superconducting and photonic systems where purity levels must meet strict tolerances. The UK’s focus on building capacity for refining lithium, rare earths and specialty metals could give domestic quantum firms more stable access to critical inputs. It may also lower cost volatility by reducing exposure to overseas processors, especially in markets where supply is concentrated in a small number of countries.

The government’s investment mechanisms — including the National Wealth Fund, UK Export Finance and a new £50 million critical-minerals project fund — are structured to support capital-intensive projects that bridge mining, midstream processing and advanced manufacturing. Quantum firms that depend on rare-earth dopants, ultra-pure metals or semiconductor-grade materials may be able to align with these programs through supply-chain integration rather than direct mineral extraction.

Defense Stockpiling and Dual-Use Technologies

The plan also outlines new steps to strengthen mineral supply chains for the defense sector. The government is considering industry-led stockpiles and diversified sourcing requirements tied to procurement, aiming to reduce strategic dependence on any single country. Because quantum technology is increasingly treated as a dual-use capability — serving defense communications, navigation, sensing and code-breaking countermeasures — the sector is likely to be affected by these measures even though it is not explicitly named in the strategy.

Quantum processors rely on materials such as ytterbium, strontium, beryllium, high-purity gold, superconducting metals and rare-earth magnets used in trapping and control systems. Defense-aligned supply rules could impose higher sourcing standards and new reporting requirements on firms operating in or selling to the UK. They may also open new funding channels for quantum hardware suppliers who align with the UK’s mineral security posture.

A Circular Economy for High-Tech Materials

Recycling plays a central role in the government’s 2035 targets, which call for 20% of total UK mineral demand to be met via recovered materials. Today, recycling of many rare earths and specialty metals remains limited by low collection rates and high processing costs. The strategy views this as an opportunity, pointing to UK capabilities in platinum-group metals and early-stage rare-earth magnet recycling.

For quantum technologies, which have not yet reached a scale where recycling is a pressing issue, the long-term benefits could be substantial. As cryogenic systems, photonic modules and trapped-ion devices enter commercial service in the 2030s, recycling infrastructure for rare earths, superconducting alloys and high-purity metals will matter more. The report indicates that recycled sources of key minerals will increase sharply after 2030 as large energy systems reach end of life. That timeline aligns with forecasts for larger-scale quantum deployments, giving the industry a future pathway to more sustainable and less volatile input materials.

The strategy acknowledges that China dominates rare earth and midstream processing, controlling the majority of global refining capacity. The UK intends to maintain engagement with China while expanding partnerships with countries such as Canada, Australia, Japan, India, Saudi Arabia and Kazakhstan. These partnerships cover long-term purchase contracts (called offtake agreements), joint project development, financing arrangements and technology exchange.

Quantum firms, particularly those developing photonic and superconducting systems, source materials from the same networks facing geopolitical tension. The UK’s effort to diversify imports and strengthen industry-to-industry ties may ease some of the supply-chain friction quantum hardware makers face as export controls tighten and markets become more protectionist.

The government’s diversification target, which aims to ensure that no single country provides more than 60% of any aggregated critical mineral supply, signals a move toward greater resilience across all high-tech sectors.