Insider Brief

- Quantum Exponential Group plc has launched fundraising for a £100 million venture capital fund to accelerate the commercialization and scale-up of UK quantum technologies in alignment with the National Quantum Strategy.

- The Quantum Technologies Fund will invest across all stages of innovation, with about two-thirds of capital directed toward UK-based companies and partnerships involving the Harwell Quantum Cluster and national quantum hubs.

- QEG brings a 3½-year investment track record and has secured an anchor commitment from a Silicon Valley fund, with the Harwell partnership supporting investor engagement and early-stage venture identification.

PRESS RELEASE — — Quantum Exponential Group plc (QEG), the UK’s first specialist quantum technology investment company, today announces the launch of fundraising for a new £100 million venture capital fund. Dedicated to start-up, scale-up and commercialisation of the UK quantum innovation, the fund supports the UK’s National Quantum Strategy and Harwell Quantum Cluster, as a national asset at the heart of it.

This major initiative builds upon the signed Memorandum of Understanding (MOU) between QEG and the Harwell Quantum Cluster, which is home to the National Quantum Computing Centre (NQCC), the Science and Technology Facilities Council (STFC) national laboratories, and the Quantum Business Incubation Programme (QuBIC).

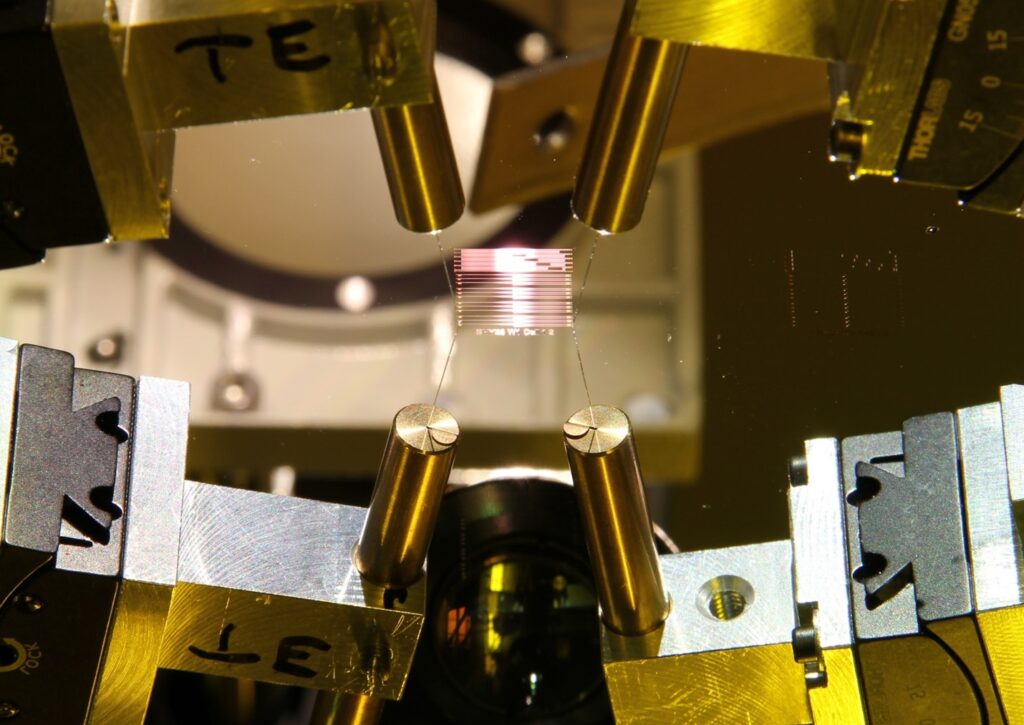

The planned fund will nurture the next generation of UK quantum businesses, helping them to commercialise cutting-edge research, attract investment, and scale into global markets—reinforcing the UK’s position as a world leader in quantum science and technology.

A fund designed to accelerate UK quantum innovation

The Quantum Exponential Quantum Technologies Fund will target £100 million at first close in 2026 and will deploy capital across the full innovation lifecycle—from pre-seed to later-stage rounds. Investments will support quantum start-ups from early-stage through to commercialisation and scale-up stages.

Approximately two-thirds of the fund’s investments will be directed towards UK-based companies to maintain UK leadership in Quantum. QEG will collaborate with the Harwell Quantum Cluster and other Quantum Hubs, the wider national and international quantum community, its strategic partners such as the Institute of Physics, London Quantum Cluster, Innovate UK and UK Quantum, UK-based quantum companies and overseas entities with strong links to the UK Quantum ecosystem, to ensure a joined-up approach to building a globally competitive quantum sector.

Track record and investor confidence

Quantum Exponential Group plc brings a 3½-year track record of managing a dedicated quantum technologies portfolio, with eight portfolio companies—all revenue generating. The fund’s investment strategy targets IRR of 25–33%, which would place it within the top quartile of deep tech VC funds.

Demonstrating international confidence in the UK quantum sector and QEG track record, QEG has already received an anchor investment commitment from a prominent Silicon Valley fund in the form of a Letter of Intent (LOI), subject to further successful due diligence.

Strategic collaboration with Harwell Quantum Cluster

Under the MOU signed today, QEG and Harwell Quantum Cluster will collaborate to identify and support promising early-stage quantum technology ventures within the Harwell ecosystem.

QEG will manage the fund and lead on attracting external investors. Harwell Quantum Cluster will jointly support this activity by providing access to the Harwell ecosystem, showcasing relevant startups, and co-hosting investor engagement events to highlight the UK’s quantum innovation capabilities. The Parties will jointly plan and deliver industry events, networking opportunities and showcase sessions, including investor roundtables.

Steve Metcalfe, CEO, Quantum Exponential Group plc, said:

“The launch of this fundraising marks a significant milestone for Quantum Exponential and for the whole UK quantum ecosystem. By establishing a £100 million UK-focussed fund, we aim to provide capital from pre-seed to scale-up stages, addressing one of the sector’s biggest challenges—bridging the funding gap that too often stalls innovation.”

Call for investors

Quantum Exponential welcomes expressions of interest from institutional and strategic investors seeking to participate in this landmark UK quantum investment fund.

Contact:

For investor enquiries, please email [email protected]