Insider Brief

- A new JLL report warns of an impending “quantum land grab” as investors race to develop specialized facilities for quantum computing, reshaping global real estate markets like artificial intelligence has done for data centers.

- The report projects commercial quantum computing could emerge by 2030, driving a decade-long shift toward hybrid data centers where quantum and classical systems operate side by side.

- JLL expects global quantum investment to surge from $2 billion in 2024 to as much as $50 billion following a major breakthrough, creating a new category of “quantum campuses” near research hubs like Boston, Munich, and Tokyo.

Quantum Land Grab: How Real-World Quantum Could Fuel Real Estate Investments Quantum computing is moving from the lab to the ledger. According to JLL’s new report, The Future of Quantum Real Estate, the coming decade could bring a “quantum land grab” as investors race to secure the specialized facilities and infrastructure that will power this emerging technology.

JLL’s report forecasts that as commercial viability nears, the real estate implications could be profound, much as artificial intelligence has done for data centers. Quantum computers demand unique physical conditions: extreme cold, isolation from electromagnetic noise, and vibration-free environments. These requirements, paired with an accelerating wave of private and public investment, are expected to create a new category of high-tech property — hybrid facilities where quantum and classical systems operate side by side.

A Decade to Deployment

JLL describes quantum computing as a once-theoretical science now nearing practical use. The firm projects that by 2030, commercially viable quantum computers could be integrated into the world’s computing infrastructure, moving from laboratory prototypes to pilot deployments in specialized data centers.

In the report, JLL analysts write that “the future of data centers is likely hybrid, combining quantum and classical computing.” That shift will not only change how computation is performed, but also where it happens — driving new patterns in data-center design, site selection, and capital investment.

The report notes that today’s quantum computers are confined to a handful of advanced research hubs — places like Boston, Munich, Toronto, and Tokyo, where academic excellence, national research funding, and private capital converge. But as the technology matures, these systems are expected to migrate toward data-center markets, especially as major cloud providers such as Amazon, Google, and Microsoft develop in-house quantum capabilities.

The roadmap JLL outlines spans roughly a decade: research labs in the 2020s, pilot deployments by the early 2030s, and widespread adoption in hybrid facilities thereafter.

The Technology Driving the Shift

Quantum computers use “qubits,” or quantum bits, to process information. Unlike classical bits, which exist as either 0 or 1, qubits can exist probabilistically between those states, a phenomenon called superposition. When multiple qubits become linked, or entangled, their states are connected even when separated by distance. This pairing of superposition and entanglement gives quantum computers the ability to process vast numbers of possibilities in parallel.

The difference in scale is staggering. Ten qubits can represent 1,024 states at once; 300 qubits could represent more states than atoms in the observable universe. Google has demonstrated that its quantum processor can complete a calculation in under five minutes that would take a top supercomputer 10 septillion years, which is longer than the universe has existed.

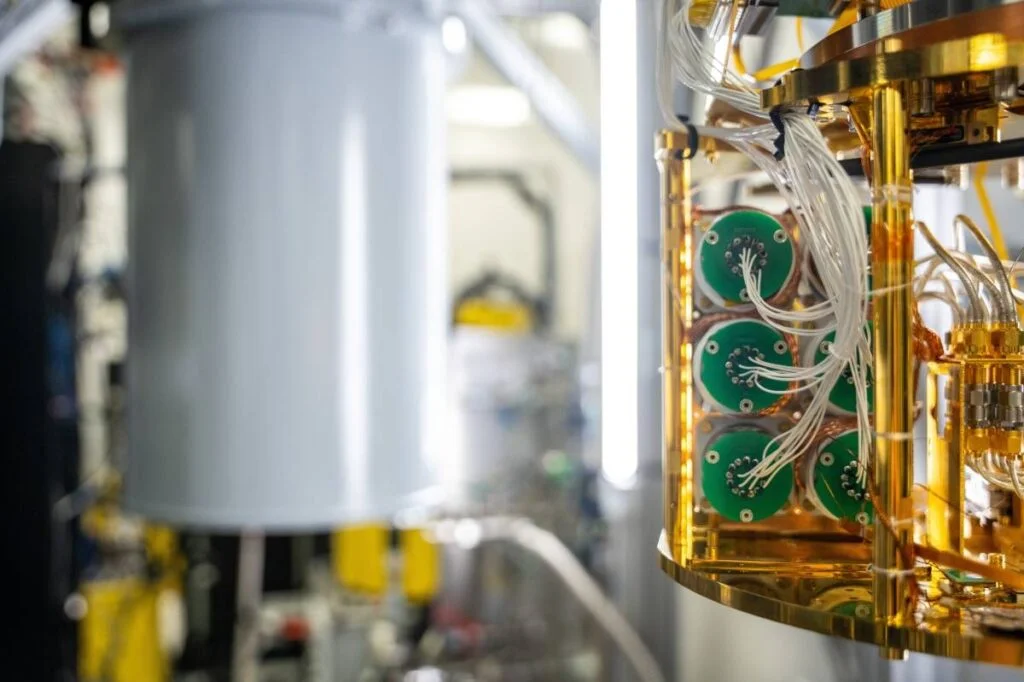

These capabilities promise to unlock advances in chemistry, logistics, and materials design that are beyond the reach of classical systems. But the physical demands of quantum hardware — including cryogenic cooling near absolute zero and electromagnetic isolation — make real estate one of the most immediate bottlenecks to commercial deployment.

Investment Accelerates as Commercial Potential Emerges

JLL reports that the global quantum industry generated less than $1 billion in revenue in 2024, but drew roughly $2 billion in private investment that year. That figure has grown from about $300 million annually between 2016 and 2019, closely tracking the early trajectory of AI funding.

The report projects that annual investment could reach $10 billion by 2027 and $20 billion by 2030. A major technological milestone, often referred to as “quantum advantage,” when a quantum computer outperforms classical systems on a useful task, could trigger up to $50 billion in new investment, mirroring the surge in AI funding after ChatGPT.

“Quantum computing is following AI’s investment trajectory but lagging by about a decade,” the JLL study suggests, adding that a technological breakthrough that delivers widespread quantum utility will have significant real estate impacts similar to the arrival of ChatGPT and AI on the data center sector.

As with AI, JLL expects the geography of quantum to remain concentrated. The study finds that investment and facility development will likely cluster around a limited number of quantum ecosystems — regions that combine research infrastructure, government support, and private enterprise.

From Quantum-as-a-Service to Quantum Campuses

To bridge the gap between cost and capability, JLL identifies Quantum-as-a-Service (QaaS) as a likely entry point for early adopters. Under this model, users can access quantum computers through the cloud, avoiding the expense of maintaining on-premise systems. Companies such as IBM, Amazon Web Services, and Google already offer limited QaaS access, allowing researchers and enterprises to test algorithms remotely.

Over time, as costs decline and engineering challenges are resolved, more organizations may adopt on-site quantum systems, particularly those integrated within large data centers. JLL notes that “hybrid facilities will typically maintain both classical and quantum components within the same overall structure, but in separate specialized rooms or sections.”

Germany’s Leibniz Supercomputing Centre is one example: it combines traditional supercomputing with dedicated quantum labs, cryogenic cooling, and vibration isolation. JLL suggests thatt this model could become standard for future “quantum campuses” — specialized zones designed for cryogenic, photonic, or superconducting systems.

The Quantum Real Estate Advantage

For real estate investors, the message is clear: quantum’s physical footprint is coming, and the race to prepare is already under way. JLL calls the current period a “window of opportunity” for developers to establish partnerships with quantum companies, governments, and data-center operators.

“Real estate opportunities will multiply quickly following a quantum leap,” the analysts write.

They suggest the industry is in a period where real estate groups can develop their own quantum first-mover advantage.

That opportunity could be as transformative for property markets as AI has been for data centers. The same forces — high energy density, cooling demand, and scarce zoning — will shape quantum’s growth, but with added layers of complexity. Quantum hardware requires isolation from noise and interference, precision environmental control, and stable power far beyond ordinary commercial standards.

If forecasts hold, quantum computing could evolve into a $100 billion industry by 2035. As commercial systems scale, the physical infrastructure to house them will become a crucial part of the quantum economy — from cryogenic labs to hybrid cloud campuses.

Positioning for the Quantum Real Estate Era

So how can you invest in quantum real estate?

For investors and developers, the emerging quantum economy may still seem distant — but the groundwork for participation begins now. JLL’s report indicates that the most successful entrants will be those who understand the technology’s physical requirements and establish relationships within the small but fast-growing quantum ecosystem.

In practical terms, that means three things: location, partnerships and readiness.

Location: Quantum infrastructure will cluster near major research universities, national laboratories, and innovation districts with access to both talent and stable energy. Cities such as Boston, Munich, and Tokyo already fit this profile. Real estate groups should evaluate proximity to these hubs and identify opportunities to repurpose or co-develop adjacent properties for future quantum tenants.

Partnerships: Developers should begin engaging with quantum hardware companies, national science agencies, and data-center operators. Early collaboration can help design facilities that meet quantum’s distinct demands — cryogenic cooling, electromagnetic shielding, and precision isolation– while maintaining operational efficiency for traditional computing workloads.

Readiness: JLL advises investors to prepare for gradual but accelerating adoption. The first wave will center on government- and university-backed quantum clusters; the next will emerge as cloud providers expand their Quantum-as-a-Service offerings. Investors who build familiarity with zoning, energy supply, and financing models suited for high-specification labs will be best positioned when commercial deployments scale.

To sum this all up, JLL frames the opportunity as analogous to the early AI data-center boom, but one requiring deeper technical literacy and longer lead times. In quantum real estate the trick may be to learn the physics, find the hubs and follow the cooling.