Insider Brief

- Public markets show quantum technology moving from theory to application, with investors gaining exposure through an increasingly diverse but uneven set of listed companies.

- Data from The Quantum Insider’s Intelligence Platform indicates four main categories of public quantum computing companies: pure-play compute companies, post-quantum security vendors, quantum software developers, and diversified global conglomerates.

- Despite rising valuations and government-backed momentum, most quantum companies remain pre-profit, making cash runway, technical progress, and credible adoption key factors for investors to assess.

The public markets reflect the shift of quantum technology from theory to applied and from lab to marketplace.

From beefy startups building quantum computers to multibillion-dollar giants embedding quantum programs inside global R&D labs to niche firms building post-quantum security chips, the sector’s publicly traded landscape is increasingly diverse – but also uneven.

Data compiled from The Quantum Insider’s Intelligence Platform, along with recent filings, investor updates and research reports, show a maturing market defined by a handful of well-capitalized hardware players, several early-revenue security vendors, and a constellation of diversified conglomerates with serious quantum ambitions.

While it’s impossible to create an exhaustive list, this is as complete and as current of a landscape as possible for public quantum computing companies.

The Shape of the Quantum Market

As of October 2025, we broadly channel publicly listed quantum companies into four groups:

- Pure-play compute companies, such as IonQ, D-Wave, Rigetti and Quantum Computing Inc., that build and operate quantum processors.

- Post-quantum cryptography (PQC) and quantum-security firms like SEALSQ, BTQ Technologies, 01 Communique, and Quantum eMotion, offering encryption and hardware defenses against future quantum attacks.

- Quantum software developers, such as Arqit and Zapata, which focus on middleware and quantum-enhanced applications.

- Diversified technology and industrial firms — including IBM, Microsoft, Amazon, Honeywell, Alphabet, Fujitsu, and Intel — that treat quantum as a long-term strategic R&D pillar rather than a standalone business unit.

Pure-Play Compute Public Companies

IonQ: Trapped-Ion

Maryland-based IonQ (NYSE: IONQ) remains the bellwether among publicly traded quantum computing companies. The company develops trapped-ion processors and quantum networking systems accessible through AWS Braket, Azure Quantum, and Google Cloud. For Q2 2025, IonQ reported $20.7 million in revenue and projected $82–100 million for the full fiscal year. Cash and investments totaled $656.8 million at mid-year, rising to $1.6 billion after a July equity raise. IonQ’s valuation – which attained new highs and hit $22 billion in mid-October – reflects investor confidence that its high-fidelity ion traps and networked architecture could scale faster than superconducting alternatives.

D-Wave Quantum: Annealing

Canadian firm D-Wave Quantum Inc. (NYSE: QBTS) pioneered commercial quantum computing through its annealing systems optimized for combinatorial problems. With trailing-twelve-month revenue near $22 million and $304 million in cash at March 2025, D-Wave remains one of the few public quantum computing companies shipping hardware. Its “Advantage2” platform, available via the Leap cloud service, underpins deals such as a recent €10 million European system sale. The company is also developing a gate-model processor, signaling a transition toward universal computing.

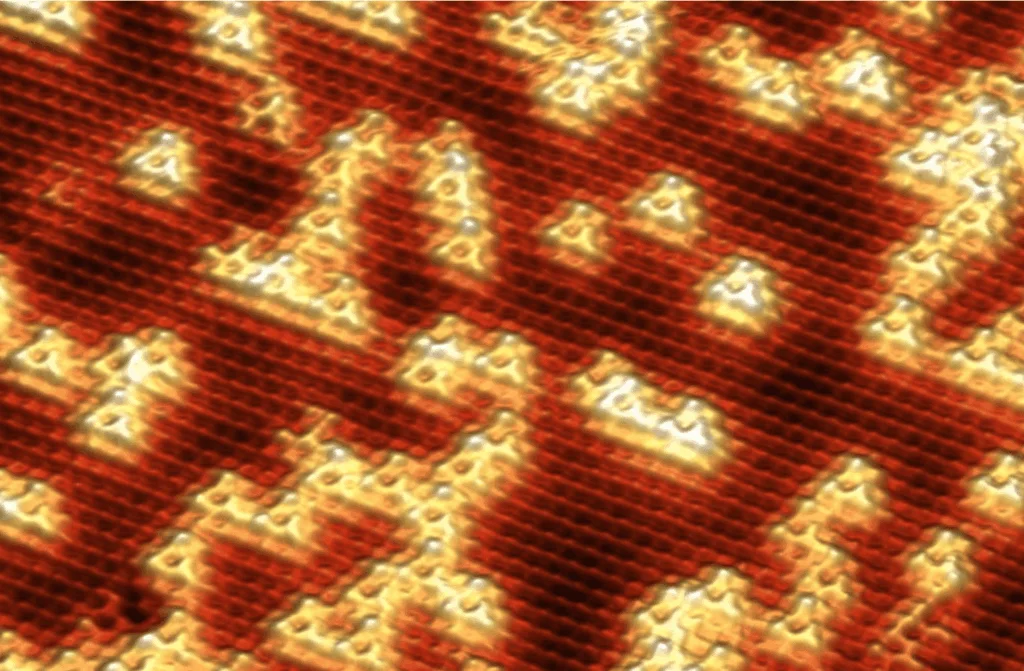

Rigetti Computing: Superconducting

California-based Rigetti Computing (NASDAQ: RGTI) continues its superconducting-qubit roadmap with a modular chiplet strategy to link multiple dies. Quarterly revenue stands at $1.8 million, and cash reserves of $571 million give it a multiyear runway. Rigetti provides access through its Quantum Cloud Services and via integrations with AWS and Azure. The company’s challenge is technical: achieving coherence and gate fidelity sufficient for mid-scale algorithms at a sustainable cost.

Quantum Computing Inc.: Photonic

Quantum Computing Inc. (NASDAQ: QUBT) is positioned around photonic computing and sensing. With roughly $0.26 million in trailing revenue but $349 million in cash after a large capital raise, QCi markets what it calls a nanophotonic “entropy computing” approach, a mix of optical components designed to execute optimization and AI workloads without cryogenics. Its valuation above $4 billion reflects speculative enthusiasm rather than proven deployment.

Together, these four define the public face of quantum computing hardware companies. Each spends heavily on R&D and infrastructure, and each depends on a long cash runway to bridge the gap between scientific milestones and commercial scale. Investors watching the segment typically weigh burn rate and technological differentiation more than quarterly earnings.

| Company | Stock Symbol | Technology Type | Headquarters | Recent Revenue | Cash Reserves | Market Cap / Valuation | Key Platform |

|---|---|---|---|---|---|---|---|

| IonQ | NYSE: IONQ | Trapped Ion | Maryland, USA | $20.7M Q2 2025; $82 to $100M FY projection | $656.8M mid year; $1.6B post raise | $22B October 2025 | AWS Braket, Azure Quantum, Google Cloud |

| D Wave Quantum | NYSE: QBTS | Quantum Annealing and Gate Model | Canada | $22M TTM revenue | $304M March 2025 | Not specified | Leap Cloud Service |

| Rigetti Computing | NASDAQ: RGTI | Superconducting Qubits | California, USA | $1.8M quarterly revenue | $571M | Not specified | Quantum Cloud Services, AWS, Azure |

| Quantum Computing Inc. | NASDAQ: QUBT | Photonic Nanophotonic | Not specified | $0.26M TTM revenue | $349M post raise | $4B plus | Entropy Computing |

Post-Quantum Security Public Companies

If quantum hardware promises future computational power, the post-quantum cryptography market offers immediate business. Especially in light of the “hack now, decrypt later” threat, these publicly-traded companies secure today’s networks against tomorrow’s quantum attacks.

SEALSQ Corp (NASDAQ: LAES)

Swiss-based SEALSQ develops secure semiconductors and hardware roots-of-trust embedding post-quantum algorithms. With FY 2025 revenue guidance of $17.5–20 million and cash of about $220 million, it’s one of the best-capitalized public quantum computing companies. SEALSQ spun out of WISeKey and listed on Nasdaq in 2023, positioning itself as a supplier of quantum-resistant chips for identity management, automotive, and IoT devices.

BTQ Technologies Inc. (NEO: BTQ)

Vancouver’s BTQ Technologies builds blockchain infrastructure hardened with PQC techniques. Revenue remains modest (C$0.25 million in Q1 2025) and cash (C$8 million) limited, but the company’s software-hardware stack targets wallets, digital signatures, and random-number generation for financial and web-scale networks. Market capitalization hovers around $1.3 billion, reflecting expectations for standardization-driven demand once post-quantum encryption becomes mandatory in global finance.

01 Communique (“01 Quantum”) (TSXV: ONE)

Toronto-based 01 Communique pivoted from legacy remote-access tools to post-quantum encryption under the IronCAP brand. With annual revenue near C$0.4 million and about C$1.3 million in cash, it licenses its encryption suite to enterprises aiming to future-proof data. Its small size belies early-mover status among Canada’s PQC cohort.

Quantum eMotion Inc. (TSXV: QNC)

Also Canadian, Quantum eMotion develops quantum random-number-generator chips derived from University of Sherbrooke research. The firm remains pre-revenue but holds roughly C$24 million in cash and a market value approaching C$480 million. Its technology could become a critical component in hardware-based quantum-safe encryption for banking, telecom, and defense.

These publicly traded quantum computing companies illustrate how quantum risk is already monetizable through classical products. Unlike the compute firms, their addressable markets – cybersecurity and authentication – exist today, providing a nearer-term path to revenue even if valuations remain volatile.

| Company | Stock Symbol | Technology Focus | Headquarters | Recent Revenue | Cash Reserves | Market Cap / Valuation | Key Platform |

|---|---|---|---|---|---|---|---|

| SEALSQ Corp | NASDAQ: LAES | Secure Semiconductors and Post Quantum Hardware | Switzerland | $17.5 to $20M FY 2025 guidance | About $220M | Not specified | Quantum resistant chips |

| BTQ Technologies | NEO: BTQ | Blockchain Infrastructure with PQC | Vancouver, Canada | C$0.25M Q1 2025 | C$8M | About $1.3B | Wallet and digital signature stack |

| 01 Communique (01 Quantum) | TSXV: ONE | Post Quantum Encryption under IronCAP | Toronto, Canada | C$0.4M annual revenue | C$1.3M | Not specified | IronCAP PQC suite |

| Quantum eMotion | TSXV: QNC | Quantum Random Number Generator Chips | Canada | Pre revenue | C$24M | About C$480M | QRNG hardware |

Quantum Software Publicly Traded Companies

Software plays in quantum computing are fewer but conceptually clearer: they sell algorithms, simulation tools, and integration layers connecting quantum and classical systems.

Arqit Quantum Inc. (NASDAQ: ARQQ)

UK-based Arqit offers a cloud platform that generates quantum-safe encryption keys on demand. The company reported preliminary FY 2025 revenue of roughly $0.53 million and held $36.9 million in cash at September 30. Its market capitalization, under $1 billion, reflects both lingering skepticism after earlier hype cycles and interest in its shift from hardware to a software-licensing model.

Zapata Computing (OTC: ZPTA)

Boston-founded Zapata remains privately thinly traded on the Expert Market, with estimated TTM revenue near $6 million. In October 2024, Zapata shuddered operations, however, recently, the company reemerged as Zapata Quantum, completing $3 million in bridge financing and converting more than $10 million of debt to equity.

The company originally developed industrial quantum machine-learning middleware linking enterprise workflows to diverse hardware back-ends. The company is rebuilding operations, pursuing uplisting to a national exchange, and targeting commercial growth in cryptography, pharmaceuticals, manufacturing and defense. The company reported that the restructuring secured over 50 patents.

| Company | Stock Symbol | Technology Focus | Headquarters | Recent Revenue | Cash Reserves | Market Cap / Valuation | Key Platform |

|---|---|---|---|---|---|---|---|

| Arqit Quantum | NASDAQ: ARQQ | Quantum safe key generation cloud platform | United Kingdom | About $0.53M FY 2025 | $36.9M September 30 | Under $1B | Cloud key distribution |

| Zapata Quantum | OTC: ZPTA | Quantum machine learning and enterprise middleware | Boston, USA | Estimated $6M TTM | $3M bridge financing; over $10M debt converted | Not specified | Rebuilt platform targeting multiple sectors |

Micro-Caps and the IPO-SPAC Pipeline

Several lightly traded public companies orbit the public-quantum sphere:

- Spectral Capital (OTC: FCCN) calls itself a quantum technology accelerator, but filings show minimal operating assets and volatile valuation around $150 million.

- SuperQ Quantum Computing (CSE: QBTQ) in Canada recently rebranded from a mining firm to offer hybrid quantum-classical computing services. Both highlight the speculative edge of the market, where disclosure standards vary.

More significant are the forthcoming SPAC combinations expected to add new entrants:

- Horizon Quantum Computing is merging with dMY Squared (NYSE: DMYY) in a deal slated to close in Q1 2026, while Infleqtion — the US-UK quantum hardware and sensing firm spun from ColdQuanta — plans to list via Churchill Capital Corp X (NYSE: CCCX) at a pre-money valuation near $1.8 billion. These transactions will expand investor options beyond the current handful of pure plays.

Earlier in 2025, Honeywell announced plans to split into three publicly listed companies by 2026, marking the end of one of America’s last major industrial conglomerates. During that announcement, Vimal Kapoor, CEO of Honeywell told the media that among many options for Quantinuum, he considered a public listing as a strong option because of Quantinuum’s ranking as one of the world’s leaders in quantum computing.

Diversified Giants: Quantum as Strategic R&D

While pure-play quantum companies are important and demonstrate the ability for the investment community to support this deep technology without immediate revenues, most corporate investment in quantum computing occurs within large, diversified companies where quantum revenues are immaterial to overall performance but central to long-term competitiveness.

United States and Europe QC Companies

- IBM (NYSE: IBM) continues its superconducting-qubit roadmap, offering 127- and 433-qubit systems via the IBM Quantum cloud and targeting 1,000-plus qubits by 2025.

- Microsoft (NASDAQ: MSFT) integrates hardware access through Azure Quantum and pursues exotic topological qubits while expanding its Q# developer ecosystem.

- Amazon (NASDAQ: AMZN) provides Braket cloud access to multiple vendors and, in 2025, unveiled its first in-house chip (“Ocelot”) to improve error-correction efficiency.

- Honeywell (NASDAQ: HON) as mentioned, owns a majority stake in Quantinuum, combining trapped-ion hardware and enterprise quantum software leadership.

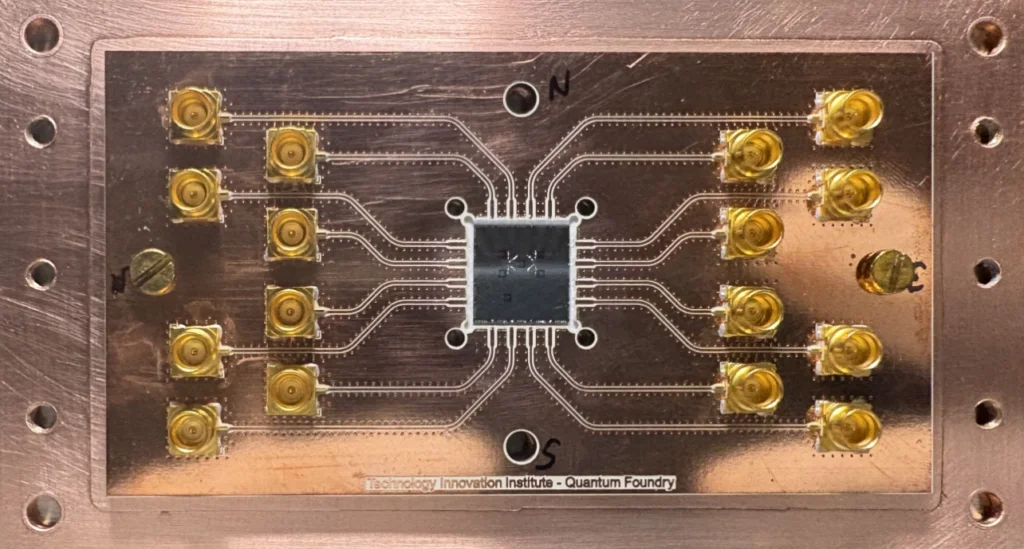

- Intel (NASDAQ: INTC) leverages silicon fabrication for spin-qubit devices developed with QuTech in the Netherlands.

- Nvidia (NASDAQ: NVDA) supports quantum simulation through its CUDA-Q framework.

- Alphabet (GOOG/GOOGL), via Google Quantum AI, pursues scalable error-corrected processors following its 2019 “quantum supremacy” milestone.

In Europe, Airbus (SE: AIR) explores aerospace applications and invests in software firm QC Ware, while BT Group (LSE: BT.A) and Nokia (Bell Labs) push quantum-secure communications. French IT firm Atos (SE: ATO) maintains a strong footprint through its Quantum Learning Machine simulator. German automaker Volkswagen (ETR: VOW3) continues applied research using D-Wave systems for traffic optimization and battery materials modeling.

Asia and the Middle East QC Companies

- Japan’s Fujitsu (6702 TYO) and RIKEN operate superconducting systems up to 256 qubits and aim for 1,000 by 2026, integrating them with high-performance computing clusters.

- NEC, NTT, and Mitsubishi Electric explore quantum annealing, photonic networks, and encrypted communications, respectively.

- In China, Alibaba, Baidu, and Tencent reported – at least at one time – research programs through national laboratories and cloud platforms, though several corporate quantum divisions have been restructured after recent regulatory changes.

- The United Arab Emirates’ International Holdings Company (ADX: IHC) invests through Quantlase Lab in photonic R&D for healthcare and secure communication.

These corporate programs are strategically defensive: ensuring readiness when quantum technology intersects with core businesses such as AI, materials science and cryptography. Investors gain indirect exposure to quantum progress without the single-project risk that burdens pure plays.

Financial Analysis: Revenue, Cash Reserves, and Investment Timelines

Across the pure-play cohort, reported revenues remain small – tens of millions of dollars annually versus valuations in the billions. IonQ, D-Wave, and Rigetti’s combined annual sales barely exceed $40 million, underscoring how nascent the market is. Yet their cash balances — collectively more than $2.5 billion – offer several years of operating runway, effectively functioning as call options on technological success.

For public quantum computing vendors, cash positions are smaller but their markets are more immediate: enterprise and government demand for quantum-safe encryption is expected to rise sharply once NIST finalizes post-quantum standards. SEALSQ’s strong balance sheet distinguishes it among peers, while BTQ and 01 Communique still rely on capital raises to fund product development.

Software providers like Arqit and Zapata occupy a middle ground: low overhead, but credibility hinges on multi-year contracts and proof that quantum-enhanced algorithms can outperform classical solutions.

The Diligence Checklist

Deep tech investing, in general, and quantum investing, specifically, is risky and complex. The typical benchmarks of performance – revenue, earnings, etc. – of quantum companies are often as reliable as they are for traditional stocks. Investors should be cautious and have a risk profile to absorb potential losses. Quantum investors should also use techniques, like diversification (for instance, investing in large corporates, alongside new pure play quantum companies) to minimize the likelihood of losses.

While traditional benchmarks are scarce, analysts evaluating quantum equities emphasize cash runway, roadmap execution, and contract quality over traditional earnings metrics.

- Cash vs. CapEx Plan: Hardware firms’ war chests — IonQ’s $1.6 billion, Rigetti’s $571 million, D-Wave’s $304 million — are crucial buffers for multi-year R&D cycles.

- Revenue Visibility: System sales can create lumpy results; recurring cloud usage or long-term service contracts matter more than one-off deliveries.

- Certification and Adoption: For PQC vendors, FIPS 140-3 and other security certifications validate commercial readiness.

- Quality of Backlog: Investors track whether pilot programs mature into annual recurring revenue rather than publicity wins.

- Disclosure Discipline: Micro-caps with thin filings pose significant information risk.

What Does the Future Hold for Public Quantum Computing Companies?

Quantum technology’s public footprint has expanded from a handful of SPACs to a genuinely global ecosystem spanning North America, Europe, and Asia. The 2025 market includes credible hardware developers, nascent security specialists, and large industrial stakeholders that treat quantum computing as a strategic hedge.

Still, it remains an industry of prototypes, not profits. Revenues are early, valuations are unstable, and consolidation is inevitable. Yet the structural trend – government backing, enterprise experimentation, and integration with AI and HPC – points toward gradual normalization. Investors now have vehicles across the risk spectrum: from direct exposure in IonQ or D-Wave to diversified participation through Microsoft, Honeywell, or Fujitsu.

In that sense, the quantum sector resembles early cloud computing circa 2006 — expensive, unproven, but increasingly indispensable. The companies profiled here form the public face of a technology that could redefine computation over the coming decades, even if today’s balance sheets are mostly promises of what’s next.

To read more about quantum investments, please read How to Invest in Quantum Stocks – A Guide to Long-Term Investing in Quantum Technology.

An updated 2025 list of quantum computing companies & leading players driving innovation, research & growth in quantum technology is available here.

This article is not meant to be investment advice, just an introduction to the quantum stock landscape.

Frequently Asked Questions

What are the main types of publicly traded quantum computing companies?

There are four main categories: pure-play compute companies that build quantum processors (like IonQ, D-Wave, Rigetti), post-quantum security firms offering encryption defenses (SEALSQ, BTQ Technologies), quantum software developers focusing on applications and middleware (Arqit, Zapata), and diversified technology giants with quantum R&D programs (IBM, Microsoft, Amazon, Alphabet).

Which quantum computing stocks have the highest market valuations?

IonQ leads with a market capitalization of $22 billion as of October 2025, followed by Quantum Computing Inc. at over $4 billion. Among post-quantum security companies, BTQ Technologies has approximately $1.3 billion market cap. However, most companies remain pre-profit with valuations based on future potential rather than current revenues.

Are quantum computing companies currently profitable?

No, most publicly traded quantum computing companies are pre-profit. Combined annual revenues for major pure-play companies like IonQ, D-Wave, and Rigetti barely exceed $40 million, while their valuations reach billions. These companies depend on substantial cash reserves—collectively over $2.5 billion—to fund multi-year R&D cycles before achieving profitability.

What is post-quantum cryptography and why is it important for investors?

Post-quantum cryptography (PQC) protects networks against future quantum attacks through quantum-resistant encryption. Companies like SEALSQ, BTQ Technologies, and 01 Communique offer immediate business opportunities addressing the “hack now, decrypt later” threat. Unlike quantum hardware companies, PQC firms target existing cybersecurity markets with nearer-term revenue potential.

Which large tech companies are investing in quantum computing?

Major technology giants with quantum programs include IBM (superconducting qubits), Microsoft (Azure Quantum platform), Amazon (Braket cloud service), Alphabet/Google (quantum AI), Intel (spin-qubit devices), Nvidia (quantum simulation), and Honeywell (majority stake in Quantinuum). These companies treat quantum as strategic long-term R&D rather than standalone profit centers.