Insider Brief

- Morgan Stanley Investment Management (MSIM) disclosed a 7% ownership stake in IonQ, according to an SEC filing.

- The stake positions the quantum computing company within the portfolios of one of the world’s largest institutional investors.

- IonQ’s growing roster of institutional investors also includes Amazon, which reported an $36.7 million stake earlier this year.

- Image: The Morgan Stanley building in Times Square New York (Icc1977, CC BY-SA 4.0 https://creativecommons.org/licenses/by-sa/4.0, via Wikimedia Commons)

Morgan Stanley has disclosed a stake of roughly 7% in IonQ, signaling another major Wall Street player is positioning itself in the closely watched quantum computing market.

According to a Schedule 13G filed with the U.S. Securities and Exchange Commission earlier in August, According to the Schedule 13G filed with the SEC in August, Morgan Stanley Investment Management (MSIM) reported beneficial ownership of 18.4 million shares of IonQ, equivalent to about 7% of the company’s float. The disclosure, reflecting holdings as of June 30, indicates the stake is held across pooled investment vehicles MSIM manages for pensions, endowments, and other investors..

IonQ’s Growing Institutional Profile

The move follows another high-profile disclosure earlier this year when Amazon reported ownership of 854,207 IonQ shares in its quarterly 13F filing. At the time, that stake was valued at about $36.7 million. Analysts noted that Amazon had previously accumulated shares in 2024, but the more formal disclosure brought increased visibility to one of the few public companies focused exclusively on quantum hardware.

Quantum computing remains an emerging field, but institutional ownership suggests that large investors see the sector is transitioning from research to commercial deployment. Together, the entries by Morgan Stanley and Amazon expand a roster of institutional backers that provide legitimacy and liquidity for IonQ’s shares.

The IonQ Platform

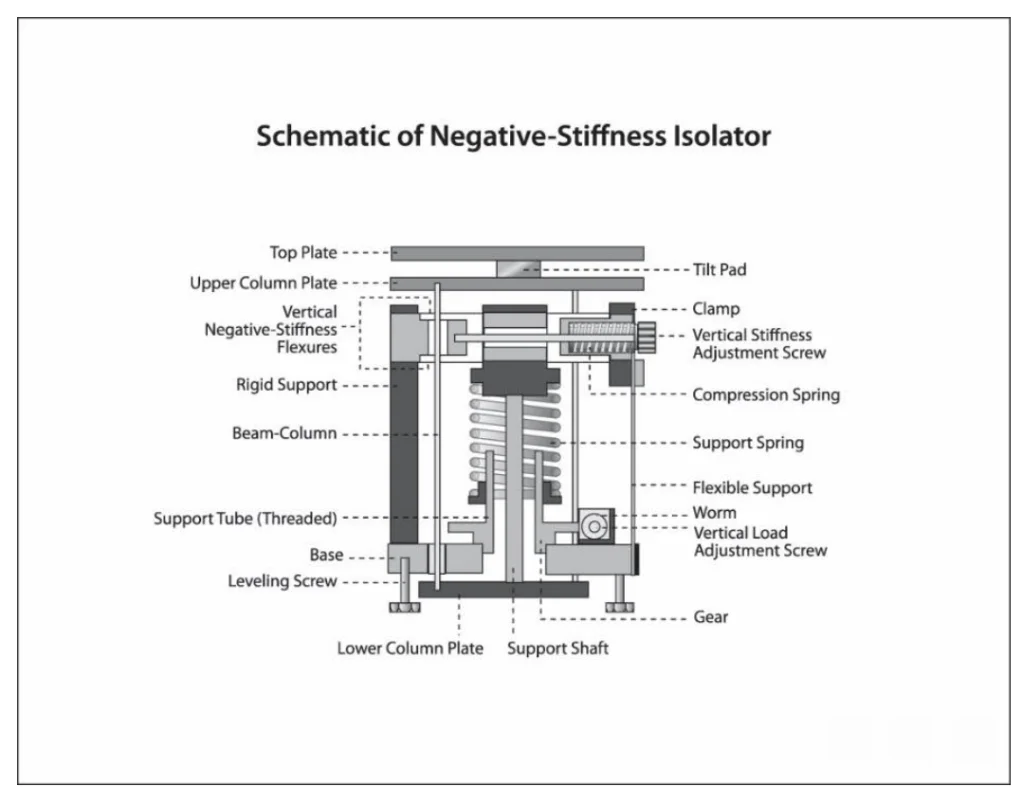

IonQ was founded in 2015 on the basis of more than two decades of academic research into trapped-ion quantum systems. The company listed on the New York Stock Exchange in October 2021, becoming the first pure-play quantum computing firm to go public. Its systems use lasers to manipulate charged atoms, a technique known for high fidelity but also complex engineering requirements.

IonQ’s most recent machines, branded IonQ Forte and IonQ Forte Enterprise, support 36 algorithmic qubits. These systems are early models in quantum computing, but are positioned as devices that could be used to solve specialized optimization and simulation problems. The company markets its devices to corporations and research institutions experimenting with early quantum applications.

As part of its product roadmap, IonQ has introduced Tempo, a forthcoming series designed to deliver performance well beyond the 36 algorithmic qubits of Forte. Tempo aims to push the company’s trapped-ion technology into the utility-scale regime, where quantum machines can outperform classical supercomputers on real-world problems. Positioned as IonQ’s flagship for the second half of the decade, Tempo underpins the company’s long-term thesis that high-fidelity, modular ion-trap architectures can scale to commercially relevant workloads in areas such as logistics optimization, material discovery, and machine learning. While still in development, Tempo represents the most ambitious step in IonQ’s roadmap and signals the company’s intent to compete directly for leadership in the coming generation of quantum hardware.

In February, IonQ’s board appointed Niccolo de Masi as president and chief executive officer. His mandate is to scale the company’s technology portfolio and sharpen its commercial strategy.

Quantum as an Investment Theme

As filings with the SEC show, IonQ’s shareholder base is beginning to reflect a mix of technology giants and traditional financial institutions. That composition may matter as the company continues to raise capital and invest heavily in building out machines that could someday move quantum computing from laboratory curiosity to real world problem solvers.

Another broader, industry-wide take on the investment is that the presence of Morgan Stanley in the quantum investment camp offers evidence of how quantum computing has emerged as an investment theme despite the technical hurdles that remain. Institutional managers tend to diversify across emerging technologies, often taking small stakes that could grow if the sector delivers on its promise. In the case of IonQ, Morgan Stanley’s disclosure brings one of the world’s largest financial institutions onto the register of a company still in its commercialization phase.

This historically signals the overall investment sentiment is one of cautious optimism. Quantum computing remains at the frontier of science, with systems that are still prone to error and difficult to scale. Yet investor interest is being fueled by the prospect of advances in materials science, pharmaceuticals, logistics and artificial intelligence once machines become powerful and stable enough.