Insider Brief

- Jordan’s central bank has launched a sector-wide roadmap to transition banks and financial institutions to quantum-resistant encryption in anticipation of future cybersecurity risks from advanced computing.

- The plan sets out a phased approach that includes identifying cryptographic assets, integrating quantum-related risks into governance and risk registers, and testing new encryption methods in non-operational environments before full deployment.

- The initiative emphasizes coordination among regulators, financial institutions, and technology providers to align Jordan’s financial sector with evolving global cybersecurity standards and maintain long-term stability and trust.

The Central Bank of Jordan has published a sector-wide roadmap to move the country’s financial and banking system toward quantum-resistant encryption, positioning the financial sector to withstand future cyber risks tied to advances in computing power.

According to the Jordan News Agency, the plan is intended to prepare banks and financial institutions for a future in which quantum computers could undermine today’s encryption methods, potentially exposing sensitive data and financial transactions. The central bank said the initiative is part of broader efforts to preserve Jordan’s status as a secure and reliable financial hub as digital risks grow more complex.

The roadmap outlines a structured transition away from current cryptographic systems that rely on mathematical problems expected to become vulnerable as quantum computing matures.

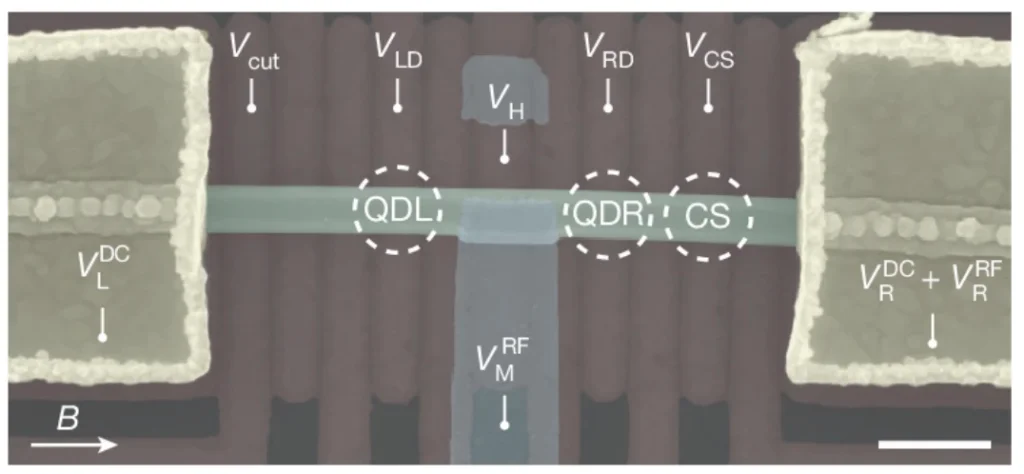

Quantum computers are designed to process certain calculations far faster than conventional machines, raising concerns that they could eventually break widely used encryption techniques. Quantum-resistant encryption refers to new cryptographic approaches designed to remain secure even against such machines.

Phased Transition Strategy

The central bank said the roadmap adopts a phased approach to reduce disruption and allow institutions to adapt over time. Financial institutions are expected to establish a clear transition path, starting with identifying where cryptographic tools are used across their systems and assessing which assets carry the highest risk.

According to the Jordan News Agency, the plan calls for quantum-related cyber risks to be formally incorporated into institutional risk registers, ensuring they are treated alongside more familiar operational and security threats. Governance frameworks are also to be strengthened, with senior oversight of the transition process.

Before any full-scale deployment, banks are encouraged to conduct pilot tests of quantum-resistant encryption in controlled, non-operational virtual environments, the agency reported. These tests are intended to surface technical and operational challenges early, before changes are rolled out across live systems within a defined timeline.

Capacity Building And Coordination

Beyond technical changes, the roadmap emphasizes institutional readiness. The central bank said financial institutions will need to build internal expertise and operational capacity to support the long-term shift, recognizing that the transition will extend over several years.

Coordination among stakeholders is a central element of the plan. The central bank highlighted the need for close integration between banks, technology providers, and external partners to ensure consistent implementation and alignment with international standards and recommendations.

The initiative reflects a growing global focus on so-called “post-quantum” security, as regulators and financial authorities seek to act before quantum computing becomes a practical threat. By moving early, the central bank aims to strengthen confidence in Jordan’s financial system and preserve its competitiveness.

The news agency added that the roadmap represents a proactive approach to emerging technology risks, ensuring the financial sector can continue operating securely while adapting to long-term technological change. Overall, the plan is intended to support stability and trust in the Jordanian banking system as global cybersecurity standards evolve under the pressure of rapid advances in computing.