Insider Brief

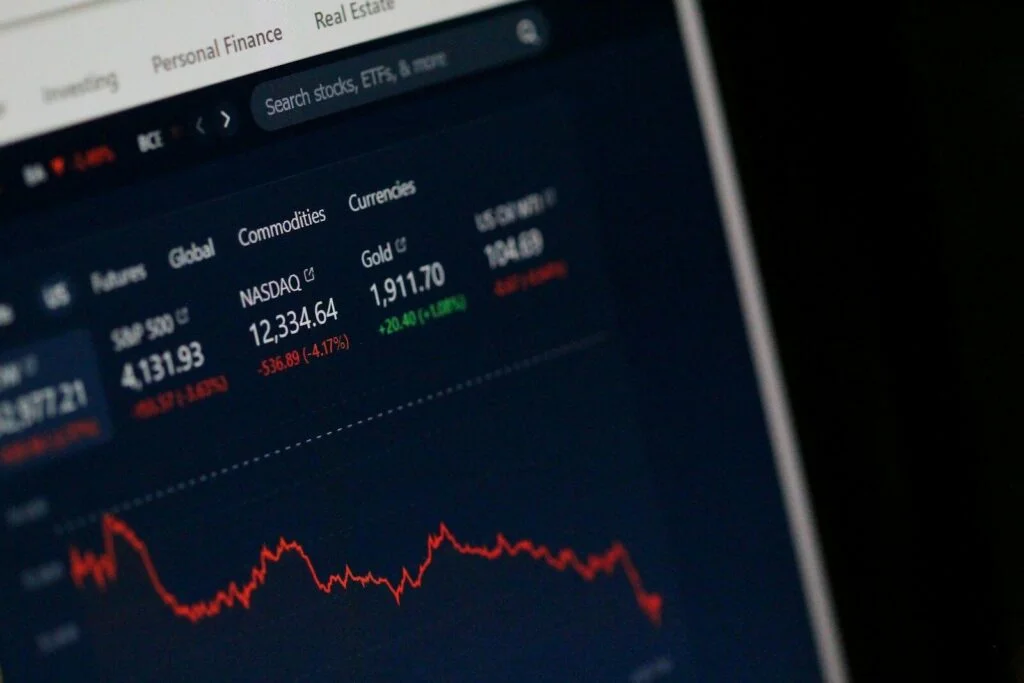

- Quantum Computing Inc. agreed to acquire Luminar Semiconductor in an all-cash transaction valued at $110 million.

- The deal brings Luminar Semiconductor’s photonic components, patents, and engineering team into QCi, strengthening its supply chain, expanding its workforce, and supporting both existing non-quantum customers and future quantum products.

- The acquisition is subject to U.S. bankruptcy court approval through a Section 363 process, with QCi acting as the stalking horse bidder and an expected closing by the end of January 2026.

PRESS RELEASE — Quantum Computing Inc. (“QCi” or the “Company”) (Nasdaq: QUBT), an innovative, quantum optics and integrated photonics technology company, today announced that it has signed an agreement (the “Stock Purchase Agreement”) to acquire Luminar Semiconductor, Inc. (“LSI”), a wholly owned subsidiary of Luminar Technologies, Inc. (“Luminar”) (Nasdaq: LAZR), in an all-cash transaction valued at $110 million (the “Transaction”), subject to customary adjustments. The acquisition will bring QCi a portfolio of core photonic technologies, patents, and a highly experienced team of engineers and scientists that will accelerate QCi’s roadmap while continuing to support and grow LSI’s established customer base.

LSI manufactures and sells a portfolio of photonic components that are important building blocks on QCi’s technology roadmap. The acquisition will bring LSI’s components, patents and talent into QCi, strengthening the Company’s supply chain, substantially increasing the engineering depth of its workforce, and accelerating the advancement of compact, fully-integrated quantum systems for commercial deployment.

Yuping Huang, CEO and Chairman of the Board of QCi commented, “This acquisition represents a meaningful step forward in our strategy to develop and scale practical, integrated quantum solutions. The post-closing revenue opportunity will be two-fold: to serve and expand LSI’s current non-quantum customer base; and to utilize LSI’s technology and products to drive the commercialization of quantum appliances in our targeted markets. LSI employees are a highly valued component of this deal and QCi will provide attractive career opportunities and competitive compensation to those that remain with the company.”

“We also believe LSI’s current customer base will benefit from QCi’s ownership,” Huang added. “We are in a strong position to invest immediately in LSI’s R&D, product development, and manufacturing capabilities. We believe this combination strengthens both organizations and positions us to accelerate our technology roadmap and put quantum technology into the hands of people.”

“LSI is a high-quality business with significant long-term potential, and this transaction with QCi provides the investment and strategic vision needed to realize that potential,” said Paul Ricci, CEO of Luminar. “By bringing together QCi’s and LSI’s complementary capabilities and engineering strengths, they will be able to bring innovations to market faster and better serve their customers across a broad set of advanced photonics and sensing applications.”

Concurrent with this announcement, LSI’s parent Luminar announced that it has initiated voluntary chapter 11 cases in the U.S. Bankruptcy Court for the Southern District of Texas. LSI is not a debtor in Luminar’s chapter 11 cases and is operating in the ordinary course. Because LSI is a subsidiary of Luminar, the transaction will require the approval of the bankruptcy court pursuant to a Section 363 sale process. QCi has agreed to be the proposed stalking horse bidder for LSI in connection with the bankruptcy cases and, in this capacity, will be entitled to customary bid protections. The parties anticipate closing the transaction subject to the satisfaction of customary closing conditions, including receipt of the bankruptcy court approval, which the parties expect to receive by the end of January 2026.