Insider Brief

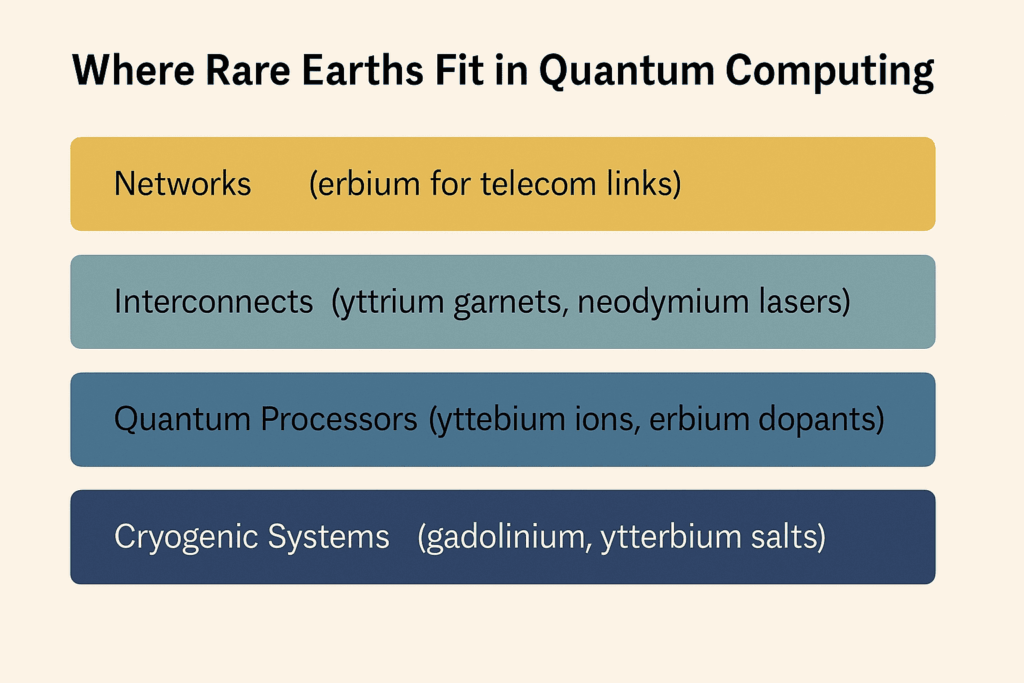

- Rare-earth elements such as ytterbium, erbium, europium, neodymium and yttrium form the hidden foundation of quantum technologies, enabling qubits, quantum memories, and photonic connections.

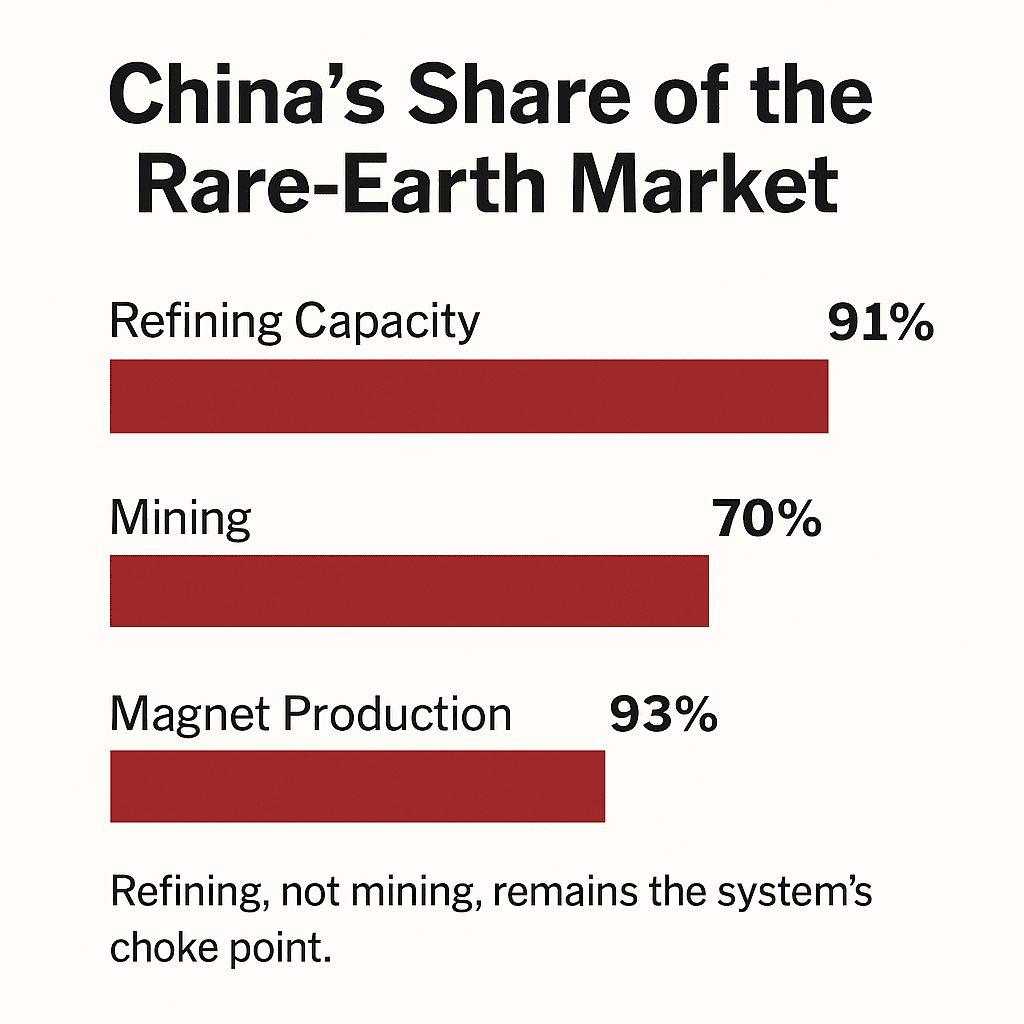

- China dominates the global rare-earth supply chain, controlling about 90 percent of refining capacity and the majority of downstream magnet manufacturing.

- Western governments are investing in new refining and recycling projects, but experts say diversifying processing—not just mining—remains the critical step to reduce dependency.

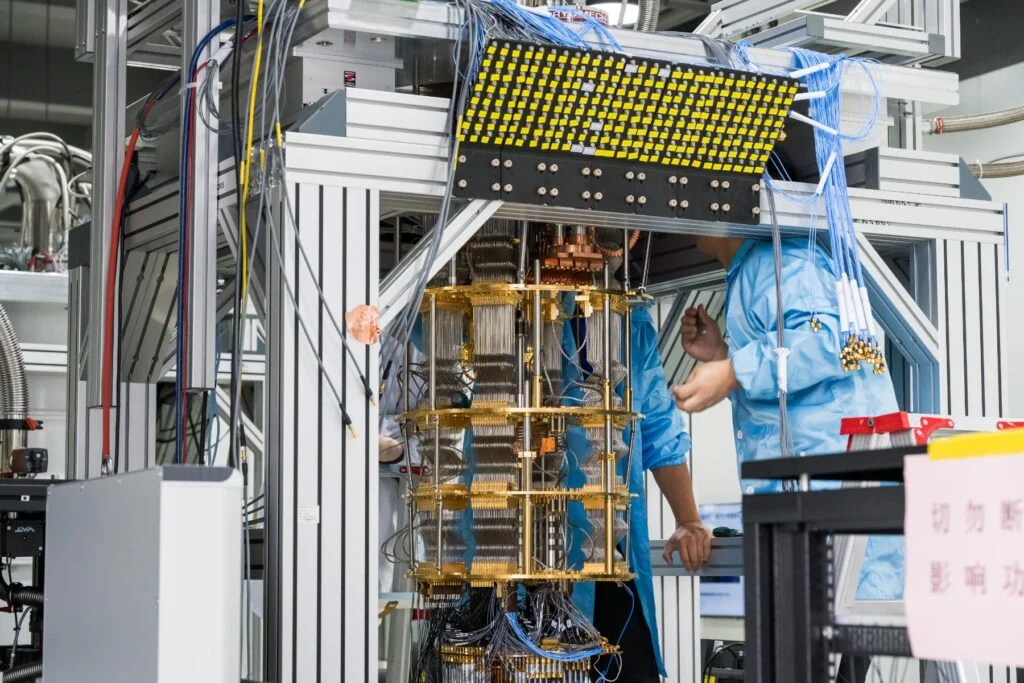

The spotlight materials for quantum computers are usually the photogenic ones — the golden chandeliers of superconducting circuits, the shimmering chips cooled to near absolute zero, or the trapped ions dancing in vacuum chambers. But the spotlight has now shifted with China’s new export restrictions on rare-earth minerals — and the United States’ swift reaction to those restrictions that sent markets in a free fall last week.

If you’re like me and the first thing you think about when you hear “rare earth” is the classic rock, R&B-rooted Detroit band from the 1970s, it may be a surprise that behind all those chandeliers and futuristic chips lies a quieter foundation of rare-earth elements. Most rare-earth elements — the lanthanides — get their quantum usefulness from a hidden layer of electrons, known to chemists as the 4f shell, tucked deep inside the atom and shielded from interference.

The peculiar chemistry of rare-earth elements makes them ideal for the quantum age. Because the 4f electrons are deeply buried inside the atom, they are shielded from environmental noise by outer shells.That isolation grants rare-earth ions the ability to maintain quantum information for long periods, or coherence, even in solid materials. Across architectures, they enable what other elements cannot: stable quantum memories, telecom-band photon interfaces, magnetic transducers, and cryogenic refrigeration.

Before delving into export controls and supply chains, it helps to understand what’s on the line. Some of the rare-earth elements underpinning quantum computing — we’ll look at ytterbium, erbium, europium, neodymium, and yttrium — play distinct roles in the quantum stack. Yet the same materials that enable quantum memories and interconnects are sourced from a supply chain dominated by a handful of nations.

Ytterbium: The Workhorse Ion

Perhaps one the most visible rare-earths in quantum computing is ytterbium. In its singly ionized state (Yb⁺), it forms the backbone of leading trapped-ion quantum computers, including systems developed by IonQ and Quantinuum. Its clean electronic transitions and favorable spin properties make it a reliable qubit that can be cooled and controlled with precision lasers.

Ytterbium ion trap quantum computing is now an entire subfield based on this review in AVS Quantum Science. Beyond ion traps, neutral ytterbium atoms are emerging in optical lattice systems, where researchers exploit their long-lived nuclear spin states for error-resistant quantum memories.

As a dopant — a trace element added to give a material new behavior — ytterbium also shows up in crystals (such as YVO₄), where researchers have measured exceptionally pure optical signals and stable spin states lasting milliseconds, for example in this arXiv study. The results in this study suggest ytterbium could bridge trapped-ion precision and solid-state scalability — though integrating it into photonic chips remains an engineering challenge.

Erbium: Quantum Internet Links

If ytterbium powers the processors, erbium may power the network. This element gives off light at the same wavelength used in today’s fiber-optic cables — about 1,550 nanometers — making it a natural fit for sending quantum information through existing telecom lines.

Crystals infused with erbium can store particles of light carrying quantum data, acting like repeaters for a future “quantum internet.” In 2023, researchers reported in Nature Communications that they used one such crystal, called yttrium orthosilicate, to hold entangled light particles — a key step toward building long-distance quantum connections. Other teams, such as the one behind the study in npj Quantum Information, have built tiny silicon chips that use erbium to catch and hold these signals long enough for error-corrected communication.

Erbium’s advantages come with hurdles. For example, its light is faint, making it hard to capture efficiently, and its performance depends on how pure and well-made the crystal is. Still, no other element so neatly bridges the quantum world and the infrastructure that already connects ours.

Europium: Time Keeper

Europium is important because of its connection to time. The Eu³⁺ ion, in particularl. is prized for its ultra-narrow optical transitions and extraordinarily long spin lifetimes, which can stretch from milliseconds to hours. Those characteristics make it an ideal element for long-term quantum memory, where information must be stored quietly until needed.

In one 2025 study reported in Nature Communications, researchers reported optical coherence times exceeding 400 microseconds and spin lifetimes beyond 30 hours in europium-doped ceramics, a record for any solid-state system. That performance arises from a unique configuration of europium, it should be pointed out, one that isolates its inner electrons from external electric and magnetic noise.

Europium’s only drawback is its subtlety: its transitions are weak, making it difficult to integrate into compact photonic circuits. But for stationary nodes in quantum networks, where longevity matters more than speed, europium remains the element to beat.

Neodymium: Strong Light

Less famous but no less promising is neodymium. Neodymium produces stronger light signals than europium, though it can’t preserve quantum information for quite as long. Known for its strong optical signal, this element gives many quantum materials their vivid glow. In quantum devices, that strength translates into a clearer, brighter interaction between atoms and light — a key requirement for building faster, more responsive quantum memories.

Researchers have shown that neodymium can be integrated into tiny crystal cavities, where it captures and releases light with remarkable efficiency. In these systems, its signals can be stored for microseconds to milliseconds — long enough to process information, if not as long as the deep-storage materials like europium.

A 2023 study comparing different rare-earth elements found that neodymium’s transitions are relatively strong but its “memory” fades faster than others such as europium or praseodymium. In other words, it trades endurance for brightness — a balance that makes it valuable wherever speed and signal strength matter more than longevity.

Yttrium and the Rare-Earth Garnets

Not all rare-earths play the starring qubit role. Some, like yttrium, serve as the substrate upon which quantum systems are built. In the form of yttrium iron garnet (YIG), it forms the magnetic core of systems that connect microwave and optical signals, helping control the flow of information between them. These components allow superconducting qubits to communicate with optical networks without back-reflected noise.

Recent demonstrations have used YIG thin films to convert microwave photons into optical signals, enabling connections between superconducting circuits and fiber networks. Other studies explore YIG-based magneto-optical chips that could route quantum signals on integrated photonic platforms.

Cryogenic Enablers

Even at the lowest levels of the stack, rare-earths keep showing up. Compounds such as gadolinium gallium garnet (GGG) and KYb₃F₁₀ are being developed for adiabatic demagnetization refrigeration (ADR). These are magnetic cooling systems that are critical to quantum technologies because they can reach millikelvin temperatures without relying on scarce — and expensive — helium-3.

These materials might not be part of the quantum logic itself, but they enable the stability that quantum coherence demands.

The Rare-Earth Supply Chain: China Leads—But the Data Are Blurry

China sits at the center of the rare-earth trade—by mining, by separation/refining, and by downstream products. Trade statistics from the World Bank make the point, even if they don’t neatly separate erbium from europium or ytterbium: customs codes typically lump “rare-earth metals, scandium and yttrium” together, so element-by-element impacts are hard to parse.

In 2024, China was the top global exporter in that grouped category, shipping about $96 million (≈8.9 million kg)—well ahead of Thailand and Japan. In 2023 the gap was even starker: $235 million from China versus $102 million from Thailand.

Production and processing tell the same story. U.S. Geological Survey summaries and industry reporting show China dominating mining and—more critically—refining. One recent estimate puts China’s share of rare-earth refining at about 91% today (projected to fall only to ~73% by 2040 even with Western build-out). Another analysis pegs China at roughly 70% of global mining and 93% of magnet manufacturing, the highest-value downstream product. For U.S. buyers, the dependency shows up in the ledger: the value of U.S. imports of rare-earth compounds and metals was about $170 million in 2024 (down 11% year over year), with past years’ sourcing led heavily by China, Reuters reports.

Bottom line: China is the system’s hub, but HS codes and reporting conventions mask which specific elements are constrained at any given moment. When Beijing tweaks quotas or licensing, the market feels it—even if the spreadsheet can’t instantly tell you whether erbium or europium moved the most.

The Rest of the Chain — Where Alternatives Can Emerge

Even with China in the lead, there are real pressure points—and opportunities—elsewhere in the chain:

- Mining & concentrates. Australia, the U.S., and Myanmar show up in global production tables, Investing News Network reports. Australia and Vietnam increasingly appear in export data for the grouped rare-earth category. More ore and mixed concentrates outside China help, but without separation capacity they don’t fix the chokepoint.

- Alloys & magnets. High-performance NdFeB magnets are a separate—and strategic—dependency, with China controlling ~93% of output, according to recent industry tallies cited by Reuters. For quantum-adjacent sectors (cryogenics, precision motion, photonics tooling), magnet bottlenecks can ripple into equipment availability.

- Embedded imports. A large share of rare earths reach end markets “inside” finished goods. USGS notes substantial U.S. dependence on magnets and components embedded in electronics, obscuring material origin and complicating policy responses.

It’s Not Supply, It’s Refining

While most of the attention is on the supply chain, experts suggest that’s not the real bottleneck.

Once dug from the ground, rare-earth ores must go through a complex, chemical-intensive process to separate individual elements that have nearly identical properties. This step, known as separation and refining, is where China’s dominance is most entrenched and most difficult to dislodge.

There is some industry and government data estimates that suggest about 90 percent of global refining capacity sits in China. Even under optimistic projections, that share might fall only to the mid-70s by 2040 as projects in the U.S., Australia and Europe come online. The challenge is not just scale but expertise: Chinese refiners have spent decades mastering solvent-extraction chains that can tease out pure erbium, neodymium, or europium from mixed concentrates.

Western governments have funded new facilities — the Lynas plant in Texas, MP Materials’ expansion in California, and Arafura projects in Australia — but most remain years away from full capacity. Meanwhile, China’s integrated system allows mined ore, chemical processing and magnet production to occur within a single national network, keeping costs low and control high.

That asymmetry in separation and refining leaves even advanced-tech sectors exposed. The materials behind quantum computers’ photonic chips, magnetic isolators, and cryogenic systems often pass through Chinese refineries long before reaching a cleanroom in the U.S. or Europe. Until alternative refining hubs mature, China’s command of this middle link in the chain will remain the single most consequential choke point in the rare-earth economy.

The Upshot? Or Maybe The Down Shot?

Most of the expert sources surveyed in this article do not see an easy path to rare-earth independence.

China’s near-monopoly on refining gives it quiet leverage over some of the world’s most advanced research. Materials that underpin many of the devices that power the quantum computing industry still pass, in some form, through Chinese refineries. That dependency has been built from decades of investment in chemical separation, processing know-how and integrated manufacturing.

If the U.S. and its allies want to secure the quantum future, the response will have to go beyond mining headlines. Three practical steps stand out:

- Invest in refining, not just extraction. New mines in Australia or Nevada mean little if the material still ships to China for processing. Building solvent-extraction capacity and technical expertise — the slow, messy middle of the chain — is essential.

- Expand recycling and circular sourcing. Rare-earth magnets, lasers, and catalysts already in circulation could become secondary supply streams. Europe and Japan are piloting recovery systems that reclaim erbium and neodymium from old electronics; scaling that approach would ease demand for virgin material.

- Strengthen traceability and stockpiles. Transparent tracking of rare-earths from mine to finished device can help manage shocks, while national or regional reserves can buffer against export disruptions.

None of these measures will close the gap quickly. But as quantum computing moves from lab prototypes to data-center-scale infrastructure, the balance between science and supply will grow only more critical. Rare-earths may not shimmer like superconducting chips or glow like trapped ions — yet they remain the quiet constants of the quantum revolution. The next phase will depend not just on who invents the technology, but on who controls the chemistry that makes it work.