Insider Brief

- Researchers from HSBC and IBM found that noisy quantum processors improved machine learning models for predicting corporate bond trade execution by up to 34%.

- The study showed that quantum-transformed data consistently outperformed classical and noiseless quantum simulations, suggesting hardware noise may enhance statistical structure in financial models.

- Results are based on European corporate bond data and require further validation, but they point to potential near-term applications of quantum devices in finance.

Quantum computers may be noisy and error-prone, but scientists are figuring out ways to make noisy quantum devices useful and, in fact, they’re finding that same imperfection appears to give them an edge. In a case released just this week, researchers say that noise can even be helpful in predicting bond trades.

The new study, published in arXiv by researchers from HSBC and IBM, demonstrates that using quantum-processed data could improve the accuracy of machine learning models for predicting whether a bond trade would go through by as much as 34%. The work suggests that, far from being a nuisance, the quirks of early quantum hardware could deliver useful advantages in financial markets today.

The study focused on “fill probabilities,” or the likelihood that a request to trade a corporate bond will be executed. This prediction is critical for banks and investors who must balance the desire to win trades against the need to remain profitable. Traditional models rely on large sets of market data, but the complex, irregular nature of corporate bond trading makes accurate prediction difficult.

According to the researchers, machine learning models that incorporated data transformed by quantum processors consistently outperformed those trained on classical data. In controlled backtests, these quantum-enhanced models reduced errors and delivered better out-of-sample test scores. The biggest surprise came from the source of the advantage: the noise inherent in current quantum hardware seemed to smooth out the data and highlight useful signals.

By contrast, noiseless quantum simulations running on classical computers showed no such benefit. The results suggest that imperfections in quantum processors may create statistical effects that help financial models perform better in uncertain markets.

How The Bond Purchase Process Works

For context on why this matters, consider a typical bond trade. A pension fund decides to sell €10 million worth of bonds issued by a manufacturing company. The request hits electronic platforms where several banks compete to respond within seconds.

Each bank must decide whether to “fill” the order — to buy the bonds at the quoted price. That choice depends on a mix of factors: the size of the trade, current market liquidity, recent price moves, and the bank’s own risk limits. If a bank underestimates the chance the trade will go through, it may quote too conservatively and lose business. If it overestimates, it could accept a trade that ends up unprofitable.

On a €10 million bond order, the difference between profit and loss can be razor thin. A margin of just 10 basis points — one-tenth of a percent — amounts to €10,000. Misjudging fill probability can turn that gain into a comparable loss. For firms handling billions of euros of trades, €10,000 may not sound like much, but across thousands of trades a year the impact can run into millions.

The HSBC and IBM study found that machine learning models fed with quantum-transformed data improved prediction accuracy by as much as 34 percent. That kind of edge could mean catching trades that would otherwise slip away or avoiding deals that would erode profits.

Understanding The Experiment

In the HSBC, IBM study, the team analyzed nearly 1.1 million trade requests covering more than 5,000 bonds in the European corporate bond market. The data spanned over a year of intraday trading and included details such as trade size, bond identifiers and market conditions. Each trade request was labeled as successful or unsuccessful depending on whether the order was filled.

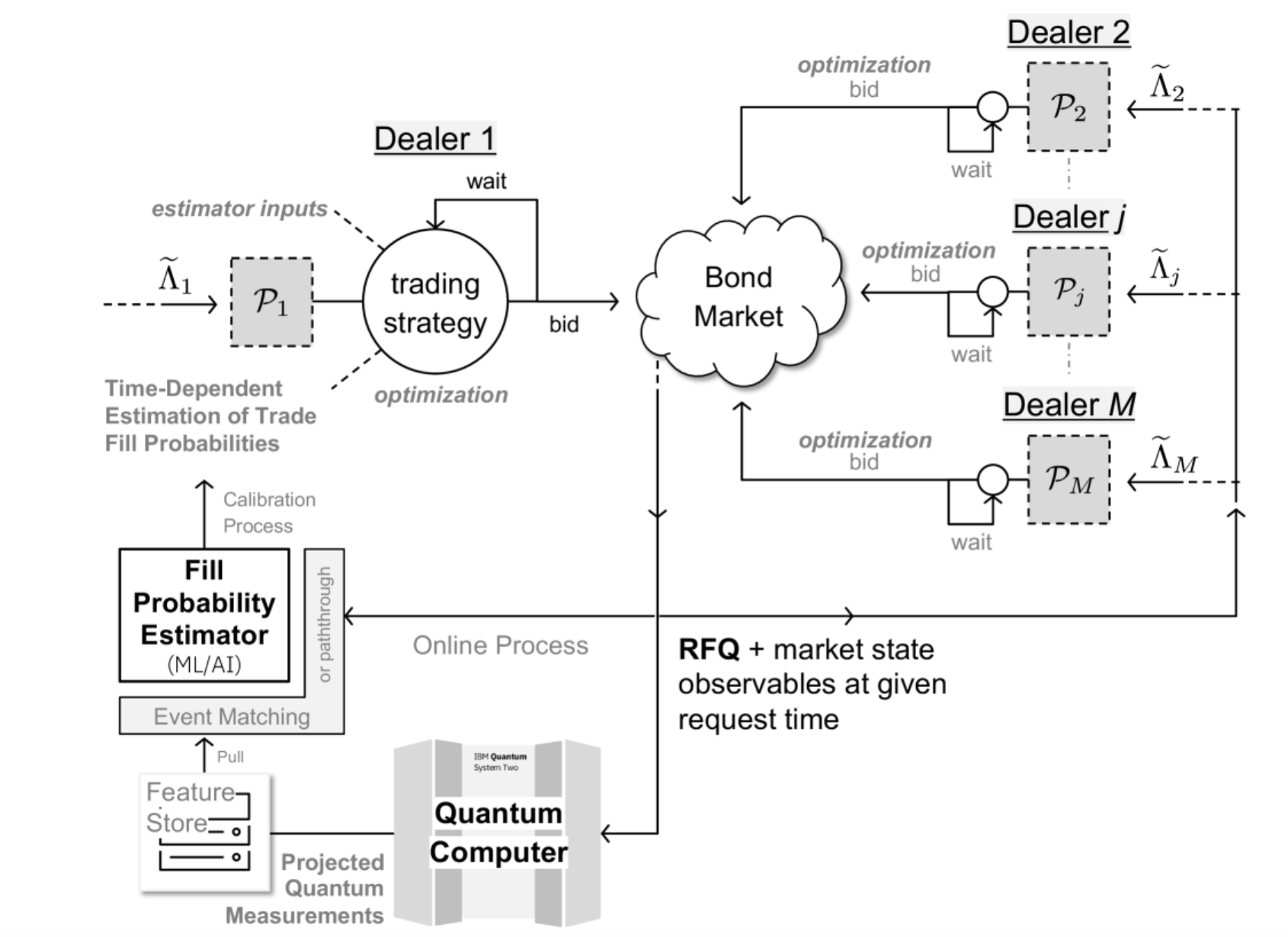

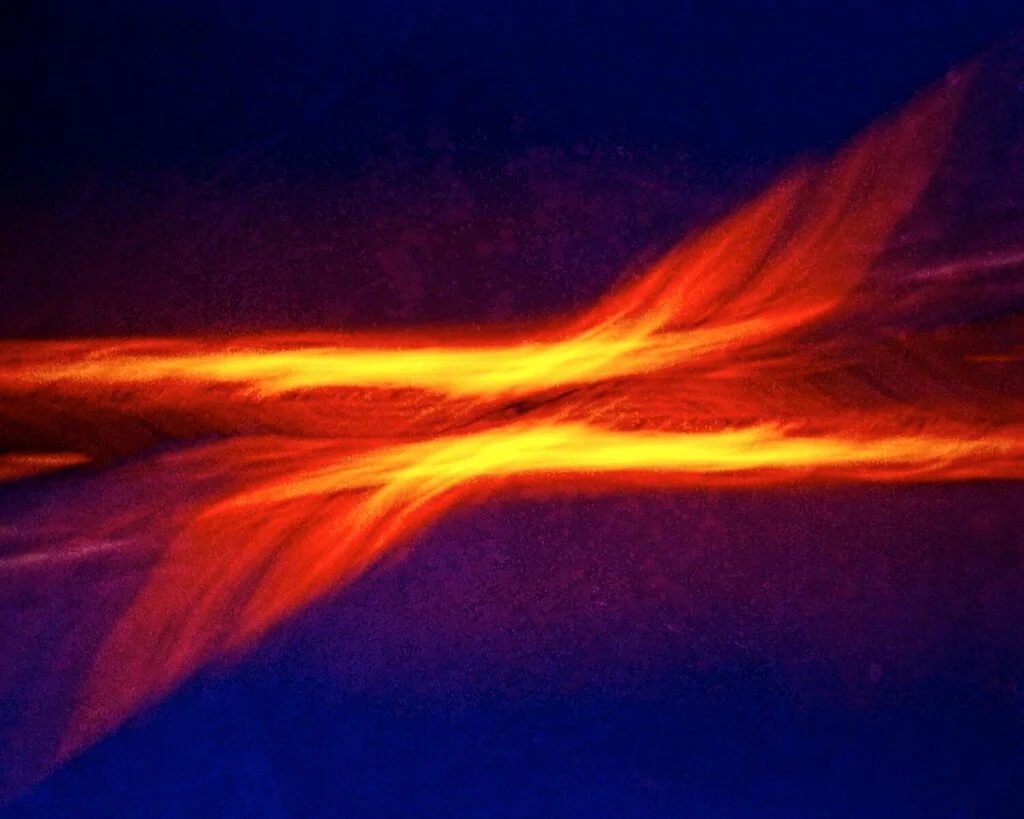

Instead of changing the machine learning algorithms themselves, the researchers altered the input data. They fed bond market features into IBM’s Heron quantum processors, which applied a special type of quantum transformation known as a Projected Quantum Feature Map. The quantum computer produced new, transformed data sets that were then used to train standard models such as logistic regression, random forests and neural networks.

Backtests compared the predictions made with classical features, noiseless quantum simulations and quantum hardware features. The quantum-hardware-transformed inputs consistently led to better model accuracy, particularly when longer, more complex quantum circuits were used.

Implications for Quantitative Finance

There are numerous take-aways from this study for the quantum industry. The immediate implication is that quantum devices may already offer practical value, even before they reach the fault-tolerant stage long seen as a requirement for real-world applications. Financial institutions face intense competition to shave milliseconds off trading decisions or improve forecasts by even a few percentage points. A double-digit boost in prediction accuracy, even in limited contexts, could have meaningful impact on trading profitability, risk management and client competitiveness.

In a €100 billion corporate bond market, for example, a 34 percent improvement in prediction accuracy could mean tens of billions of euros in orders executed more smoothly, reducing friction and wasted liquidity.

This sounds great for bond traders and Wall Street, but is there anything in it for Main Street?

While it’s a little speculative, it’s not out of the realm of possibility that, if such improvements hold up beyond a single dataset, the implications could ripple well beyond trading desks. More accurate forecasts mean tighter pricing and more efficient markets, where buyers and sellers face fewer mismatches and less wasted liquidity. Over time, that efficiency can reduce volatility, limit sudden liquidity squeezes and lower the chance that trading errors cascade into systemic stress.

For an economy that depends on smooth capital flows, even incremental gains in predictive accuracy can translate into stronger market stability and more resilient financial infrastructure.

Zooming out one more level: If confirmed across other datasets and asset classes, the approach could mark one of the earliest commercially relevant uses of quantum computing in finance.

Remaining Questions

The researchers stress that the study does not claim a universal advantage for quantum computing. Instead, the results show that quantum-transformed features can help in specific, data-heavy problems where noise itself may create useful statistical structure. However, this could encourage more applied research on hybrid models that use quantum systems as offline data transformers within existing trading platforms.

The study has other important caveats. For example, the observed performance gains were tied to a specific dataset of European corporate bond trading, and there is no guarantee the effect will generalize to other markets or instruments. The researchers acknowledge that the magnitude of the gains, particularly the 34% uplift, remains puzzling and not fully explained by current theory.

Because the results rely on empirical backtesting, they cannot rule out that the improvements were shaped by peculiarities in the dataset or by statistical artifacts. The role of quantum noise itself is also not well understood: why exactly the imperfections in hardware lead to better-performing features remains an open research question.

Today’s quantum systems also remain limited in scale and availability. The IBM Heron processor used in the experiments has just over a hundred qubits, and the approach required careful tuning and error mitigation. For now, any financial institution exploring this route would need to treat quantum as an exploratory tool rather than a production-ready technology HSBC.

Where This Could Go Next

The researchers suggest several future directions. The first of which is replication. Testing the method on different datasets, including equities, derivatives, and other fixed-income products, could help determine whether the gains persist. Second is theory: developing a clearer understanding of why quantum noise contributes to improved model performance. Third is integration: exploring how to incorporate quantum-transformed features into live trading systems in ways that meet regulatory and operational requirements.

The study also points to broader possibilities. By showing that quantum computers can complement, rather than replace, classical models, it opens the door to a hybrid future where quantum devices are used selectively to tackle specific challenges in finance. This incremental path may be more realistic than waiting for large-scale fault-tolerant machines.

As the researchers note, what began as an experiment in quantum finance may hint at a new way to exploit the very flaws of quantum machines.

And there’s one final bit of speculation: Wouldn’t it be interesting that in an industry where even a small edge can mean millions, that the reviled noise that we detest so much in quantum systems might just turn out to be a feature, not a bug?

About The Quantum Insider

The Quantum Insider is recognized as the world’s leading source for timely quantum computing news, industry insights, and market intelligence. Our editorial team delivers trusted analysis to researchers, investors, and industry leaders.