Insider Brief

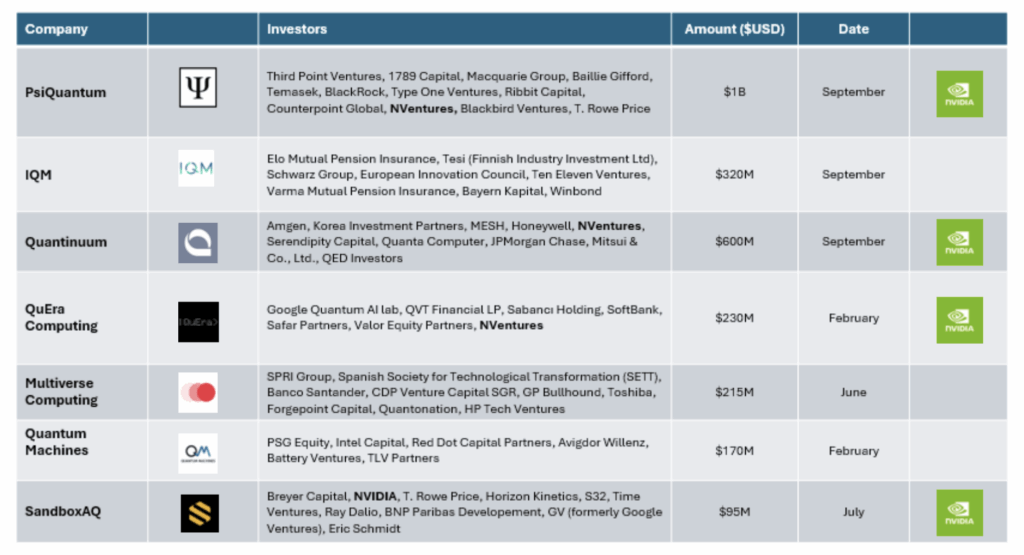

- NVIDIA’s venture arm NVentures invested in QuEra, Quantinuum and PsiQuantum in early 2025, signaling a strategic shift toward quantum computing after years of skepticism.

- The investments span all three major quantum hardware modalities — neutral atom, trapped ion, and photonic — giving NVIDIA broad exposure to potential winners in the sector.

- Beyond capital, the partnerships offer NVIDIA integration opportunities across AI and HPC stacks while aligning it with companies nearing fault-tolerant and utility-scale milestones.

NVIDIA’s venture arm, NVentures, has invested in three quantum computing companies in the first half of 2025, a sharp turn from the company’s previously skeptical posture toward the field just a few years ago.

The investments not only span three different modalities of quantum hardware — neutral atom, trapped ion, and photonic — that give the chip giant exposure across the technology spectrum, but also happen to be three of the biggest raises in quantum — so far — this year. NVIDIA was also involved in another large raise — SandboxAQ’s $95 million round — a company centered on artificial intelligence, but on that might also be considered a quantum adjacent play.

The move to secure investments in companies across the quantum landscape may seem unusual because, less than two years ago, NVIDIA’s CEO Jensen Huang downplayed quantum computing, positioning GPUs and AI as the superior route for accelerating science and industry. This year’s investment streak suggests either a change of heart or a hedging strategy that acknowledges quantum’s potential role in the broader computing stack.

The Come-to-Qubits change of heart take on the recent moves may be more emotionally satisfying for those in the quantum community, but it might ultimately be a bit superficial. One point that stands out about the investments is that NVentures is spreading its bets across the quantum modalities. Another interesting point: the companies receiving NVentures’ backing are treating it as more than just capital. For firms like QuEra, this connection with the world’s most valuable chipmaker creates opportunities for technical collaboration, integration with NVIDIA’s GPU ecosystem and heightened visibility in the global computing market. On NVIDIA’s side, successful, well-funding quantum companies exploring opportunities in what is shaping up to be a classical-quantum high performance computing landscape are also likely to be prime customers for NVIDIA’s equipment and service

Next, we’ll take a look at the three targets of NVIDIA’s NVentures’ investment team.

QuEra Computing: Neutral Atom Systems

Boston-based QuEra Computing announced that NVentures joined its $230 million Series B round, first disclosed in February. The funding expands QuEra’s resources for developing neutral-atom quantum computers, a modality that arranges arrays of atoms controlled by lasers to serve as qubits.

The partnership goes beyond capital, the announcement notes. QuEra will collaborate with NVIDIA on hybrid quantum-classical computing projects at the NVIDIA Accelerated Quantum Center. These initiatives include AI-powered error decoding and integration with NVIDIA’s HPC infrastructure.

With backers that now include Google, Amazon Web Services and NVIDIA, QuEra is positioning itself at the intersection of quantum, cloud and AI. The company’s roadmap calls for fault-tolerant quantum systems capable of addressing high-performance computing (HPC) markets — an area aligned with NVIDIA’s broader ambitions in supercomputing.

Quantinuum: Trapped Ion Scale-Up

Honeywell-owned Quantinuum recently disclosed a $600 million Series B round valuing the company at $10 billion pre-money. The financing marked one of the largest quantum raises to date and is believed to be the highest publicly reported valuation for a privately held quantum firm.

New investors included NVentures, along with Quanta Computer and QED Investors. Those investors joined returning backers Morgan Private Ventures, Mesh Ventures and Korea Investment Partners. The scale of the raise signals strong investor confidence in trapped-ion technology, where qubits are encoded in ions confined by electromagnetic fields and manipulated with lasers.

Quantinuum has gained a reputation of consistently improving algorithmic performance on its trapped-ion systems, while developing a suite of quantum cybersecurity and chemistry applications. NVIDIA’s involvement connects it to a platform that many industry analysts regard as one of the closest to achieving fault tolerance.

PsiQuantum: Photonic Ambitions

PsiQuantum, based in Palo Alto, announced in March that it had raised $1 billion in a Series E round at a $7 billion valuation. The financing was led by BlackRock with participation from Temasek, Baillie Gifford, NVentures, and other institutional investors.

The funds will support PsiQuantum’s efforts to build utility-scale quantum computers using photons as qubits. The company is constructing facilities in Brisbane and Chicago to deploy large prototypes, improve chip performance, and expand barium titanate production — a critical material for its photonic chips.

PsiQuantum’s approach relies heavily on semiconductor manufacturing techniques and advanced cooling and networking systems. By leveraging the infrastructure of the semiconductor industry, the company aims to scale to millions of qubits, a threshold it argues is necessary for commercial utility.

PsiQuantum’s Manufacturing Strategy

| Component | Approach | Strategic Advantage |

|---|---|---|

| Qubit Type | Photonic, light based | Room temperature operation and reduced cooling costs |

| Manufacturing | Semiconductor fab processes | Leverages existing chip production infrastructure |

| Scale Target | Millions of qubits | Necessary threshold for commercial quantum advantage |

| Facilities | Brisbane and Chicago sites | Government backed quantum research hubs |

| Critical Material | Barium titanate chips | Proprietary photonic chip production capacity |

So, Why NVIDIA is Investing Now?

Why quantum? Why now? Those are the big questions. NVIDIA’s participation across three modalities suggests — to us — several strategic motivations.

First, quantum computing is increasingly framed as complementary to AI and HPC rather than as a competitor. By investing, NVIDIA ensures its GPU and AI platforms remain central to hybrid quantum-classical workflows. QuEra’s announced collaborations around error decoding and integration with NVIDIA’s accelerated computing stack underscore this point.

Another motivator is that quantum technology is edging closer to commercialization. Multi-hundred-million and billion-dollar raises indicate that investors expect the next five years to produce early utility-scale systems. By buying into multiple modalities, NVIDIA takes a portfolio approach — gaining exposure to whichever technology proves most viable, or at the very least, to the one that proves viable first.

The investments also strengthen NVIDIA’s position in the broader computing ecosystem. As governments and corporations build quantum research hubs and supercomputing centers, having direct stakes in leading firms gives NVIDIA both influence and optionality in shaping future standards.

There is an outlier reason for the recent wave of investments. While it is speculative, it is also possible Huang and NVIDIA executives were presented with stronger evidence of inevitability of quantum computing — perhaps a deeper look at the research pipelines of some of these companies, or inside conversations with trusted leaders in computer technology.

NVIDIA’s shift on quantum computing, then, appears to reflect a convergence of market signals, technical progress and strategic positioning rather than a sudden reversal of belief. When CEO Jensen Huang remarked that quantum computing was “20 years away,” the field was still dominated by laboratory demonstrations with limited qubit counts. In the past two years, however, the industry has attracted billions in capital, produced credible roadmaps toward fault tolerance, and drawn commitments from governments and Fortune 500 companies alike.

What Might Come Next for NVentures?

With its recent investments in QuEra, Quantinuum and PsiQuantum, NVIDIA’s NVentures has now placed bets across the three major quantum computing modalities. This could very well be the last chapter of NVIDIA’s venture arm’s quantum investment playbook.

However, the possibility exists that rather than signaling the end of its interest, this cross-modality portfolio actually marks the opening chapter of a broader quantum strategy.

The next logical step could be expanding into unrepresented modalities, superconducting qubits stands out. Despite being the most mature quantum architecture, superconducting systems are absent from NVentures’ current quantum roster. An investment in a startup advancing scalable superconducting designs — or addressing its persistent limitations in noise and coherence — would round out NVIDIA’s modality coverage and deepen its stake in a future full-stack landscape.

Beyond hardware, NVentures may move to shore up quantum-classical integration points, an area where NVIDIA’s existing strengths in GPUs and high-performance computing offer natural synergies. Companies developing quantum compilers, hybrid workflow tools, simulation platforms, or error mitigation software could become strategic targets, particularly those whose solutions are already compatible with NVIDIA’s CUDA-Q or cuQuantum frameworks.

Another likely trajectory involves backing large-scale testbed infrastructure. With QuEra and PsiQuantum both targeting utility-scale systems, NVentures may co-sponsor quantum lab expansions or hybrid data center facilities, especially in regions with national quantum initiatives. Such participation would allow NVIDIA to help shape early market standards while future-proofing its GPU ecosystem for a coming wave of quantum-accelerated workloads.

Though less certain, NVentures may also extend its reach beyond computing. Quantum networking, communication, and sensing — each with growing momentum and market projections — remain untapped sectors in its portfolio. A foray into quantum cryptography or sensing could provide additional strategic hedges while aligning with sovereign security agendas and new government funding channels.

Potential Future Investment Targets for NVentures

| Category | Investment Focus | Strategic Rationale | Example Companies or Areas |

|---|---|---|---|

| Hardware Completion | Superconducting qubits | Most mature modality, currently unrepresented in portfolio | Scalable superconducting startups addressing noise and coherence |

| Integration Layer | Quantum classical software | Natural synergy with NVIDIA GPU and HPC strengths | Compilers, hybrid workflow tools, simulation platforms |

| Infrastructure | Utility scale testbeds | Co sponsor quantum labs and hybrid data centers | National quantum initiative facilities, quantum cloud infrastructure |

| Adjacent Technologies | Quantum networking and sensing | Strategic hedges in growing markets | Quantum cryptography, quantum communication, quantum sensors |

| Strategic Acquisitions | Key IP and capabilities | Fill technical gaps and accelerate commercial returns | Utility-scale testbeds |

Finally, NVIDIA may selectively pursue acquisition opportunities. As the ecosystem matures, startups with key intellectual property — in areas like photonic integration, cryogenic control, or post-quantum security — could become acquisition targets, especially if they offer short-term commercial returns or fill technical gaps in NVIDIA’s stack.

Frequently Asked Questions

Why did NVIDIA change its stance on quantum computing after Jensen Huang called it “20 years away”?

NVIDIA’s position evolved as quantum computing transitioned from laboratory demonstrations to near-commercial viability. Between 2023 and 2025, the industry attracted billions in funding, produced credible roadmaps toward fault-tolerant systems, and secured commitments from major corporations and governments. Rather than a reversal, this represents strategic adaptation to quantum computing’s complementary role alongside AI and HPC.

What quantum computing modalities has NVIDIA invested in?

NVIDIA has invested in three major quantum hardware modalities: neutral atom systems (QuEra Computing), trapped ion technology (Quantinuum), and photonic quantum computing (PsiQuantum). This portfolio approach hedges against technological uncertainty while ensuring NVIDIA has exposure to whichever modality achieves commercial viability first.

How much has NVIDIA invested in quantum computing companies?

While specific investment amounts from NVentures aren’t disclosed, NVIDIA participated in funding rounds totaling over $1.8 billion: QuEra’s $230 million Series B, Quantinuum’s $600 million Series B, and PsiQuantum’s $1 billion Series E. NVIDIA also invested in SandboxAQ’s $95 million round, a quantum-adjacent AI company.

What does NVIDIA gain from these quantum investments beyond financial returns?

NVIDIA’s quantum investments provide multiple strategic benefits: technical collaboration opportunities (like QuEra’s AI-powered error decoding), integration pathways between quantum systems and NVIDIA’s GPU/HPC infrastructure, influence over emerging industry standards, and positioning as an essential supplier to quantum companies requiring classical computing resources.

Which quantum modality is NVIDIA missing from its portfolio?

Superconducting qubits – the most mature quantum technology used by IBM, Google, and Rigetti – remain absent from NVentures’ current portfolio. This represents a notable gap that NVIDIA may address in future investment rounds.

Is quantum computing still decades away from practical applications?

Current industry consensus suggests utility-scale quantum systems may arrive within 5 years rather than 20. Companies like Quantinuum are approaching fault-tolerant milestones, while PsiQuantum and QuEra are building infrastructure for million-qubit systems. However, timeline predictions remain speculative and depend on overcoming significant technical challenges in error correction and scalability.

How does quantum computing complement NVIDIA’s core AI and GPU business?

Quantum computing is increasingly viewed as complementary rather than competitive with AI and classical computing. Hybrid quantum-classical workflows require GPUs for error correction, optimization, pre-processing, and post-processing tasks. NVIDIA’s investments ensure its hardware and software platforms remain central to these emerging hybrid architectures.

What might NVentures invest in next?

Potential future investments include: superconducting qubit companies to complete modality coverage, quantum-classical integration software (compilers, workflow tools), utility-scale infrastructure projects, quantum networking and sensing technologies, and strategic acquisitions of companies with critical IP in areas like photonic integration or post-quantum cryptography.