Insider Brief

- SkyWater Technology identified quantum computing as its second-largest end market and forecast revenue growth of more than 30% in 2025.

- The company is expanding capabilities in superconducting films, interposers, and chip integration, while preparing to launch a superconducting design platform in the second half of the year.

- Executives said the Minnesota fab has been converted into a center of excellence for quantum development and that new customer engagements are underway to accelerate adoption.

SkyWater Technology is positioning itself as a critical U.S. hub for quantum computing and advanced semiconductor manufacturing, leveraging its recent $93 million acquisition of Infineon Technologies’ Fab 25 facility in Austin, Texas, to quadruple domestic production capacity and set the stage for growth in emerging deep-tech markets, such as quantum.

The Minnesota-based foundry reported second-quarter 2025 revenue of just over $59 million, at the upper end of its earlier forecast, with stronger-than-expected performance in its advanced technology services (ATS) segment driving an improved gross margin of 19.5%, according to the company’s earnings statement. Adjusted EBITDA reached $2.3 million, also ahead of expectations.

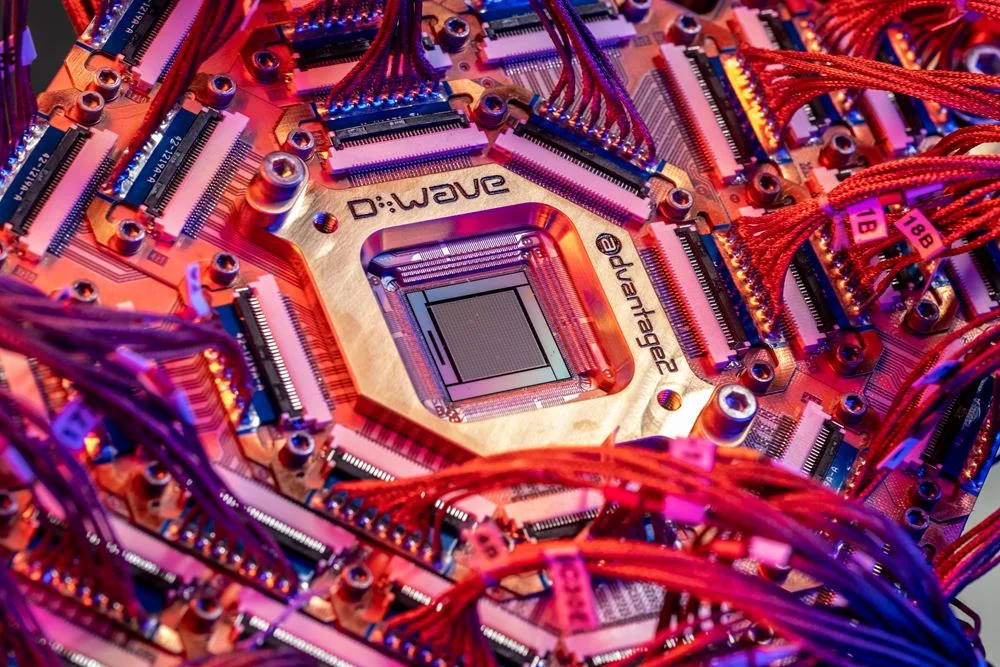

Executives described quantum computing as a central driver of SkyWater’s future revenue in an earnings call, projecting that the segment will expand by more than 30% this year. The company is developing components seen as essential to scaling quantum processors.

“As for the expected revenue trajectory ahead for SkyWater, there are multiple growth vectors to be excited about today,” Thomas J. Sonderman, CEO & Director, said during the earnings call. “The first is quantum computing. As we’ve been reporting for several quarters, we’re currently seeing strong momentum in quantum computing applications, a domain of growing strategic importance to both the economy and national security. We are building on a solid foundation in this space by expanding our capabilities in superconducting film development, interposers and chip operation enablement, all critical building blocks for scalable quantum systems.”

He added that its Minnesota fab has been transformed into a “center of excellence” for quantum technology development,

“Through targeted investments, SkyWater has transformed our legacy node fab in Minnesota into a high-value production capable asset that now serves as a center of excellence for quantum technology development,” Sonderman said, according to the transcript. “Since last quarter, we’ve made meaningful progress engaging with additional new quantum customers, further building upon our unique position as a trusted enabler of early-stage quantum solutions within a secure U.S.-based environment.”

The earnings call noted that SkyWater is working with additional new quantum customers beyond those already engaged in earlier quarters, highlighting its role as a domestic partner for early-stage quantum computing efforts. The company plans to launch a superconducting design platform in the second half of 2025, which it said will allow clients to accelerate quantum and supercomputing hardware development .

SkyWater’s quantum strategy is not confined to one approach. While superconducting qubits remain a focus, the company also collaborates with European startup SiQuantum, which is pursuing photonic quantum computing, and has indicated interest in ion-trap systems as another pathway under review. Executives said the firm’s chiplet and packaging capabilities provide flexibility to support multiple modalities as the quantum sector evolves.

Fab 25 Acquisition Boosts Scale and Security

The Fab 25 acquisition, finalized on June 30, marked what SkyWater called its first transformative deal. The $93 million purchase, funded entirely through a new $350 million credit facility, included a multiyear supply agreement with Infineon valued at more than $1 billion.

The Austin plant is capable of producing 200-millimeter wafers at the 65-nanometer scale, a node size considered mature but still crucial for defense, automotive, and industrial applications. With the addition, SkyWater said it has expanded its domestic 200-millimeter foundry capacity fourfold, making it the largest U.S.-based pure-play foundry operator in that segment. Executives said Fab 25 opens more than $300 million in annual revenue potential while meeting U.S. government and customer demand for secure, onshore manufacturing options.

SkyWater is also integrating Infineon’s high-voltage and copper interconnect intellectual property into its S130 platform. Management said this will enable quicker product transfers and allow customers to begin multi-project wafer runs in 2026, a key step toward scaling up quantum and other specialized chip designs.

Defense and Policy Pressures

While SkyWater’s commercial expansion is accelerating, the company acknowledged that its defense business continues to face near-term headwinds. Programs with the U.S. Department of Defense are operating at 2024 funding levels due to delays in federal appropriations. Executives said this has limited growth in government-backed projects for 2025, despite what they described as strong demand aligned with national security priorities .

The company emphasized that more than $5 billion worth of semiconductors used annually in U.S. defense applications are still sourced from China and Taiwan, a situation executives called a “clear vulnerability.” They noted that federal actions, including a Section 232 investigation into microelectronics imports and signals from the Commerce Department about a potential “Lighthouse” action plan, underscore Washington’s urgency to expand secure domestic chipmaking capacity .

SkyWater positioned itself as a key partner in this shift, citing its trusted foundry status and alignment with strategic government interests in microelectronics, quantum, artificial intelligence, missile defense, and hypersonics .

Short-Term Pressure, Long-Term Ambition

For the third quarter, SkyWater projected approximately $50 million in ATS revenue and $75 million to $80 million from Fab 25’s wafer services, with an additional $2 million to $3 million in tool sales. The company expects a consolidated gross margin of 11% to 14% in the period, pressured by $8 million to $10 million in non-cash depreciation from the Fab 25 purchase accounting adjustments.

Operating expenses for Q3 are projected between $18 million and $20 million, reflecting both modest organic expense growth and roughly $5 million per quarter in additional costs tied to the Austin fab. Interest expenses will add another $4.5 million to $5 million, according to the earnings statement. The company forecast a third-quarter net loss of 14 to 20 cents per share and adjusted EBITDA of $10 million to $12 million.

By the fourth quarter, SkyWater expects to reach a consolidated revenue run rate of roughly $140 million per quarter, with wafer services contributing in the mid-$80 million range and ATS in the mid-$50 million range. Management said that should translate into adjusted EBITDA margins of at least 10% heading into 2026.

Looking ahead, the company projected 2026 revenues of at least $600 million and adjusted EBITDA of $60 million or more. Executives pointed to anticipated growth in quantum computing services, expanded advanced packaging operations in Florida, and customer product transfers into Fab 25 as the major contributors to that trajectory.

“Beyond that, we’re executing across high-impact growth vectors,” said Sonderman. “ThermaView is modernizing defense

sensing platforms. Our quantum initiatives are advancing future state compute and our Florida-based advanced packaging operation is addressing one of the final integration gaps in U.S.-based chip production. These aren’t isolated wins, they’re components of a long-term infrastructure strategy. As we look towards 2026, SkyWater is emerging not just as a growth story, but as a strategic cornerstone in reshaping the U.S. semiconductor landscape, where national interest, customer demand and technology execution converge.”