Insider Brief

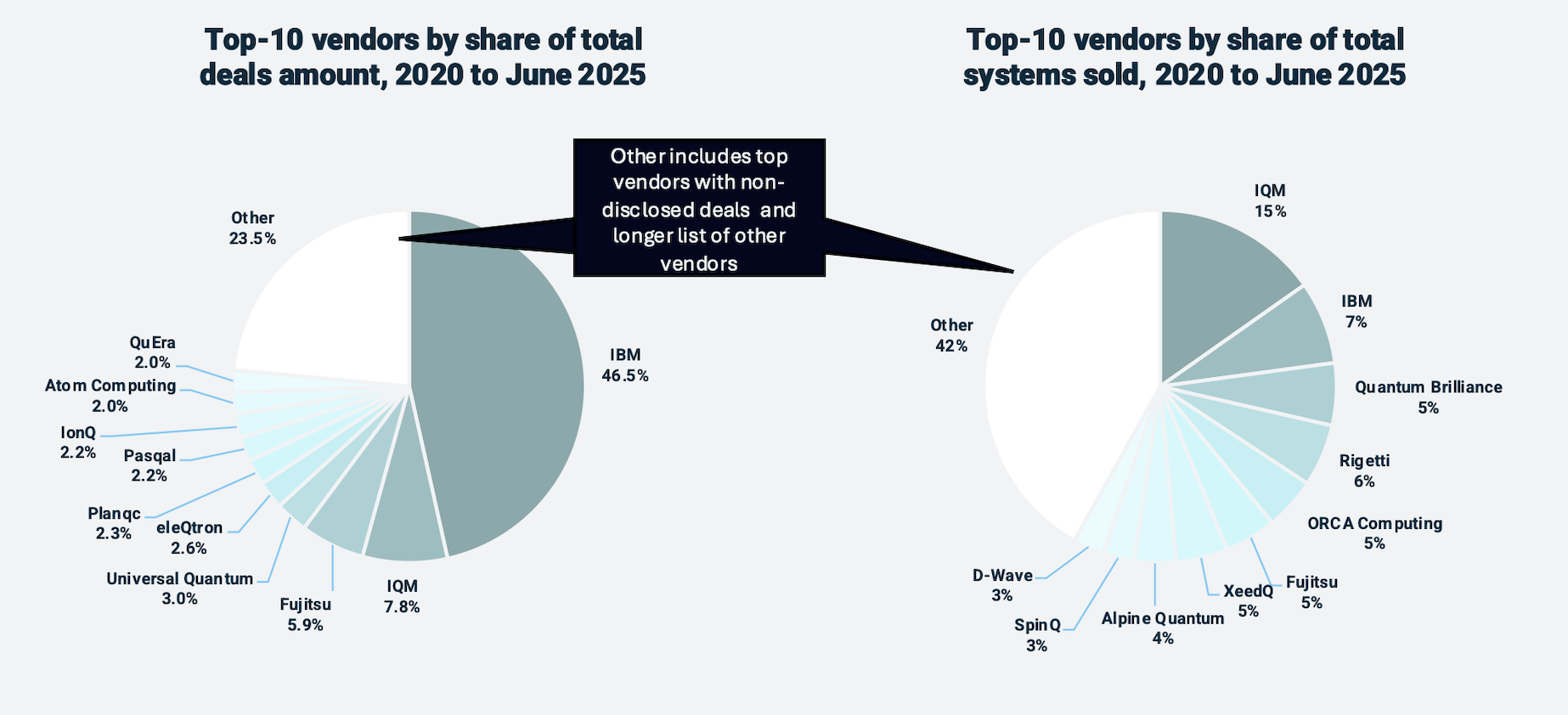

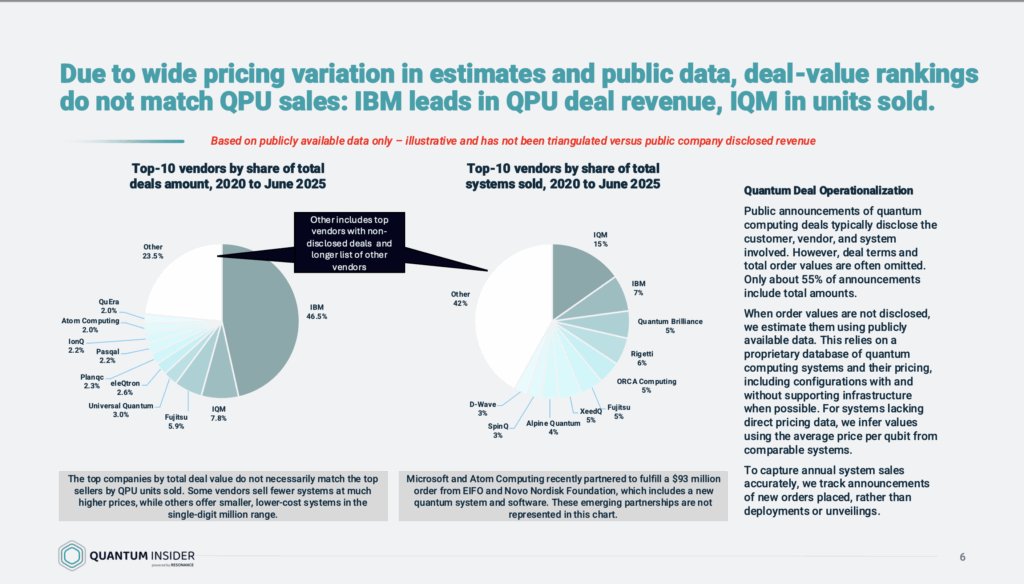

- IBM leads in disclosed global quantum computer deal value since 2020 with 47%, while IQM ranks first in system shipments at 15%, highlighting different sales strategies, according to information from The Quantum Insider’s 2025 Quantum Market Sizing Report.

- The market remains fragmented beyond these leaders, with vendors such as Fujitsu, Rigetti, ORCA Computing, Quantum Brilliance, and D-Wave capturing smaller shares in either volume or value.

- Significant opacity persists in quantum sales data, as many deals lack pricing disclosure and contracts often include bundled infrastructure, complicating apples-to-apples comparisons.

Although the initial figures of the global sales of quantum computers remain opaque, an essential piece of the puzzle in improving our understanding of the contours of this fast-emerging industry is beginning to shape. Questions remain, but this picture does offer some a glimpse of the new leaders in quantum sales.

According to a new analysis of publicly available data from The Quantum Insider’s Quantum Market Sizing Report, IBM has captured nearly half of global deal value for quantum processing units (QPUs) since 2020, while Finland’s IQM has sold the most systems by volume.

Between 2020 and June 2025, IBM accounted for 47% of disclosed deal value, ahead of rivals, according to the report. The company’s contracts, often tied to high-performance systems bundled with supporting infrastructure, put it in a revenue category of its own.

However, IQM leads on volume, shipping 15% of the world’s disclosed quantum systems, reflecting momentum selling its smaller systems internationally.

The gap offers evidence of a fundamental insight about the market: the quantum hardware is not yet commoditized, and price differences are vast. Some vendors sell fewer but far more expensive systems, while others move more devices at lower cost, focusing on delivering more compact, less expensive machines.

Market Fragmentation

Outside of IBM and IQM, the market appears to be relatively fragmented. The estimates suggest that Fujitsu, Rigetti, ORCA Computing, Quantum Brilliance and D-Wave all capture slices of unit sales but remain marginal in terms of overall deal value. Collectively, smaller vendors make up a significant portion of activity but lack the scale to crack the top spots.

Emerging partnerships are important in the emerging quantum industry, although this, too, can complicate the picture somewhat. Microsoft and Atom Computing, for example, recently announced a $93 million order from Denmark’s EIFO and the Novo Nordisk Foundation. That deal includes a new quantum system and software but does not yet appear in the rankings, highlighting how time lags and selective disclosure obscure the current state of play.

The divergence between deal value and unit volume could either reflect the idea that standard pricing has yet to form in the industry, or it is a glimpse of how selling strategies are shaping in the market. For example, as mentioned above, some vendors, like IBM, sell a small number of multi-million-dollar systems that include significant infrastructure and service layers. Others, like IQM, sell in the single-digit million-dollar range, targeting universities, startups, and research labs. That strategy boosts system counts but keeps revenue share modest.

This dynamic could reveal how companies are positioning themselves strategically. High-priced systems cater to government contracts and national initiatives, which seek flagship machines as symbols of technological sovereignty. Lower-priced offerings appeal to institutions looking to experiment with quantum algorithms, train researchers, and build ecosystems.

While both IBM and IQM favor the superconducting approach to quantum computing, it’s likely too early to draw any conclusions that this modality is becoming the preferred system. Because quantum computing systems were pioneered using the superconducting approach and many early developers learned on superconducting systems, the approach may have a jump on commercialization in these early days.

Apples to Apples?

Public announcements of quantum computing sales typically reveal who bought from whom, and in some cases the type of system involved. But full order values are disclosed only about half of the time, according to The Quantum Insider analysts. That leaves much of the field a little in the shadow. Vendors with undisclosed terms or fragmented sales account for 24% of total deal value and 42% of unit sales.

This highlights one of the core challenges with relying on public disclosures in quantum computing. IonQ, for example, is guiding to $82 million–$100 million in revenue for 2025, yet the company does not fully break down how much of this comes from system sales versus research contracts, cloud access, or government programs. D-Wave reported $18.1 million in the first half of 2025, implying a full-year range of $36 million–$41 million if trends persist, while Rigetti posted just $1.8 million in revenue for Q2 with no annual guidance. These figures are useful reference points, but they remain backward-looking and incomplete. By contrast, deal-value and unit-volume data provide an interesting transaction-level picture of activity. Taken together, the disparity underlines the opacity of quantum revenue reporting and the difficulty of benchmarking vendors with consistent, apples-to-apples metrics.

When pricing data is missing, analysts are left to make estimates based on comparable systems, inferred per-qubit pricing, or the limited number of published order values. Although that can move the estimates closer to ground truth, differences in how systems are configured – whether bundled with cryogenics, software, or service contracts – make apples-to-apples comparisons difficult.

What Does This Mean for Investors

There are a few key takeaways for investors, the analysts report.

First, there’s a standard investment narrative around quantum that the industry remains a distant prospect, with commercialization years – if not decades – away, depending on who you ask. But the data tells a different story. Quantum devices are already being sold at a steady pace, and the market is a highly competitive environment. Multiple vendors are competing for deals, offering systems at vastly different price points and targeting a range of customers, from national governments to research labs and private companies. What emerges is not a hypothetical future market, but a real, if still immature, competitive landscape where revenues and unit sales are beginning to show clear leaders.

Another key investor takeaway is that deal-value rankings do not necessarily reflect future market leadership. A company selling more systems may be better positioned to seed a broad user base and ecosystem, even if revenue lags in the near term. On the other hand, firms with outsized contracts may command headlines today but could face a narrower adoption base if they sell fewer machines overall.

While the industry waits for standardized disclosure of contract terms, system specifications and pricing, it is difficult to benchmark performance across vendors. The analysts relied on proprietary databases and inferred averages to mitigate the issues, but a margin for error remains.

Data Limitations

Standard limitations still apply and it’s important for investors to understand that this data is incomplete and the potential exists for some skew in the results.

The data, covering 2020 through June 2025, relies on announcements of new orders rather than system deployments or unveilings. That distinction matters: many announced systems are delivered years later, meaning revenue recognition and operational impact lag behind deal announcements.

In addition, because only a little over half of deals include pricing information, analysts must model the rest. For systems lacking direct pricing, values are estimated using average per-qubit pricing from comparable systems.

A Market in Flux

As quantum computing inches closer to commercialization, clarity on pricing and deal flow will be crucial for understanding who is actually building momentum.

However, as you might expect in a nascent market, the emerging quantum hardware market remains volatile. In the future we could see a number of scenarios shaping up. Leaders in deal value may not maintain their advantage if unit sales scale differently. Smaller players could break into the top ranks if they secure a few large contracts. And new partnerships, such as those involving Microsoft, could quickly change the landscape once reflected in the data.

To explore the full market model, sector insights, and data behind these projections, access the complete Quantum Market Sizing Report via The Quantum Insider’s Market Intelligence platform. You can read more about report highlights in The Quantum Insider.