Insider Brief

- Rigetti Computing raised $350 million through an at-the-market stock offering, bringing its total cash reserves to approximately $575 million with no outstanding debt.

- The funds will support expansion of Rigetti’s superconducting quantum hardware, internal manufacturing, and potential acquisitions or partnerships, according to a company news release.

- While the raise boosts financial flexibility, it may dilute existing shareholders and intensify pressure to demonstrate commercial progress amid uncertain near-term revenue.

PRESS RELEASE — Rigetti Computing has raised $350 million through a stock sale to fund its next phase of growth, giving the quantum computing firm a cash reserve of about $575 million with no outstanding debt.

The announcement, made through a company news release, represents a capital injection at a time when quantum firms are racing to convert scientific prototypes into commercially viable systems. The proceeds will help Rigetti expand its superconducting quantum hardware, invest in manufacturing and pursue potential deals with strategic partners.

According to the release, the equity raise was conducted under an at-the-market (ATM) offering, a mechanism that allows a public company to issue and sell shares over time rather than in a single offering. Rigetti had previously disclosed the ATM program but completed the full $350 million issuance in recent months.

With the new capital, Rigetti intends to support working capital needs, invest in capital expenditures and fund general corporate operations. It also will have its eyes on partnerships and acquisitions.

“Rigetti intends to use the proceeds from the offering primarily for working capital, capital expenditures and other general corporate purposes, and may also use a portion of the net proceeds to enter into strategic collaborations, acquisitions or partnerships in the future,” the release states.

Rigetti — a Quantum Pioneer

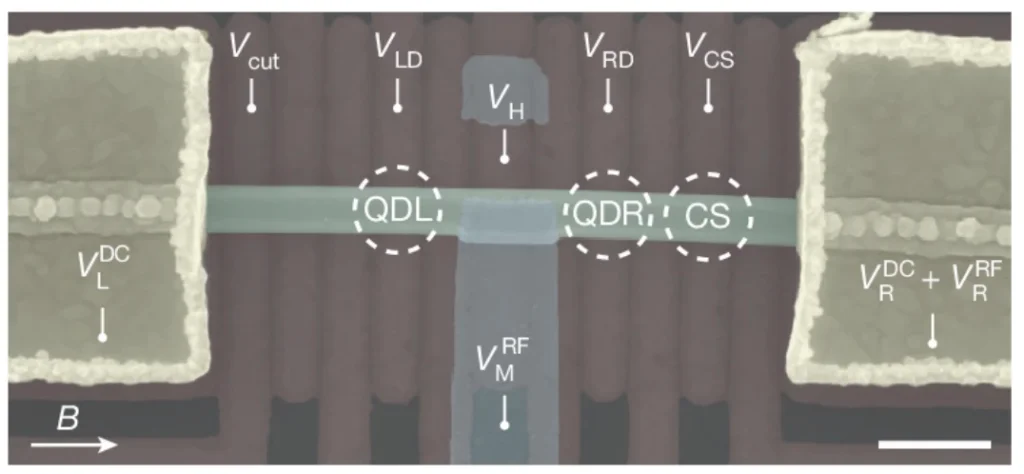

The company, which trades on Nasdaq under the ticker RGTI, has operated quantum systems over the cloud since 2017 and started selling on-premises systems in 2021. These systems, with qubit counts ranging from 24 to 84, have been adopted by national labs and dedicated quantum centers. The hardware uses superconducting gate-based qubits—a leading architecture in the quantum race—known for fast gate speeds but also requiring low-temperature environments and precise error correction techniques.

Rigetti’s recent product, the 9-qubit Novera QPU, was launched in 2023 to support academic and industrial researchers who want to integrate a high-performance quantum unit into existing cryogenic setups, according to the release. Unlike cloud-access systems, Novera is designed to be installed on-site, allowing for local experimentation, customization, and tighter integration into existing lab workflows.

Rigetti also designs and manufactures its own chips at Fab-1, a dedicated quantum device fabrication facility the company says is the first of its kind. This in-house capability may give it more control over supply chains, design iterations and intellectual property — factors that are increasingly important as companies shift from research prototypes to commercial systems.

Business Case for ATM Raises

The business case behind the funding includes that it offers Rigetti capital to stay competitive in a field marked by high R&D costs, long timelines and evolving customer demand. Governments, pharmaceutical firms,and financial institutions have shown growing interest in quantum solutions that could accelerate tasks like optimization, drug discovery, and risk modeling. But translating quantum science into actual commercial returns requires not only scientific progress but also infrastructure, talent and capital.

Raising funds through stock rather than debt reduces the company’s financial risk, especially in a capital-intensive field where near-term revenue is limited. The absence of debt also gives Rigetti flexibility to respond to changing market conditions or strategic opportunities without servicing interest payments.

Rigetti’s move suggests it aims to position itself as a long-term player with the balance sheet to match.

However, it’s important to note the potential downsides of ATM raises. Large equity raises like this can dilute existing shareholders’ stakes, potentially lowering the value of their holdings. Raising such a large sum without a clear path to near-term revenue may also heighten scrutiny over how efficiently the capital is deployed.