Insider Brief

- SEALSQ Corp announced a $20 million public offering through the sale of 10 million ordinary shares at $2.00 per share to institutional investors.

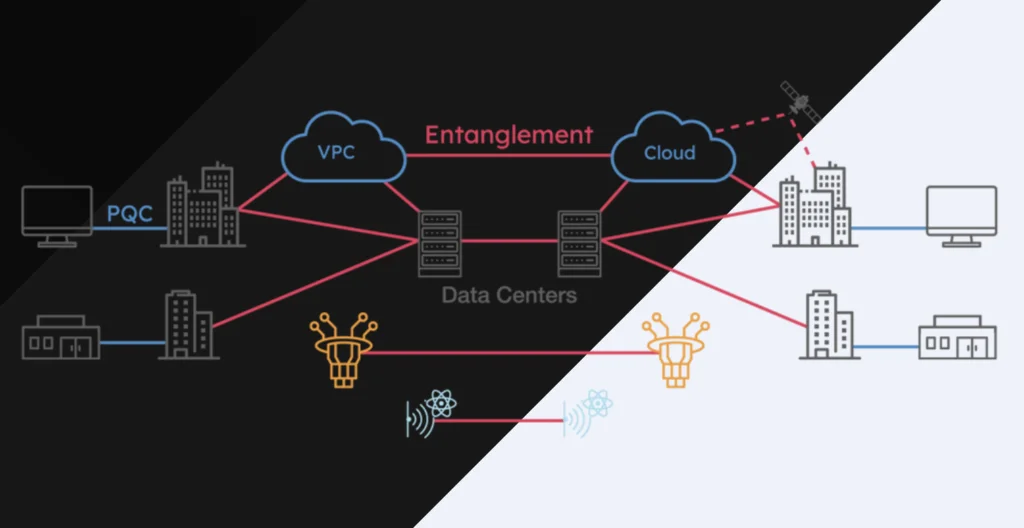

- The company plans to use the proceeds to fund its investment in the Quantix EdgeS joint venture, acquire IC ALPS, and advance post-quantum semiconductor and ASIC development in the U.S.

- Maxim Group LLC is serving as the sole placement agent, with the offering expected to close on or about May 6, 2025, pending customary conditions.

PRESS RELEASE — SEALSQ Corp (NASDAQ: LAES) (“SEALSQ” or “Company”), a company that focuses on developing and selling Semiconductors, PKI and Post-Quantum technology hardware and software products, today announced that it has entered into a securities purchase agreement with several institutional investors to purchase 10,000,000 ordinary shares at a public offering price of $2.00 per ordinary share, for gross proceeds of $20.0 million (the “Offering”), before deducting commissions and offering expenses.

Maxim Group LLC is acting as the sole placement agent for the Offering.

SEALSQ currently intends to utilize the net proceeds from the Offering to fund its planned strategic investment in the Quantix EdgeS joint venture, support the intended acquisition of IC ALPS, the continued deployment of its next-generation post-quantum semiconductor technology and ASIC capabilities in the United States and for general corporate purposes. The Offering is expected to close on or about May 6, 2025 (the “Closing Date”), subject to the satisfaction of customary closing conditions.

The Offering is being made pursuant to an effective shelf registration statement on Form F-3 (File No. 333-286098) previously filed with and subsequently declared effective by the U.S. Securities and Exchange Commission (“SEC”) on April 2, 2025. A prospectus supplement relating to the securities to be issued in the Offering will be filed by the Company with the SEC.