Insider Brief

- Quantum computing is moving from the lab to real-world applications, requiring a full ecosystem of developers, infrastructure providers, and enabling technologies beyond just advances in qubit design.

- The Quantum Insider’s Vendor Market Map categorizes key players across applications, software, quantum processors, and hardware components, reflecting the diversity and complexity of the growing quantum industry.

- While quantum applications are emerging in finance, pharmaceuticals, and logistics, widespread business adoption remains uncertain due to ongoing challenges in hardware scalability and software integration.

Quantum computing is moving from the lab into the real world, brought about by advances across hardware, software, and applications. But scaling quantum technologies requires more than just breakthroughs in qubit design and number – it demands a cohesive ecosystem of developers, infrastructure providers and enabling technologies.

There is simply no way the industry scales without these players.

The Quantum Insider’s High-Level Vendor Market Map offers a strategic overview of this evolving landscape, identifying key players across four core segments:

- Quantum Applications – Industry-specific solutions for finance, pharmaceuticals, logistics, and more.

- Software Offerings – Platforms, tools, and simulators for quantum programming and algorithm development.

- Quantum Processing Units (QPUs) – Superconducting, ion-trap, neutral atom, and photonic quantum hardware providers.

- Hardware Components – Cryogenics, lasers, and critical subsystems enabling quantum operations.

This map captures the diversity and complexity of the quantum market, but it represents only a fraction of the full ecosystem. The Quantum Insider actively tracks over 2,000 companies, providing market intelligence that goes beyond a single-page visualization.

| Company | Description |

|---|---|

| Multiverse Computing | Develops quantum-inspired algorithms for finance, energy optimization, and industrial use cases. |

| QC Ware | Builds enterprise-ready quantum algorithms and near-term quantum applications. |

| QuantFi | Applies quantum computing techniques to quantitative finance and risk modeling. |

| HQS Quantum Simulations | Specializes in quantum simulations for chemistry and materials science. |

| Qubit Pharmaceuticals | Uses quantum computing to accelerate drug discovery and molecular design. |

| ParityQC | Designs scalable quantum computing architectures and parallel execution models. |

| Horizon Quantum | Develops quantum software tools, compilers, and application workflows. |

| Classiq | Provides a high-level platform for automated quantum algorithm design and synthesis. |

| Q-CTRL | Develops quantum control and error suppression software for stable qubit operation. |

| Riverlane | Builds quantum error correction and control software infrastructure. |

| Quantum Machines | Provides quantum orchestration software and control hardware. |

| Aliro Quantum | Focuses on quantum networking and secure quantum communications. |

| BlueQubit | Offers cloud-based access to quantum processors and high-performance simulators. |

| AWS | Provides cloud-based access to quantum hardware through Amazon Braket. |

| Microsoft Azure | Offers Azure Quantum for cloud access to quantum computing resources. |

| Google Cloud | Delivers cloud access to Google Quantum AI hardware and simulators. |

| Atos | Develops hybrid high-performance and quantum computing platforms. |

| Fujitsu | Builds quantum-inspired digital annealing and optimization systems. |

| NVIDIA | Supports quantum workflows via GPU acceleration and CUDA Quantum. |

| IBM | Develops superconducting quantum computers and quantum-centric supercomputing systems. |

| Rigetti | Builds superconducting quantum processors and modular quantum architectures. |

| D-Wave | Specializes in quantum annealing systems for large-scale optimization problems. |

| IQM | European manufacturer of superconducting quantum processors. |

| Anyon Systems | Develops scalable superconducting quantum computing hardware. |

| Quantinuum | Builds trapped-ion quantum computers with integrated software stacks. |

| IonQ | Develops trapped-ion quantum computers for enterprise and cloud environments. |

| Alpine Quantum Technologies | Creates trapped-ion quantum systems for research and industry. |

| Pasqal | Builds neutral-atom quantum computers for industrial applications. |

| QuEra Computing | Develops large-scale neutral-atom quantum processors. |

| Intel | Develops silicon spin qubits using CMOS manufacturing techniques. |

| Diraq | Builds silicon-based quantum processors using donor qubits. |

| Quantum Motion | Develops scalable silicon quantum computing architectures. |

| PsiQuantum | Builds photonic quantum computers using silicon photonics technology. |

| Xanadu | Develops photonic quantum hardware and open-source quantum software. |

| Quandela | Provides photonic quantum processors and cloud-based quantum access. |

| Oxford Instruments | Supplies cryogenic systems for quantum computing hardware. |

| Bluefors | Provides dilution refrigerators for quantum systems. |

| FormFactor | Supplies cryogenic probing and testing solutions. |

| Toptica | Builds precision laser systems for quantum computing applications. |

| Coherent | Provides industrial and scientific laser technologies. |

| Qblox | Develops scalable quantum control electronics. |

| CryoCoax | Manufactures cryogenic cabling and interconnect solutions. |

How Are Quantum Applications Emerging Across Industries?

Quantum computing is not just an academic pursuit—it is beginning to solve real-world problems. While still in the early stages, quantum-powered applications are emerging across sectors:

- Finance – Risk modeling, portfolio optimization, and fraud detection.

- Pharmaceuticals – Drug discovery and molecular simulation.

- Supply Chain & Logistics – Route optimization and resource allocation.

- Materials Science – New materials design and energy storage innovations.

Key companies driving these applications include Multiverse Computing and QC Ware list financial applications among their strengths, while Qubit Pharmaceuticals and ProteinQure focus on quantum-powered drug discovery. Meanwhile, Aliro Quantum and ParityQC are tackling logistics and cryptography.

Despite these advances, quantum applications remain highly dependent on the underlying hardware. Until quantum processors achieve greater reliability and scalability, many of these solutions will operate as hybrid quantum-classical algorithms, running on quantum simulators and early-stage QPUs.

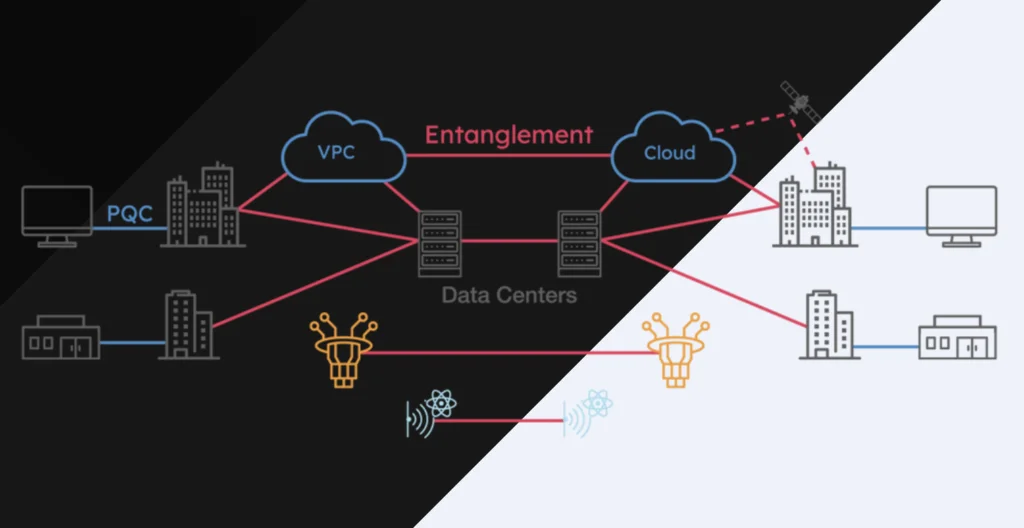

What Software Layer Connects Users to Quantum Computing Power?

Quantum computing’s complexity demands a robust software layer to bridge the gap between hardware and end users. This segment includes:

- Quantum Control & Error Mitigation – Ensuring stable, reliable qubit operations.

- Quantum Programming Platforms – Simplifying algorithm development.

- Cloud Access to QPUs – Providing remote access to quantum hardware.

- Quantum Simulators & Emulators – Allowing classical machines to mimic quantum behavior.

Key players in this space include Q-CTRL, Riverlane, and Quantinuum, which focus on quantum control software, while Classiq and StrangeWorks offer platforms for algorithm design. AWS, Azure, and Google Cloud provide direct cloud access to QPUs, democratizing quantum computing for enterprises and researchers.

What Quantum Hardware Architectures Are Competing for Market Leadership?

At the core of the quantum supply chain are Quantum Processing Units (QPUs), where companies are racing to develop scalable, fault-tolerant quantum computers. The market is divided into several competing architectures:

- Superconducting Qubits – IBM, Rigetti, D-Wave, Quantum Circuits, IQM, Anyon Systems

- Ion Traps – Quantinuum, IonQ, EleQtron, Alpine Quantum Technologies (AQT)

- Neutral Atoms – QuEra Computing, Infleqtion, Pasqal

- Silicon-Based Qubits – Diraq, Equal1, Quantum Motion

- Photonics-Based Qubits – PsiQuantum, Xanadu, Quandela, ORCA Computing

Each technology has strengths and weaknesses. Superconducting qubits currently lead in commercial adoption, with IBM’s Quantum Network providing the largest user base. Ion-trap and neutral-atom qubits offer better coherence times but face scalability challenges. Photonic quantum computing, backed by PsiQuantum and Xanadu, aims to leapfrog other methods with fiber-optic-compatible architectures.

No single approach has emerged as the clear winner. Most likely, different quantum hardware types will coexist in a hybrid computing ecosystem, much like today’s mix of CPUs, GPUs, and TPUs.

| QPU Architecture | Main Strength | Key Limitation |

|---|---|---|

| Superconducting Qubits | Fast gate speeds, ecosystem maturity | Cryogenic complexity |

| Ion Traps | High fidelity and coherence | Scaling and control complexity |

| Neutral Atoms | Natural scalability | Logical qubit implementation |

| Silicon-Based Qubits | CMOS compatibility | Early-stage architectures |

| Photonics | Fiber-optic compatibility | Manufacturing and integration challenges |

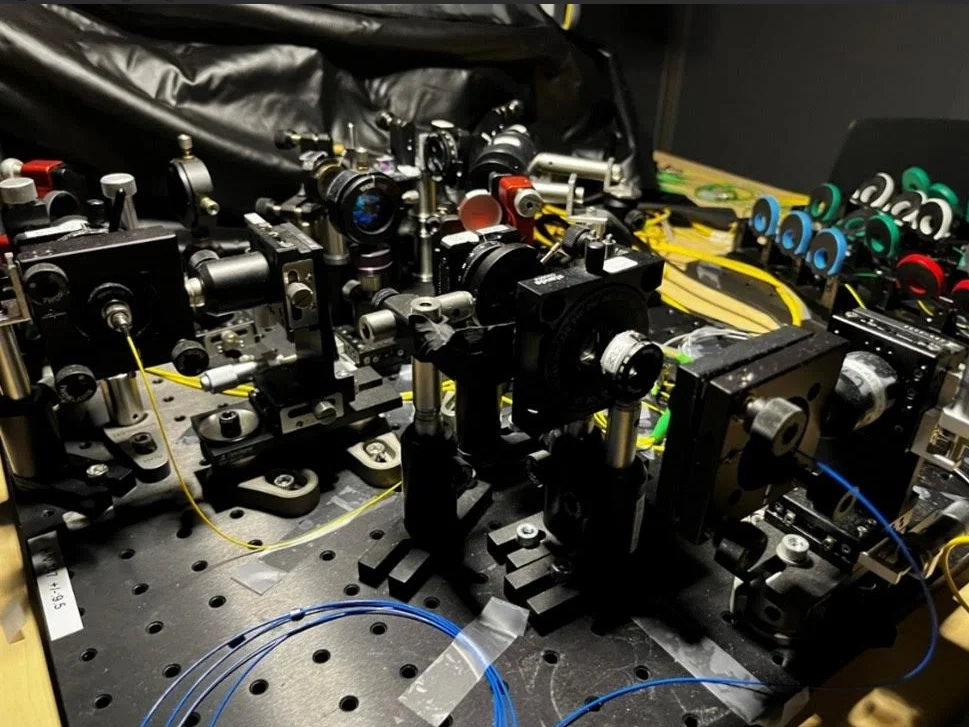

The Critical Role of Hardware Components

Quantum computing depends on a vast supply chain of specialized hardware components. Unlike classical computers, which rely on mature semiconductor manufacturing, quantum machines require cryogenics, precision lasers, and custom control electronics.

Key hardware suppliers include:

- Cryogenics & Testing – Oxford Instruments, Bluefors, ICE, FormFactor, Montana Instruments

- Lasers & Optics – Vescent, SEEQC, Toptica, Coherent, QANT

- Control Electronics & Signal Processing – Keysight Technologies, CryoCoax, Qblox, PIONIQ

Without these enabling technologies, quantum computers would remain theoretical constructs. Advances in cryogenics and control electronics are critical to improving qubit stability, coherence, and error rates—all essential for commercial-scale quantum computing.

| Supply Chain Area | Current Bottleneck | Impact on Commercialization |

|---|---|---|

| Cryogenics | Cost and scaling complexity | Limits large-scale deployment |

| Lasers & Optics | Precision and stability requirements | Affects qubit fidelity and uptime |

| Control Electronics | Latency and signal noise | Constrains error correction performance |

What Does Market Growth Look Like for Quantum Computing?

Despite the technical hurdles, quantum computing investment is accelerating. Governments, defense agencies, and private-sector leaders are betting that quantum advantage will unlock economic and strategic benefits over the next decade.

Investment Growth – Quantum funding has surged, with over $30 billion in global public and private investment.

Market Expansion – The quantum industry is projected to reach $100 billion+ by 2040, driven by advancements in hardware and enterprise adoption.

Government Funding – The U.S., China, and the EU are leading national quantum initiatives, ensuring quantum technology remains a geopolitical priority.

However, commercialization remains a challenge. Widespread business adoption of quantum computing is unlikely before 2035, as hardware scalability and software integration remain key obstacles.

The Road Ahead: Strategic Considerations for Investors and Enterprises

For businesses evaluating quantum opportunities, key factors to consider include:

- Technology Maturity – Which quantum architectures will scale first?

- Market Timing – When will industries transition from quantum R&D to production use cases?

- Ecosystem Partnerships – How will hybrid quantum-classical computing evolve?

While the industry is still early-stage, forward-thinking companies are positioning themselves to capture first-mover advantage. Those investing now—whether through direct funding, research partnerships, or ecosystem development—will be best positioned to capitalize on quantum computing’s inevitable breakthroughs.

How Can You Access Comprehensive Quantum Market Intelligence?

The Quantum Insider’s Intelligence Platform provides deeper insights, including detailed competitor analysis, technology roadmaps, and investment tracking.

Get instant access to the latest quantum market intelligence.

Want a preview of the full report? Contact our team here.

Unlike static reports, our intelligence is continuously updated, tracking over 2,000 companies across the quantum supply chain. Whether you’re an investor, enterprise leader, or technology strategist, staying informed is critical to navigating this rapidly evolving sector.

Subscribe now and stay ahead in the quantum revolution.

Frequently Asked Questions

What is the quantum supply chain?

The quantum supply chain encompasses four interconnected layers: (1) Quantum applications solving industry-specific problems, (2) Software platforms connecting users to quantum hardware, (3) Quantum Processing Units (QPUs) providing the core computational power, and (4) Hardware components like cryogenics, lasers, and control electronics that enable quantum operations. Over 2,000 companies globally participate across these segments.

Which industries will adopt quantum computing first?

Finance, pharmaceuticals, logistics, and materials science are leading early adoption. Financial institutions use quantum for portfolio optimization and risk modeling, pharmaceutical companies leverage quantum for drug discovery and molecular simulation, logistics firms deploy quantum annealing for route optimization, and materials scientists use quantum to design new materials and catalysts. These industries combine high computational needs with tolerance for early-stage technology limitations.

What is hybrid quantum-classical computing?

Hybrid quantum-classical computing combines quantum processors for specific subroutines with classical computers for problem setup, error mitigation, and result verification. This approach dominates current quantum applications because existing quantum hardware lacks the reliability and scale for standalone operation. Hybrid systems deliver incremental value today while the industry develops fault-tolerant quantum computers expected in the late 2020s and early 2030s.

Why are there so many different quantum hardware approaches?

Five major quantum architectures—superconducting qubits, ion traps, neutral atoms, silicon qubits, and photonics—each offer different tradeoffs between gate speed, coherence time, scalability, operating temperature, and manufacturing complexity. No single approach has proven superior across all metrics, leading companies to pursue different technologies. Most experts predict multiple architectures will coexist, optimized for different applications, similar to how classical computing uses CPUs, GPUs, and TPUs for different workloads.

When will quantum computing become commercially viable?

The timeline varies by application and definition of “commercially viable.” D-Wave delivers commercial value today for specific optimization problems using quantum annealing. Broader commercial adoption for chemistry simulation, drug discovery, and cryptography-related applications is projected for 2030-2035, pending hardware improvements in error correction, qubit counts, and gate fidelity. Widespread enterprise adoption beyond pilot programs likely won’t occur until 2035 or later.

How much is being invested in quantum computing?

Over $30 billion in global public and private investment has flowed into quantum computing, with major contributions from the U.S. government ($1.2+ billion through the National Quantum Initiative), China (estimated $15+ billion), and the EU (€1 billion through the Quantum Flagship program). Private venture capital and corporate strategic investment add billions more annually. The market is projected to reach $100+ billion by 2040.

What skills are needed to work in quantum computing?

Quantum computing requires interdisciplinary expertise combining quantum physics, computer science, electrical engineering, and mathematics. Specific roles include quantum algorithm developers (physics + programming), quantum error correction specialists (mathematics + quantum mechanics), quantum hardware engineers (electrical engineering + cryogenics), and quantum application developers (domain expertise + quantum computing knowledge). The skills gap represents a major industry bottleneck, with universities and companies racing to train quantum-ready workforces.

Should my company invest in quantum computing now?

The answer depends on your industry, resources, and risk tolerance. Companies in finance, pharmaceuticals, logistics, and materials science should start quantum readiness programs now—experimenting with cloud-based quantum systems, training technical teams, and identifying potential use cases. Organizations in other sectors can monitor developments but may reasonably wait until hardware matures. However, first-mover advantage accrues to those who build quantum capabilities during the development phase rather than waiting for full commercialization, making early strategic investment worthwhile for competitive positioning even if immediate ROI remains limited.

How do I stay current on quantum computing developments?

The quantum computing industry evolves rapidly, with major announcements weekly. The Quantum Insider’s Intelligence Platform provides continuously updated tracking of 2,000+ companies, funding rounds, technology partnerships, and market trends. Academic preprint servers like arXiv publish cutting-edge research, quantum computing conferences showcase emerging developments, and major hardware providers (IBM, Google, Microsoft) publish roadmap updates regularly. Staying informed requires dedicated monitoring rather than periodic report reviews given the pace of change.