Insider Brief

- Horizon Quantum Computing plans to go public through a merger with dMY Squared Technology Group in a deal valuing the company at approximately $500 million.

- The Singapore-based firm develops software tools to simplify quantum computing, aiming to create a common software platform across different quantum hardware systems.

- The proposed merger is at an early stage, with a definitive agreement expected in the second quarter and a closing anticipated by year-end, pending regulatory and shareholder approvals.

Horizon Quantum Computing plans to go public through a merger with dMY Squared Technology Group, a publicly traded special-purpose acquisition company, the companies said Monday in a statement. The deal, still in early stages, values Horizon Quantum at roughly $500 million.

“We are excited to partner with the dMY team because of their experience in enterprise hardware and software as well as their success as pioneers in the quantum computing industry,” said Dr. Fitzsimons, Founder and CEO of Horizon Quantum. “While quantum hardware continues to advance, the true revolution lies in enabling users to harness these powerful systems for solving real-world challenges. The ‘applications bottleneck’ represents a critical barrier between quantum computing’s theoretical promise and practical impact — one that our team is committed to breaking through.”

The Singapore-based company develops software tools aimed at simplifying quantum computing, an emerging field that promises immense processing power but remains difficult to program. Horizon Quantum says its technology could serve as the foundation for a future quantum operating system, similar to how Windows and DOS transformed classical computing.

The merger would give Horizon Quantum access to public markets and additional capital as it works to develop software that can run across different quantum computing platforms. If the deal goes through, Horizon Quantum’s current management will continue to lead the company, with Fitzsimons as CEO.

Harry You, Chairman of dMY Squared, said, “Quantum computing application development addresses the critical gap between advancing hardware capabilities and real-world implementation. We could not be more pleased and excited to work with Joe and his team at Horizon Quantum, who are working to create a common software platform across different quantum computing hardware approaches.”

You’s company, dMY Squared Technology Group, is a special-purpose acquisition company (SPAC), a type of holding company that allows companies to go public without going through a traditional IPO.

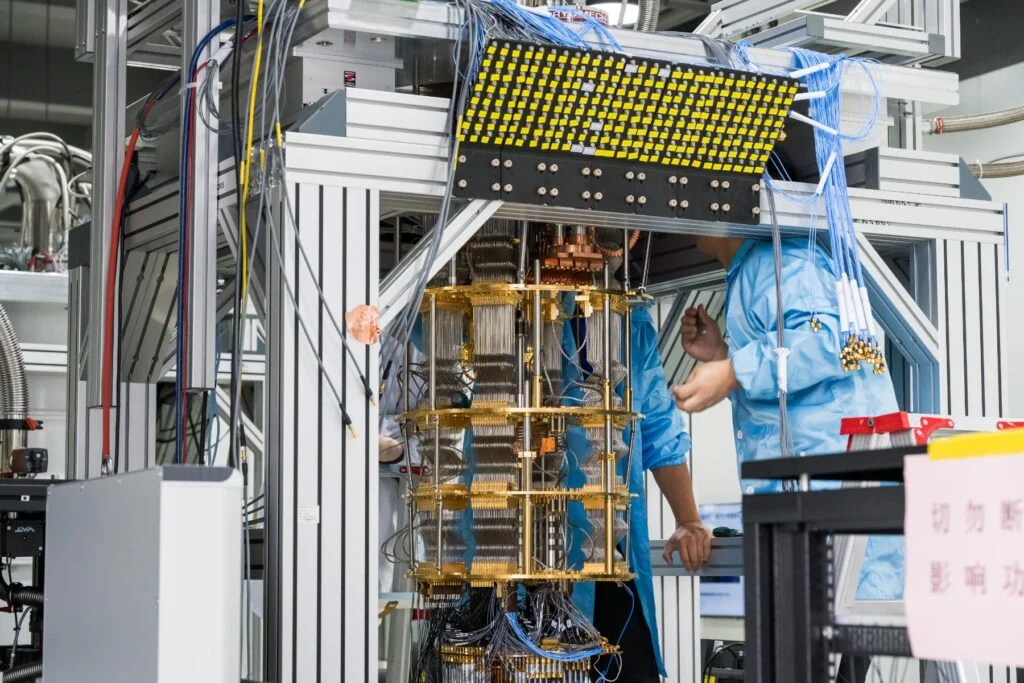

Quantum computers rely on the principles of quantum mechanics to process information in ways that traditional computers cannot. While hardware development has made progress, practical applications remain limited due to the complexity of programming these systems. Horizon Quantum’s software aims to bridge that gap by making it easier for developers to write code for quantum machines.

The proposed merger is structured as a non-binding letter of intent, meaning it is not yet final. Both companies expect to sign a definitive agreement in the second quarter of this year, with a closing anticipated before the end of the year.

The transaction is subject to due diligence, regulatory approvals, and shareholder votes. If completed, the combined company would be publicly listed, though the companies have not yet disclosed which stock exchange they intend to trade on.

A newly formed holding company would file a registration statement with the U.S. Securities and Exchange Commission, including a proxy statement for dMY’s shareholders. Investors will be able to review these documents for more details once they become available.

Horizon Quantum was founded by Fitzsimons, a former tenured professor in Singapore known for his research in quantum computing. He co-invented universal blind quantum computing, a method for securing cloud-based quantum operations, and has published over 60 peer-reviewed articles.

The deal may reflect growing interest in quantum computing, with companies and investors betting that advances in the technology will eventually yield commercial breakthroughs. While major tech firms like IBM and Google are developing quantum hardware, companies like Horizon Quantum are working to ensure that these machines can be programmed for practical use.

If the business combination proceeds as planned, it would be one of the latest quantum computing firms to enter public markets. Other companies in the sector, including IonQ and Rigetti Computing, have gone public through SPAC mergers in recent years, though some have faced challenges in meeting growth expectations.

There should be some level-setting. Neither Horizon Quantum nor dMY can guarantee that the deal will close, and both companies caution that negotiations could fall through. If a definitive agreement is reached, investors will be able to review filings with the SEC for further details.