Insider Brief

- Quantum computers could potentially break current blockchain encryption, risking billions in cryptocurrency assets, according to a quantum policy expert.

- Quantum-resistant cryptography and quantum random-number generators are emerging as vital solutions to protect blockchain networks from quantum attacks.

- Companies are already developing quantum-secure blockchain technologies to counter these future threats.

Cryptocurrencies are maturing.

Quantum computing is maturing.

Both crypto and quantum are earning attention from Presidential candidates and global policymakers, eager to tap into both the power of these new technologies, as well as the extensive communities of advocates.

When Blockchain Meets Quantum Computing

Taken separately, practitioners of those fields may be excited about this developments. However, the two deep techs are on a collision course.

Quantum computing is poised to disrupt a wide range of industries, and the world of cryptocurrencies is no exception, points out Arthur Herman in a recent op-ed in the Korea Herald. Herman, Senior Fellow at the Hudson Institute and Director of the Quantum Alliance Initiative, writes that the same technology that could unlock immense computational power might also render existing cryptographic systems, including those that secure blockchain networks, vulnerable to attacks.

This alarming possibility, he argues, should be a wake-up call for the cryptocurrency industry and for anyone relying on blockchain technology.

Can Quantum Computing Break Blockchain?

Herman’s analysis highlights the inherent risks quantum computing poses to blockchain and cryptocurrencies. Currently, blockchain relies on Distributed Ledger Technology (DLT), a form of decentralized encryption that allows for secure, anonymous transactions.

“Cryptocurrencies prefer to use blockchain or DLT because it allows all parties to track, verify, and agree upon transactions, even as individual participants remain anonymous,” Herman explains in the piece.

While critics like to diminish cryptocurrency and blockchain as merely tools for speculation, other experts disagree seeing the technology that could empower entirely new economies and business models.

Chris Dixon, a General Partner at Andreessen Horowitz, who leads a16z crypto, which invests in web3 technologies, writes that blockchain has spawned two cultures: the computer and the casino.

Dixon writes: Two distinct cultures are interested in blockchains. The first sees blockchains as a way to build new networks. I call this culture the computer because, at its core, it’s about blockchains powering a new computing movement. The other culture is mainly interested in speculation and money-making. Those of this mindset see blockchains solely as a way to create new tokens for trading. I call this culture the casino because, at its core, it’s really just about gambling.”

Herman points out that large corporates are among the advocates in the computer culture camp.

“Microsoft, Walmart and JPMorgan are already starting to deploy their own private blockchain networks in which only partners, suppliers or customers are allowed to participate, while delivering thousands of transactions per second,” he writes.

The Quantum Threat to Blockchain Security

However, as quantum computers become more advanced, the encryption methods that protect these transactions may become obsolete. Herman points out that traditional cryptographic methods, including the widely used Elliptic Curve Cryptography (ECC), could be easily cracked by quantum algorithms like Shor’s algorithm.

“In short, blockchains that use the same cryptographic building blocks as other forms of DLT will be just as much at risk to the quantum computer threat as other digital technologies,” Herman writes.

The potential fallout from such a scenario could be catastrophic. According to a study conducted by the Quantum Alliance Initiative, a successful quantum attack on Bitcoin alone could lead to a loss of at least $3 trillion, a blow that would send shockwaves through the global economy.

Herman warns, “The real danger regarding the future of blockchain is that it’s used to build critical digital infrastructures before this serious security vulnerability has been fully investigated. Imagine a major insurance company putting at great expense all its customers into a blockchain-based network, and then three years later having to rip it all out to install a quantum-secure network, in its place.”

Quantum-Resistant Blockchain Solutions

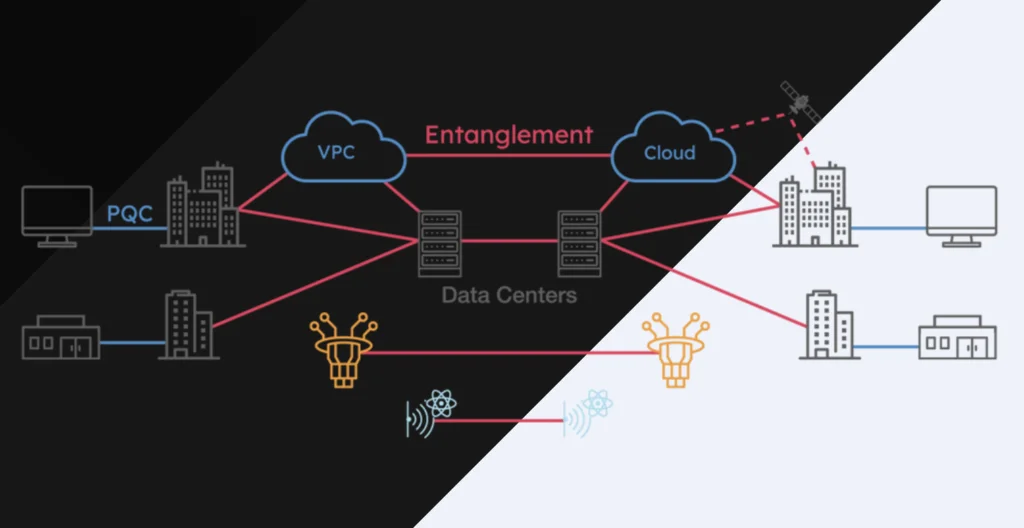

Despite the bleak outlook, Herman offers a solution that lies within the very technology posing the threat. Quantum cryptography, particularly quantum random-number generators and quantum-resistant algorithms, could provide the necessary safeguards to protect blockchain networks from quantum attacks.

“Quantum random-number generators are already being implemented today by banks, governments, and private cloud carriers. Adding quantum keys to blockchain software, and to all encrypted data, will provide unhackable security against both a classical computer and a quantum computer,” he notes.

Moreover, the U.S. National Institute of Standards and Technology (NIST) has stepped in to address the issue by releasing standards for post-quantum cryptography. These quantum-resistant algorithms are designed to withstand attacks from quantum computers, making them a crucial component in the next generation of blockchain security.

“Just as asymmetric encryption uses difficult math problems to stump classical computers, post-quantum cryptography uses difficult math problems to stump a quantum computer,” Herman explains.

The transition to quantum-resistant blockchain systems has already begun. Herman cites the example of Quantum Resistant Ledger, a U.K.-based company led by Dr. Peter Waterland, which is working on developing DLT systems that can withstand quantum attacks. Efforts like this suggest a broader shift towards securing digital assets against the looming quantum threat.

Looking ahead, Herman suggests that a coordinated approach integrating crypto, blockchain and quantum technologies could inaugurate a new era in finance and digital security.