Insider Brief

- Honeywell is considering an initial public offering for Quantinuum, reportedly valuing the company at $10 billion.

- Honeywell has an approximate 54 percent ownership stake of Quantinuum.

- The news is preliminary and based on a report from Bloomberg News that cites insiders close to the deal as the story’s sources.

- Image: Quantinuum’s H2 Chip

Honeywell International Inc. is contemplating an initial public offering (IPO) for its majority-owned quantum computing subsidiary, Quantinuum, potentially as early as next year, Bloomberg News is reporting.

The firm has reportedly initiated discussions with several investment banks regarding a potential listing in the United States and may pursue a valuation around $10 billion, according to Bloomberg News, citing people close to the potential deal.

Quantinuum was established in 2021 through the merger of Cambridge Quantum and Honeywell Quantum Solutions. It is arguably the largest full-stack, pure play quantum company, employing approximately 500 individuals across its offices in the United States, the United Kingdom, Germany and Japan.

Honeywell is considered the largest shareholder with an approximately 54 percent ownership stake of Quantinuum. Ilyas Khan, founder and Chief Product Officer of Quantinuum, is reportedly the second largest shareholder with an approximate 23% holding as of 2021. Other shareholders include IBM and JSR Corp from Japan.

Nod of Market Approval?

Bloomberg reports that following news of the possible IPO, Honeywell shares experienced a significant surge, climbing up to 2.6% on Friday. This would be the largest intraday increase since early June, the financial news service adds. Honeywell’s current market value is set at roughly $133 billion.

In January, Honeywell successfully concluded a $300 million funding round for Quantinuum, achieving a pre-money valuation of $5 billion. The fundraising was led by JPMorgan Chase & Co., with participation from Mitsui & Co. and Amgen Inc. This investment round brought Quantinuum’s total fundraising to approximately $625 million since its inception.

Quantinuum’s technology uses the properties of quantum mechanics and, specifically, relies on the trapped-ion approach to performing useful calculations with complex and delicate quantum states. Quantinuum’s H-Series technology, part of their advanced quantum computers, has achieved high-fidelity quantum operations and enhanced error correction. Designed with a modular approach, the H-Series boasts a high quantum volume, indicating it has an inherent advanced capability to solve complex problems.

This spring, Microsoft and Quantinuum scientists demonstrated the most reliable logical qubits ever recorded, conducting over 14,000 error-free experiments using Quantinuum’s ion-trap quantum hardware and Microsoft’s qubit-virtualization system for error diagnostics and correction. Scientists from both companies suggested at the time that the experiment marked an important step out of the current Noisy Intermediate-Scale Quantum (NISQ) era.

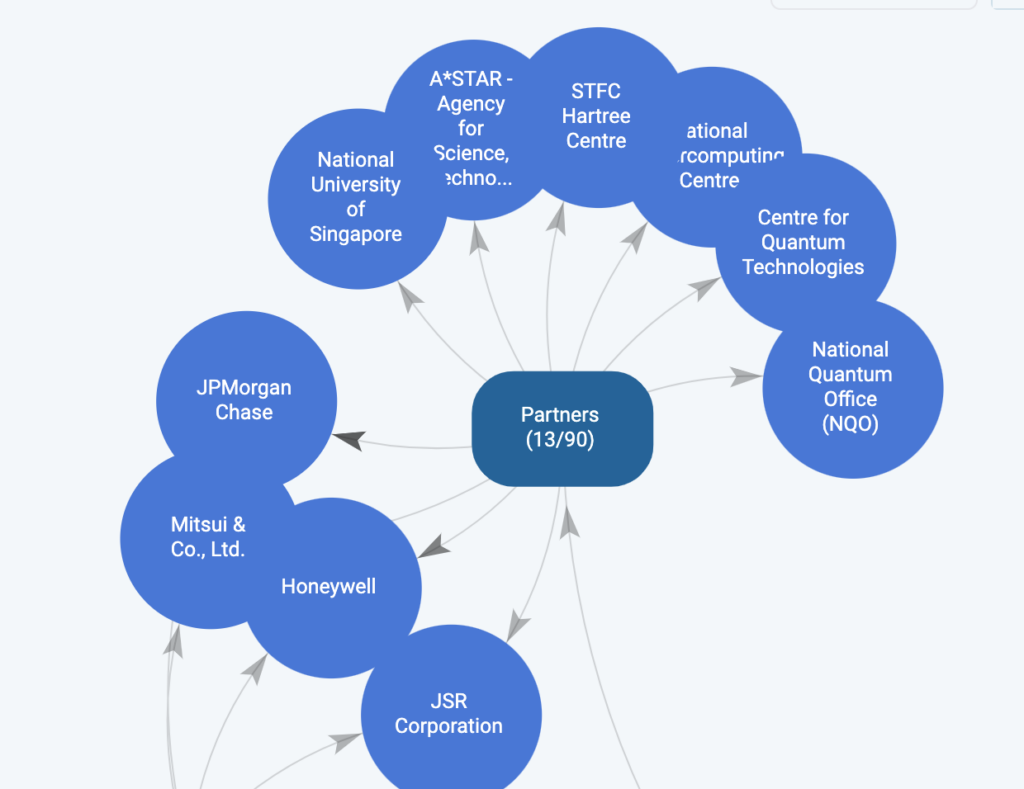

The Microsoft partnership is just one of many academic and industrial partnerships that Quantinuum has forged in its short, but highly productive history. The Quantum Insider’s Intelligence Platform reports at least 90 of Quantinuum’s partnerships. Amgen, Mitsui & Co, JPMorgan Chase and the University of Cambridge are among the company’s sprawling list of international collaborators.

Larger Ramifications

To speculate a bit, an IPO would obviously mark a significant milestone for Quantinuum but also likely be an inflection point in the interest and investment in quantum computing technology in general. This potential listing could raise awareness that could pave the way for further advances and commercial applications in quantum.

If Quantinuum’s reported $10 billion valuation figure — double its current estimated valuation — holds, there may be a ripple effect of recalibrated valuations throughout the quantum technology industry.

What Happens Now?

The discussions concerning the IPO would still in preliminary stages, and the specifics of the plan are subject to change. Representatives from Honeywell and Quantinuum declined to comment on the matter. Recognizing this is extremely preliminary in the IPO process, then, it might be good to explore what the possible next steps would be for Honeywell.

Recognizing that discussions concerning the IPO are still in preliminary stages, and that Bloomberg News said representatives from Honeywell and Quantinuum declined to comment on the matter, the initial next step in the process would probably involve formalizing these discussions with investment banks to finalize the underwriting team. Then, the teams would need to prepare detailed financial disclosures and file an S-1 registration statement with the U.S. Securities and Exchange Commission (SEC).

Following this, Quantinuum would embark on a roadshow to pitch the company to potential investors, highlighting its technological advancements and market potential. During that roadshow, Quantinuum would likely lean heavily into recent advances, such as the company’s logical qubit research with Microsoft, to emphasize its position as a leader in quantum computing innovation.

The length of the IPO process varies, but it usually takes between six months and a year, recognizing that not all IPOs successfully make it to market. However, based on that timeline and depending on how far along Honeywell is on its decision-making process, a Quantinuum IPO could occur as early as early or mid 2025.