Insider Brief

- IonQ recognized revenue of $5.5 million for the second quarter, 111% growth compared to the same period last year.

- Company executives report IonQ intends to achieve a 64 algorithmic qubit-system by the end of 2025.

- Critical Quote: “We are now well on our way to our revised, higher bookings expectations of $49 million to $56 million for the year. We are also within striking range of our goal of $100 million in cumulative bookings within the first three years of IonQ’s commercialization, starting in 2021.” — Peter Chapman, President and CEO of IonQ

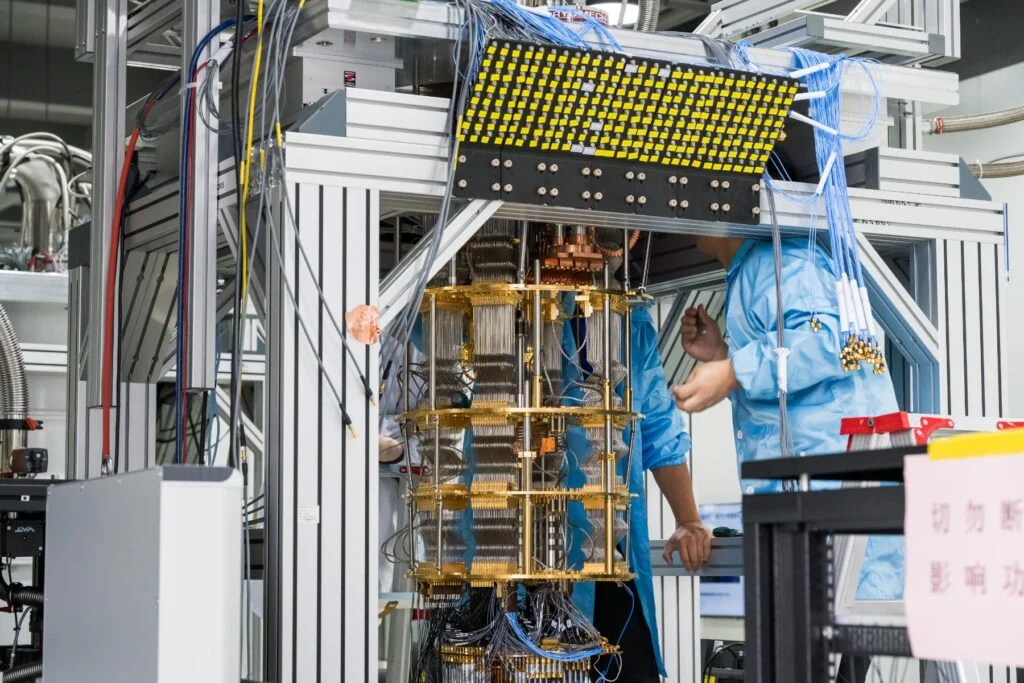

PRESS RELEASE — IonQ (NYSE: IONQ), a leader in the quantum computing industry, today announced financial results for the quarter ended June 30, 2023.

“This was another landmark quarter for IonQ, most notably with a record-setting $28 million in bookings, bringing the total to over $32 million in the first half,” said Peter Chapman, President and CEO of IonQ. “We are now well on our way to our revised, higher bookings expectations of $49 million to $56 million for the year. We are also within striking range of our goal of $100 million in cumulative bookings within the first three years of IonQ’s commercialization, starting in 2021.”

“Our impressive second quarter results come on the heels of us achieving our 2023 technical target of 29 algorithmic qubits (#AQ) seven months early. As our path to #AQ 64 and quantum advantage comes into clearer focus, we have seen both public and private institutions investing not just in our current Forte platform, but in IonQ’s technical roadmap. Our track record of success is beginning to speak for itself in the public markets, and we are relentlessly focused on bringing broad quantum advantage to all our customers.”

Second Quarter 2023 Financial Highlights

- IonQ recognized revenue of $5.5 million for the second quarter, which is above the high end of the previously provided range, and represents 111% growth compared to $2.6 million in the prior year period. This reflects some progress for one of IonQ’s customer contracts taking place earlier than expected, shifting revenue into the second quarter.

- IonQ achieved $28.0 million in new bookings for the second quarter, and $32.2 million year-to-date.

- Cash, cash equivalents and investments were $509.2 million as of June 30, 2023.

- Net loss was $43.7 million and Adjusted EBITDA loss was $19.4 million for the second quarter.* Exclusions from Adjusted EBITDA include a non-cash loss of $15.5 million related to the change in the fair value of IonQ’s warrant liabilities.

*Adjusted EBITDA is a non-GAAP financial measure defined under “Non-GAAP Financial Measures,” and is reconciled to net loss, its closest comparable GAAP measure, at the end of this release.

Commercial Highlights

- IonQ and QuantumBasel partnered to jointly establish a European quantum data center, which will be the future home of IonQ systems capable of up to #AQ 35 and #AQ 64.

- IonQ signed a memorandum of understanding with South Korea’s Ministry of Science and ICT to become a core provider of education for Korean students, researchers, and industry professionals. IonQ also met with South Korea’s President, Yoon Suk Yeol, to discuss how IonQ quantum computing can help accelerate the nation’s economy.

- IonQ Forte access was expanded to all IonQ direct access customers, offering the power of #AQ 29 to developers around the world. IonQ recently published benchmarks validating IonQ Forte’s #AQ 29 performance level.

Technical Highlights

- IonQ published a manuscript with Oak Ridge National Laboratory on modeling the molecular structure of the benzene molecule, commonly used as an industrial solvent and as a benchmark to evaluate quantum chemistry algorithms. IonQ believes this represents the most accurate benzene model run on a quantum computer to date.

- IonQ intends to achieve an #AQ 64 system by the end of 2025. The company believes that with that #AQ milestone, its systems will deliver quantum advantage for certain use cases and classical computers will no longer be able to fully simulate an IonQ system.

- IonQ expects to share a more detailed technical roadmap and upcoming product specifications at Quantum World Congress on September 27th, which will be live-streamed for all who are interested in learning more about accessing IonQ’s upcoming systems.

2023 Financial Outlook

- For the full year 2023, IonQ is increasing its revenue outlook range to $18.9 million to $19.3 million.

- For the third quarter of 2023, IonQ is expecting revenue of between $4.8 million and $5.2 million.

- For the full year 2023, IonQ is increasing its bookings expectation range again to between $49 million to $56 million, projecting more than 100% growth in bookings year-over-year at the midpoint.

- Seeing increased demand for its systems, IonQ hopes to sell a number of systems over the next 18 months, in various configurations based on customer needs. The Company’s guidance for this year is a probability weighted average of its pipeline, which already accounts for the 2023 portion of these potential sales.