Insider Brief

- IQ Capital has successfully raised $400 million (£320 million) across two funds.

- The firm is a deep tech-focused venture capital firm with offices in London and Cambridge.

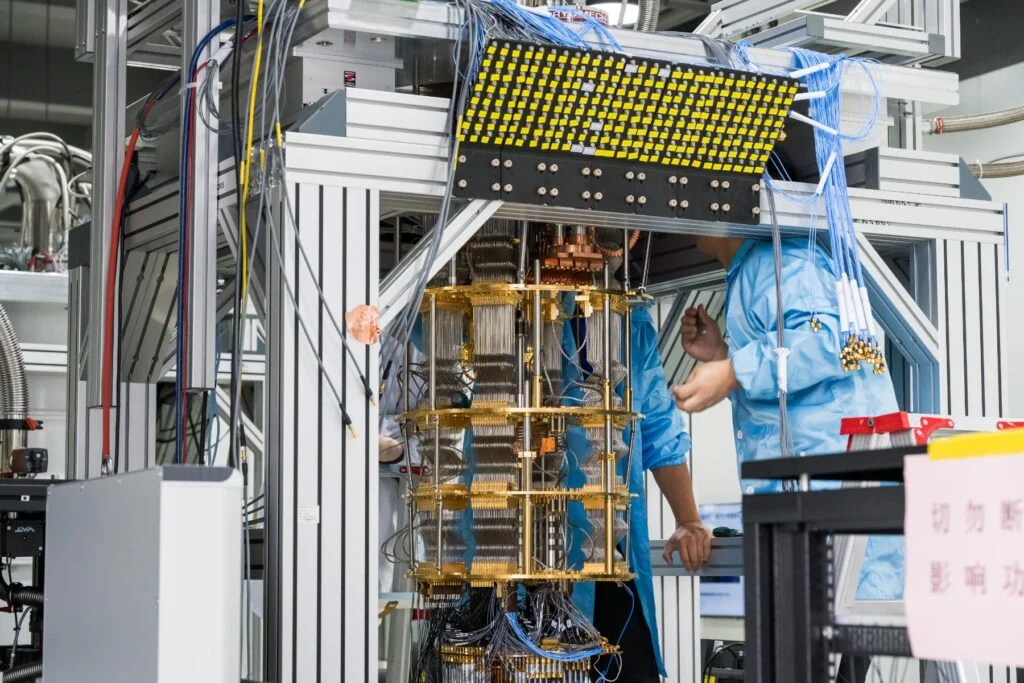

- IQ Capital is an investor in the quantum space. They are one of the backers of Nu Quantum.

IQ Capital, a deep tech-focused venture capital firm with offices in London and Cambridge, has successfully raised $400 million (£320 million) across two funds to further invest in the sector, UK Tech News (UKTN) is reporting.

The firm achieved a final close of $200 million (£160 million) for its fourth fund and simultaneously launched its second growth fund of the same size.

It’s likely quantum startups will be among the mix of deep tech companies that could receive a financial boost from the fund. IQ Capital is an investor in Nu Quantum, according to The Quantum Insider’s Intelligence Platform.

Max Bautin, managing partner and co-founder of IQ Capital, highlighted the significant opportunities within deep tech, including quantum. He also mentioned other target technologies including “novel AI” models to new energy and climate solutions, robotics and space tech and synthetic biology.

IQ Capital now boasts a total of over $1 billion in assets under management.

Kerry Baldwin, managing partner and co-founder of IQ Capital, emphasized the significance of deep tech in driving global technological advancements, telling UKTN, “Deep tech will play a pivotal role as both the UK and Europe continue to lead the way in developing technology that will have a lasting global impact.”

The venture capital firm primarily invests in seed to Series A stage startups in the UK and Europe. The newly launched growth fund aims to support startups across multiple stages and has allocated up to $30 million for investments in companies looking to expand internationally.

IQ Capital has already made notable investments, including protein generative AI startup DreamFold, which received financing from the firm’s fourth fund. Among its alumni investments are Grapeshot (acquired by Oracle), Bloomsbury AI (acquired by Facebook), and Phonetic Arts (acquired by Google). The firm’s portfolio also features companies such as TOffeeAM, a 3D printing software startup, and Nyobolt, a battery tech maker based in Cambridge.

The funding for IQ Capital’s fourth fund came from various sources, including British Patient Capital, institutions, funds of funds, family offices, corporates, and entrepreneurs.

If you found this article to be informative, you can explore more current quantum news here, exclusives, interviews, and podcasts.