This article on Chinese Quantum Companies and National Strategy was written from information and data on The Quantum Insider’s proprietary market intelligence platform and premium report: Quantum Technology in China.

Introduction

A Brief Overview of Quantum Computing

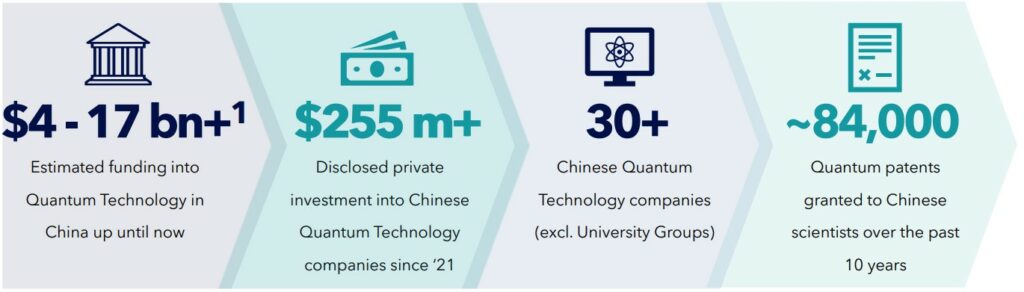

Quantum technology is anticipated to revolutionize computing, taking advantage of the world of spooky actions at the subatomic level. It is slated to improve and transform how we conduct large-scale optimization modeling, establish hacking-proof cryptography, and instantaneous communication from entanglement, to name a few. Quantum’s uses are undeniable, if not distant. Yet, as progress and discoveries climb the roadblocks, quantum has become one of the hot potatoes states use in their geopolitical tech race. China is no different, prioritizing quantum technology and Chinese quantum companies since 1985 amounting to today being estimated to comprise over 50% of the world’s public investment towards quantum.

Similarly, Chinese quantum companies are seen more frequently in the investment portfolios of Chinese VCs and angel investors, offering promising opportunities for the future. In this area, private investment is more than doubling each year from predominantly domestic private investors.

This article will uncover the difficult-to-attain information from inside the Middle Kingdom, China, shedding light on the nation’s public spending and private investments landscape of quantum computing. The metrics, data, and insights which made this article possible came from the bespoke Quantum Insider Intelligence Platform and the premium report which delves into greater detail on the points made.

China’s Role and Investments in the Quantum Technology Market

We are amidst a 21st-century technology race between the West and China. A competition not on space exploration but on emerging technologies such as AI and quantum.

The rising tensions between China and the US with geopolitical risks straining global supply chains have prompted China to seek technological sovereignty in advanced semiconductors, quantum technology, AI, and more.

As a result, China has increased its state funding to an estimated (but highly disputed) >$15 billion* in quantum research and advancement with its assorted applications from security to defense to AI.

Comparably, the recently announced 10-year plan to progress and commercialize quantum in the UK was £2.5bn ($3.125bn) from the £1bn allocated in 2014. Further, the Chinese state funding is double the committed total across the EU for quantum and four times that of the US.

Here are two shining examples of where the Chinese national spending and policy focus on quantum goes:

- The world’s largest quantum research facility in Hefei, Anhui Province, a 37-hectare National Laboratory for Quantum Science.

- The Chinese scale-up Origin Quantum attained $148m in Series B funding led by the state-owned venture fund Shenzhen Capital.

It goes without saying China is one of the global leaders in quantum, presenting opportunities for foreign investment and demanding attention from policymakers.

China’s Quantum Computing Market

Overview of Chinese Quantum Companies

In one snapshot, this is China’s quantum strategy and market:

Breaking down the Chinese quantum companies by segment reveals significant growth in quantum computing, despite the nation’s leading role in quantum communications and quantum dots. See the pie chart below.

Government Initiatives and Investments in Quantum Computing

The difference between the quantum investment market of the US to China is the different economic models underpinning the two nations. China has significantly higher public spending beyond simply R&D compared to the US. Whereas private investments in quantum technologies, research, and startups are substantially higher in the US than in China.

Here are the differences in four points:

- China’s public spending on quantum is four times higher than the US.

- US private investment in quantum is over 1350% higher than in China.

- There are over 10x the number of quantum startups and 6x quantum investors in the US to China.

- Interestingly, China holds over 30% quantum patents than the US. However, the patents resided in the US are accredited in globally respected journals for their scientific impact and innovation.

To venture outside the Pax Americana perspective, public spending in the UK comprises almost 0.12% of FY21 GDP with $4.4bn, 0.07% in Germany with $3bn and France with $2.2bn, and the pan-European Quantum Flagship initiative of 0.01% of GDP with $1.1bn.

In either case, China accounts for over 50% of the estimated global public investment in quantum allocated to research and Chinese quantum companies.

Because of the rising adversarial relationship between the US and China, the US is turning protectionist in its policies and national strategy. In August of last year, the signed CHIPS and Sciences Act aims to compete with China’s increasing focus and state funding towards advanced semiconductor sovereignty and Chinese quantum supremacy. The Act comprises $280 billion of spending to support advanced semiconductor research, advancement, and domestic manufacturing with emerging technologies such as quantum.[1] Furthermore, the Dutch imposed a trade restriction with China under US pressure, barring access to their Advanced Semiconductor Materials Lithography (ASML).[2]

These external factors and the geopolitical tech race will further spur China’s state and private spending with favorable policy incentives toward quantum technology and Chinese quantum companies. In other words, presenting opportunities for quantum investors and the attention of policymakers.

Chinese Quantum Achievements

China is one of the leading international players in quantum technology. To keep the cold war analogy motif, China became the first to launch a quantum-enabled satellite named Micius which some referred to as the 21st-century Sputnik. A quantum breakthrough that established an over 4,600 km quantum communications network between Shanghai and Beijing, comprising quantum radars and quantum decryption. We will circle back to this as a case study.

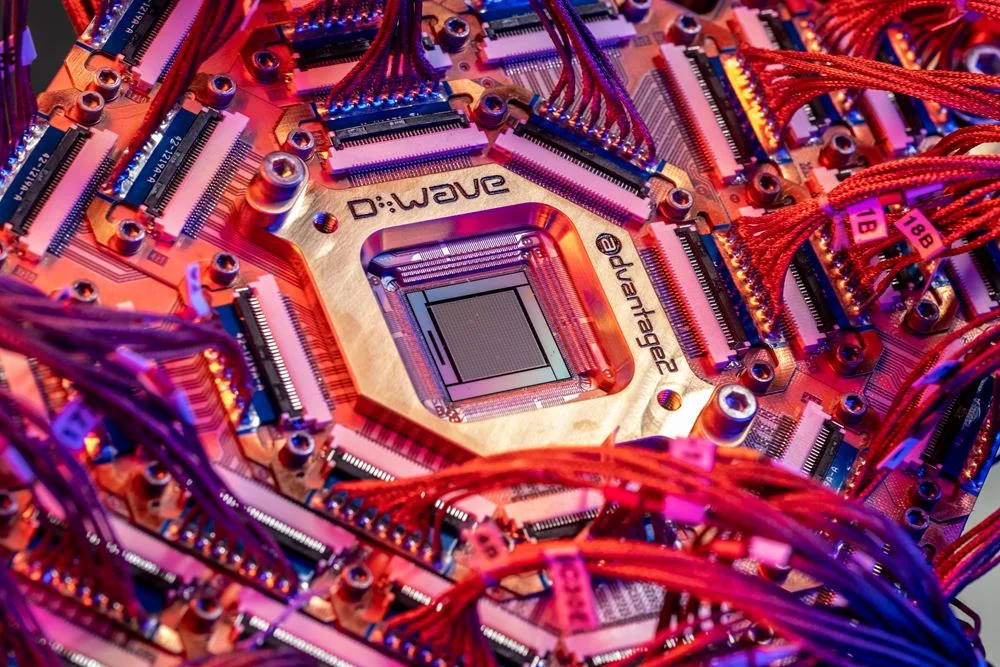

Further, a year after Google AI Quantum announced the capabilities of the Sycamore quantum computer achieving 53 Qubits with a declaration of quantum supremacy (a significant quantum advantage over traditional supercomputers), China announced they leapfrogged Google with two quantum computers named Zuchongzhi (superconductor quantum computer) and Jiuzhang 2.0 (photonic quantum computer), the former claiming 66 Qubits (although in demonstration achieved 58 Qubits).

A Focus on Chinese Quantum Education

Following the historical precedent, China’s policy changes obey a five-year plan, and as such, the latest 14th five-year plan from 2021 announced quantum technology as one of the key pillars of the Chinese technology sovereignty and Chinese quantum supremacy goal. Yet, becoming a leader in quantum technology is no easy endeavor with a high demand for educated white-collar labor.

Because of this, two Chinese education reforms titled the “Education Modernisation 2035 Plan” and the “Implementation Plan for Accelerating Education Modernisation” were set in place. Two legislative initiatives aiming to prepare the future Chinese for a quantum future funded by about 4% of the Chinese GDP, approximately $150-200bn yearly. While as a supporting measure, the Chinese state, since 2008, also encouraged student repatriation at leading Western universities.

Besides public schooling, Chinese quantum companies such as Origin Quantum, CIQTEK, and Alibaba have established in-house quantum education while frequently interacting with universities down to primary schools, sparking an interest in quantum technologies.

The Chinese Quantum Business Environment

Over 30 key quantum companies are active in China, spanning large tech conglomerates like Alibaba with Quantum Computing as a Service to startups like TuringQ developing optical quantum computer chips.

However, four key business figures behind the Chinese quantum environment are worth noting:

- Pan Jianwei, known as the “Father of Quantum”

- Guo Guangcan, the pioneer of quantum optics

- Guo Guoping, Origin Quantum founder

- Jin Xianmin, TuringQ founder

Four respected figures within quantum in China you can discover more about in the premium report this article is based on “Quantum Technology in China 2023 Review”, for their roles, legacy, and position within the Chinese quantum landscape.

The Chinese Private Quantum Investment Landscape

While the private investment environment for quantum in China is significantly smaller than its state spending, investments are rapidly growing.

By and large, quantum investments are centered around Pre-seed/Seed, Series A, and Series B of private quantum businesses. In 2021, $62m was invested into quantum startups, with over two-thirds classified as Seed funding. The following year, 2022, this investment figure more than tripled with $194m invested, with over two-thirds being Series B funding and the rest Series A. Likewise, 66% of these private investments went to Superconducting Quantum Computers, 31% to Photonics, and only 3% to Trapped Ion.

Here are three examples.

Three Case Studies: Quantum Computing Success Stories in China

Alibaba Quantum Computing As A Service

Active in quantum since 2015, Alibaba is a diversified tech conglomerate. The corporation today operates its own Quantum Lab Academy teaching employees and students about the prospects of quantum computing. Whereas Alibaba Quantum Laboratory is a full-stack R&D service offering an 11-qubit quantum cloud platform. Alibaba, to date, has reportedly further invested over $15bn into emerging technologies such as quantum (based on limited rumours).

Origin Quantum’s Soaring Rise in Quantum Technology

Origin was founded in 2017 and is a successful scaleup that offers quantum simulation in upskilling and training quantum computing developers. Origin further manufactures a two-qubit chip based on quantum dot technology and a six-qubit chip using superconducting. The scaleup has accrued a total of $163m and is ranked number six for total quantum patents globally, with the latest development of delivering a 24-qubit superconducting quantum computer.

The Chinese Breakthrough in a Satellite Quantum Communication Network

Marked as the Sputnik of the 21st century. In 2016, the Chinese defied reality by launching the first quantum satellite establishing a quantum communication network using entanglement to communicate instantaneously between Xinjiang Ground Station, Delingha Ground Station, and Ali Observatory. The quantum satellite Micius has since achieved entanglement-based quantum-key distribution, allowing for fully secure and encrypted communication.

The ultimate aim is to use this technology to achieve a secure quantum-based internet. As the latest announcement, in 2021, China accomplished the world’s first integrated quantum communication network from over 700 optical fibers with two ground-to-satellite links using quantum key distribution (QKD).

In conclusion

Driven by its national strategy to attain technological sovereignty and quantum supremacy in AI, quantum, advanced semiconductors, and more. China’s state funding in quantum research and improvement comprises over 50% of the world’s public spending on quantum. This considerable state focus on quantum has propelled China to be a global leader in pioneering and advancing a spanning quantum communications network and constructing the largest quantum research facility in the world.

So despite the significant disparity between China’s private investment landscape lacking behind the US, it is expanding at an unprecedented pace every year with an increasing number of startups and scale-ups further nurtured by large tech conglomerates like Alibaba.

Overall, China’s rapid advances in quantum technology, combined with significant state funding and increasing private investment, have positioned it as a major player in the global quantum market, presenting opportunities for foreign investors and policymakers to take note of the nation’s undeniable achievements.

If you want a detailed picture of China’s quantum market, investment landscape, opportunities, and more, check out the premium report: Quantum Technology in China 2023 Review.

Notes:

*It is difficult to accurately calculate and estimate China’s subsidizing and state investment in quantum due to lacking information availability and reliability.

[1] Badlam J, Clark S, Gajendragadkar S, Kumar A, O’Rourke S, Swartz D. The CHIPS and Science Act: Here’s what’s in it. McKinsey Co 2022:7. https://www.mckinsey.com/industries/public-and-social-sector/our-insights/the-chips-and-science-act-heres-whats-in-it.

[2] Sterling T, Freifeld K, Alper A. Dutch to restrict semiconductor tech exports to China, joining US effort. Reuters 2023:4. https://www.reuters.com/technology/dutch-responds-us-china-policy-with-plan-curb-semiconductor-tech-exports-2023-03-08/.

If you found this article to be informative, you can explore more current quantum news here, exclusives, interviews, and podcasts.