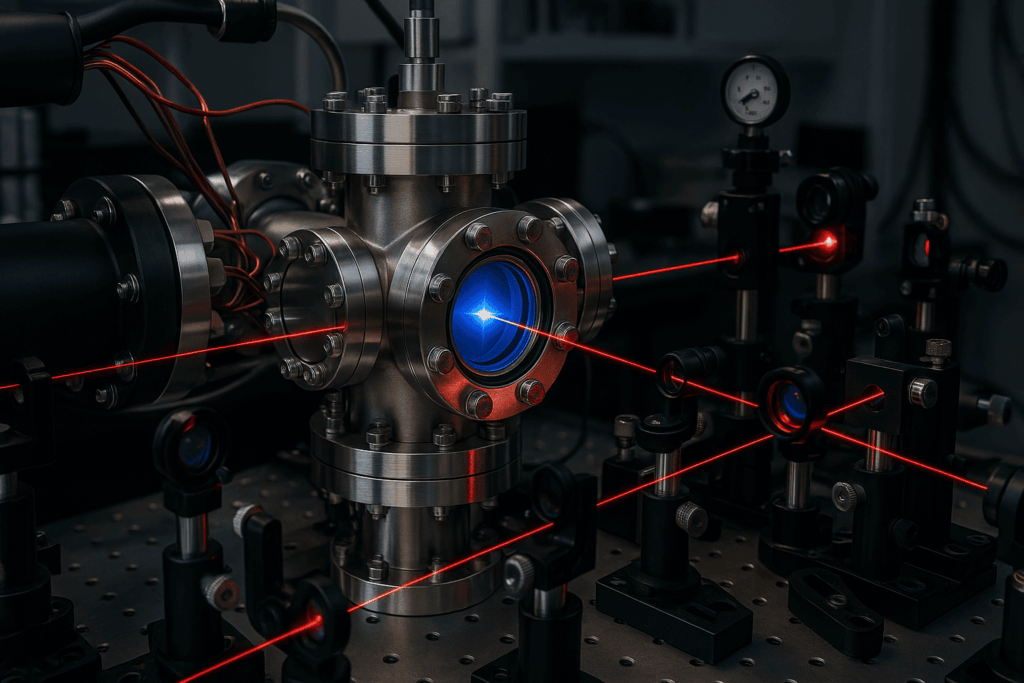

Rigetti Computing, a pioneer in quantum computing, is facing de-listing, according to a letter to investors from Nasdaq.

Nasdaq reports that Rigetti, one of the first quantum tech companies to test the public market, is in violation of the stock exchange’s bid price rule. The rule states that the closing bid price of a company must maintain a minimum bid price of $1 a share for the previous 30 consecutive business days. Rigetti is currently trading at around .90 a share and last briefly hit $1 in mid-January.

According to Nasdaq, the superconducting qubit-based company could regain compliance if at any time during this 180-day period the closing bid price of the Company’s common stock is at least $1.00 for a minimum of ten consecutive business days. If Rigetti is unable to regain compliance before the compliance date, Rigetti could be eligible for an additional 180 calendar days to satisfy the stock exchange. To qualify, the company will be required to meet the continued listing requirement for market value of publicly held shares and all other initial listing standards for Nasdaq with the exception of the bid price rule.

One possible approach to compliance is through a reverse stock split, which would need to be conveyed in a written notice to Nasdaq.

The potential delisting is the latest in a string of setbacks for the company. In November 2022, Chad Rigetti stepped down as CEO of the company and was replaced by Subodh Kulkarni. The company’s third quarter results were also delayed.

Rigetti announced a special purpose acquisition company — or SPAC — merger deal with Supernova Partners Acquisition II Ltd. in October. The Rigetti SPAC closed on March 2, 2022 after a Feb.28 vote of Supernova shareholders on February 28, 2022. Then, the value of the company was set at about $1.5 billion. Based on today’s stock price and shares outstanding, the company is worth a little over $100 million.

SPACs, which have recently fallen out of favor, were considered faster ways to take a company public, compared to the initial public offering — IPO — route.

If you found this article to be informative, you can explore more current quantum news here, exclusives, interviews, and podcasts.