Moody’s establishes new initiative, partnerships roadmap, and use cases all focused on quantum computing for the financial services industry and beyond

By Sergio Gago Huerta – Managing Director of Moody’s Quantum Computing

At Moody’s, how we leverage technology to deliver data, analytics, and insights is an integral part of how we provide solutions to our customers. It’s core to our global risk-assessment strategy. In fact, Moody’s has a rich history of empowering customers with through advanced technologies from cloud computing to artificial intelligence to blockchain. A strong example of this validation is the annual Chartis RiskTech 100 report, which recognized Moody’s Analytics with the #2 overall ranking out of 100 of the best companies in comprehensive risk management.

Today we’re excited to announce a quantum leap forward with our exploration of quantum computing, which promises extensive improvements for computationally expensive problems. To that end, we’ve created the Moody’s Analytics Quantum Computing Team. As managing director, I will lead the team with resources in the U.S. and Europe; the group will report into Caroline Casey, General Manager of Customer Experience and Innovation.

When cloud computing came along, for example, we envisioned how it could help us deliver more value to our customers and achieve our growth goals. Quantum takes this approach to the next level, potentially many times more valuable as it leads to greater competitive advantage at scale by improving our products’ accuracy, speed, and capabilities.

Moody’s actually began its quantum journey several months ago to uncover use cases, develop partnerships, and internal capabilities to help identify where quantum will be relevant to producing an enhanced solutions portfolio. Initial use cases include implementation of some of Moody’s proprietary models for economic capital, and risk modelling and portfolio management in the banking, insurance, and buy-side solutions the company has in the market.

The more powerful computing by quantum offers the potential to revolutionize our ability to dimensionalize risk and provide even better solutions for customers.

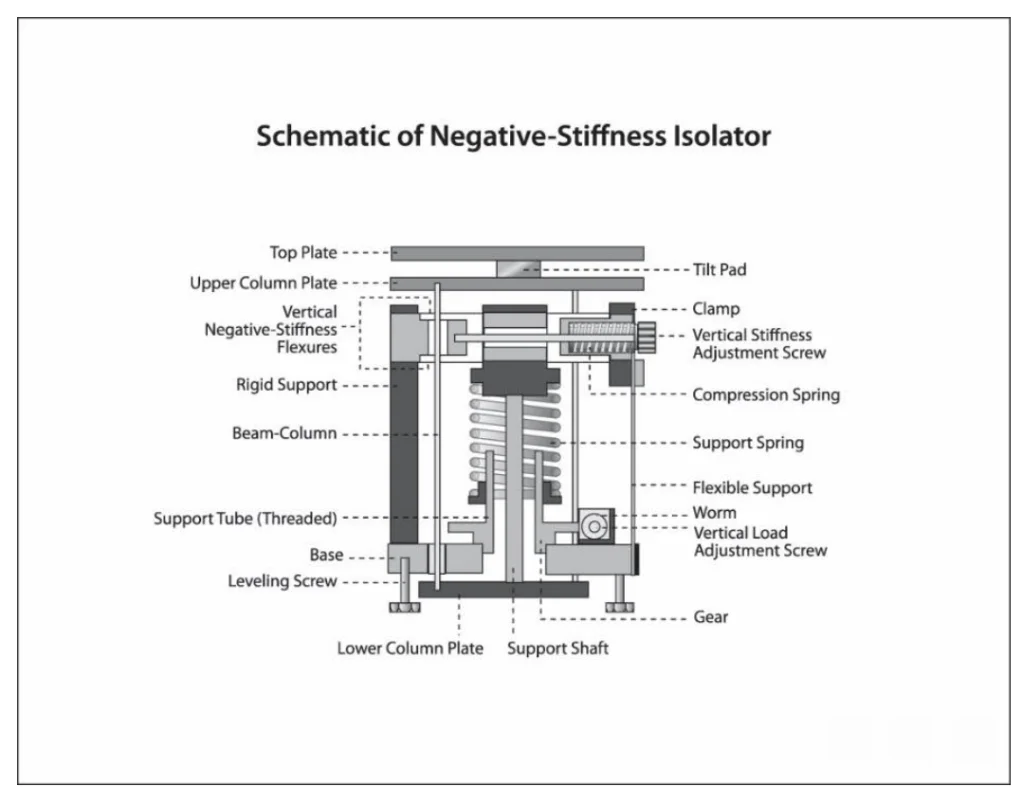

The quantum computing industry is still in a state of maturation and the consensus is that practical, production-ready solutions will take a few years. But an investment today is what yields the results of tomorrow. And when we combine the right hardware and algorithms with that investment, Moody’s will be well-positioned to apply this technology to its products.

This is also a fantastic opportunity for partnering not only with hardware and algorithm providers but with some of Moody’s key clients on developing specific solutions and use cases based on quantum. Strategic partnerships will be critical to success in this space, particularly with hardware and algorithm providers, and we anticipate announcing some of them in the coming weeks and months.

Moody’s vision is that quantum computing algorithms will only be as good as the mathematical and financial models that underpin them. Extensive industry and domain expertise is critical to build quantum algorithms that are not just fast, but also adapted to the realities of the industry. That includes credit modelling, optimization, or compliance requirements like the upcoming Basel IV banking reforms.

Moody’s has some of the best quantitative analysts, the best models, and the best data sets. By researching quantum possibilities, we increase our options to solve those problems exponentially faster and create a unique and compelling competitive position.

This is just the beginning. And we believe now is the perfect time to accelerate our interest in quantum computing. We are currently hiring quantum application specialists. If you know people interested, or have partnership and collaboration enquires you can reach out to me (sergio.gagohuerta@moodys.com) or follow this link to see our related job postings.

If you found this article to be informative, you can explore more current quantum news here, exclusives, interviews, and podcasts.