Insider Brief

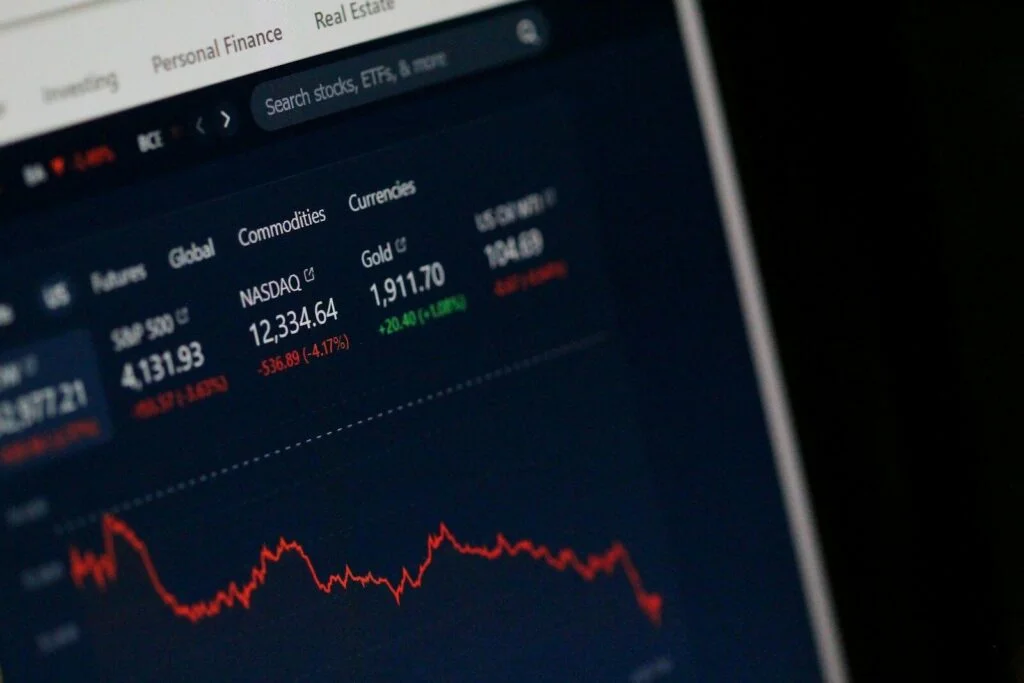

- Rigetti Computing, Inc. reports revenue for the second quarter of fiscal year 2022 was $2.1 million, increasing by 39% from $1.5 million in the prior year period.

- Adjusted EBITDA for the second quarter of 2022 was a loss of $15.1 million, versus a loss of $8.1 million in the prior year period.

- Offers an encouraging update on the company’s technological roadmap and still on track for an 84-qubit system 2023.

- Rigetti Computing is listed on NASDAQ as RGTI and found on TQI’s Intelligence Platform here.

In its second quarter earnings report, Rigetti Computing Inc. reported a revenue of $2.1 million, a 39% increase from same period last year. The company saw a loss of $15.1 million, compared to $8.1 million in the same period, and also reported cash and cash equivalents of $184.0 million as of June 30, 2022.

In the report and on the earnings call, Rigetti CEO and Founder Chad Rigetti said that revenue and losses were about in line with they expected — and gave an upbeat forecast on the company’s future, as well as its ability to deliver on the technological roadmap.

“We delivered against our core objectives for the second quarter 2022 results, advancing our product roadmap, continuing to attract key talent, and strengthening our base of customers and partnerships,” said Rigetti. “Our technical teams made tremendous progress in the second quarter, and we remain on track to meet our anticipated roadmap milestone previously announced in connection with our first quarter 2022 earnings results. We also deepened existing relationships and won new deals in the U.K. and U.S. as we continued to work hand-in-hand with top organizations in pursuit of quantum advantage.”

Potential Setbacks

Company officials did call out potential problems that could impact the bottom-line for 2022, but that news doesn’t look severe.

According to the earnings release statement, the company had earlier estimated that revenues for fiscal year 2022 to be in the $12 million to $13 million range. However, the process to secure a $4 million contract with a government agency, which was included in those previous estimates, has taken longer than anticipated. Revenue recognition for some or all of that estimated figure could be deferred to a fiscal period after 2022 if negotiations are not completed and contracts are not executed until after 2022.

That would mean that the loss would be greater than the $50 million to $53 million range that was predicted in May.

Roadmap on Track

The company reports its planned single-chip 84-qubit quantum computer is on track for in 2023 and a 336-qubit multi-chip processor later in 2023. If they continue to deliver on the roadmap that means a 1,000+ qubit system would be ready in late 2025, and a 4,000+ qubit system in or after 2027. The patented, multi-chip scaling technology would be used in both its planned 1,000+ qubit system and its planned 4,000+ qubit system.

“We are very excited about our product roadmap and remain on track to meet our technology roadmap targets announced in connection with our first quarter 2022 earnings. We are making excellent progress on our 84 qubit system planned for 2023. We recently completed the design of the chip packaging and expect to begin testing chips this month. This next generation processor will be the first to introduce a new lattice expected to bring higher conductivity and our tunable coupling technology.”

Equity Facility

In a tough macroeconomic environment, Rigetti said that the company has resources to draw on, specifically, a committed equity facility, which is a source of credit that can be called on for loans to a company.

Under the terms of this agreement, Rigetti could issue up to $75 million of shares of its common stock to B. Riley. Further, the company issued to B. Riley 171,008 shares of common stock as consideration for B. Riley’s commitment to purchase shares of Company common stock under the agreement.

“We believe this facility should provide financial flexibility to support our continued focus on our mission and business plan,” Rigetti said in the earnings call. “Given the current macro environment, we believe this is both prudent and an important vote of confidence from the capital markets. With technology advancements, business progress, and the potential to add cash to our balance sheet, we are moving with focus and intention towards our mission.”

Brian Sereda, Chief Financial Officer, elaborated during the earnings call, adding that the equity facility is a vote of confidence from the market.

“While our balance sheet remains in good shape we believe that having access to capital markets further strengthens our balance sheet and is prudent given the amount of general uncertainty and depth and duration of both the current macroeconomic and capital markets downturn,” Sereda said. “We believe additional working capital on our balance sheet would allow us to remain focused on our key priorities and technology roadmap. We also believe that having access to capital is another important vote of confidence from the equity markets despite current conditions.”

Recent Business Developments

The company also updated on the following key business developments:

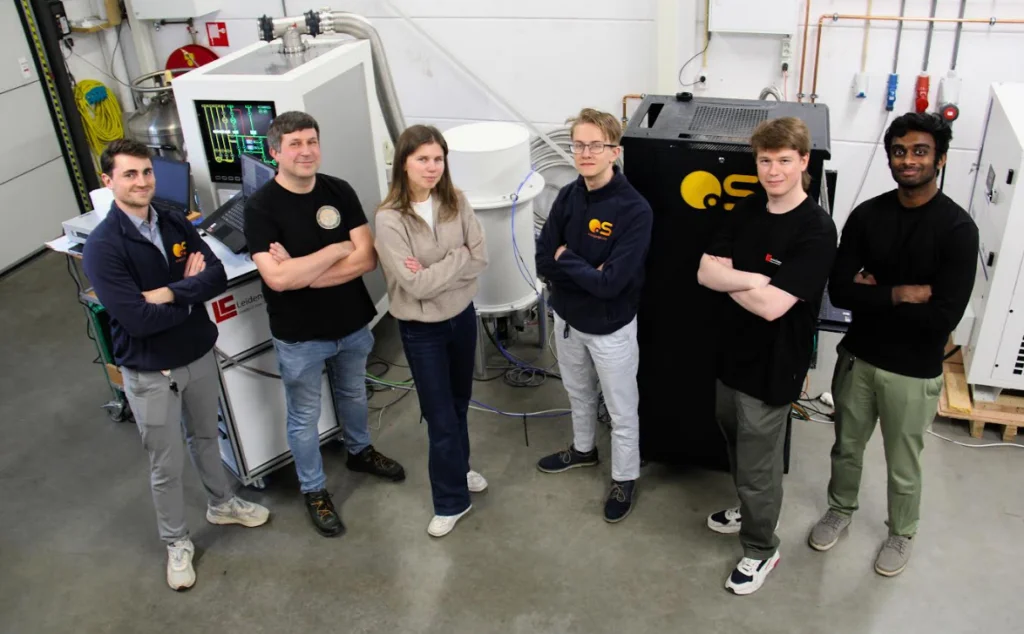

- Rigetti announced the launch of its 32-qubit Aspen-series quantum computer in the U.K. on June 21, 2022. As Rigetti’s first U.K.-based quantum computer, this system is expected to be available over the Cloud through Rigetti QCS™ to the Company’s U.K. partners, including Oxford Instruments, the University of Edinburgh, Phasecraft, and Standard Chartered Bank. The Rigetti-led consortium aims to advance practical quantum computing applications in the areas of machine learning, materials simulation, and finance, and is backed by funding from the U.K. government’s Quantum Technologies Challenge, led by U.K. Research & Innovation. Delivering this system achieves a key milestone of the consortium in its efforts to accelerate the commercialization of quantum computing in the U.K.

- Rigetti UK Limited, a wholly owned subsidiary of Rigetti, jointly received two Innovate U.K. awards on April 29, 2022, as part of the ISCF Commercializing Quantum Technologies Challenge. Rigetti expects to utilize each award alongside its partners to make advancements within critical areas of quantum computing. As part of the awards, Rigetti and Riverlane plan to work together on research and development for quantum error correction. Additionally, Rigetti, Phasecraft, and BT (formerly British Telecom) plan to develop quantum algorithms and software for solving optimization and constraint satisfaction problems with quantum computers.

- Rigetti has been selected by the Defense Advanced Research Projects Agency (DARPA) to lead a program to develop benchmarks for quantum application performance on large-scale quantum computers. The program is worth up to $2.9 million to Rigetti and its partners over three years based on the achievement of certain milestones, of which approximately $1.5 million is subject to DARPA’s exercise of an option to extend the initial eighteen-month term. This award is part of DARPA’s Quantum Benchmarking Program. The goal of this program is to re-invent key quantum computing metrics, make those metrics testable, and estimate the required quantum and classical resources needed to reach critical performance thresholds.

- Following the conclusion of the 2022 Russell indexes annual reconstitution, Rigetti was included in the Russell 2000 index.

Rigetti has been trading between $4.06 and $4.85. Its 52-week high was $12.75.

You can find more information on Rigetti’s investors page.

For more market insights, check out our latest quantum computing news here.