PRESS RELEASE — Quantonation Ventures announces the final closing of its first fund dedicated to Quantum Technologies at € 91 million, exceeding its initial target of €50 million.

In a statement, Quantonation reports that within three years has been able to put on a launch pad the most promising Quantum Tech companies in the world and establish itself as the largest investor in the field.

The company writes: “Three years and a half ago, we founded Quantonation with the fierce conviction that the 2nd Quantum Revolution was finally coming: thesScience that had been elaborated over the last 100 years with success could at last be turned into devices and applications in the fields of sensing, communications and computing. A key challenge we’ve identified from the start is the huge entry barrier resulting from the complexity of the concepts and the relative immaturity of the sector, leading sometimes to claims that are unfounded.”

The team reports that it has been successful at internalizing a deep expertise, leveraging a network of experts, building

connections with the leading ecosystems worldwide to source the best companies and making sound investment decisions, with 19 companies in the portfolio and 2 exits already.

Quantonation has invested in spin-outs from the most recognized universities all over the world, including MIT, Ecole Polytechnique, Ecole Normale Supérieure, l’Institut d’Optique, Oxford University, Waterloo University and University of Sherbrooke. They have also monitored more than 400 startups developing quantum technologies, constituting the largest deal flow in the field.

Christophe Jurczak, Managing Partner said, “Thanks to this successful Final Closing beyond our own ambitious target, we will be able to pursue scouting for the best quantum companies in the world and supports a fantastic roster of founders in their entrepreneurial journey, in the long term. This will be also a great opportunity to expand the team and deepen our scientific expertise beyond our current focus. This amazing journey is only starting.”

As a first step, and because investing in Quantum a few years ago was not as obvious a value proposition as it is now, the company made their first investments from an ad-hoc holding company before raising for a new more ambitious investment vehicle, our fund Quantonation 1, last year. Quantonation 1 invests in early-stage companies, from Seed to Series A and holds all the participations the team has invested in since 2018.

Jonathan Sibilia, Partner Molten Ventures stated, “Quantonation is a great example of what we seek when investing in an emerging GP: subject matter experts able to seize the value of an emerging industry. Deep tech companies are the long-term drivers of massive change, we must nurture these companies to help them achieve their potential. We’re convinced by Quantonation’s vision and ability to incubate the next generation of leading deep tech companies.”

According to the statement, the multiplier effect of its first tickets is impressive: the portfolio companies raised in total more than €100 million of VC money materializing a strong appetite from co-investors (x3 on Quantonation’s ticket), and as much non-dilutive public money, materializing the priority that Governments worldwide put on quantum technologies. This led to the creation of more than 200 jobs during the last 3 years, and the team is proud that this provides new opportunities for young PhD to express themselves after their academic training.

“We’ve been blessed to be joined in our journey to materializing the impact of quantum science into the public’s life with a list of trailblazing innovators, corporates, funds of funds, family offices, with the strong support of the Fonds National d’Amorçage 2 (the French Seed Fund) which is managed by Bpifrance on behalf of the French State and Audacia,” the team writes in their statement.

Markus Solibieda, Managing Director of BASF Venture Capital GmbH said, “Quantum computing can have a significant impact on many industries, including chemicals, pharmaceuticals, automotive, aerospace, and finance. Quantonation has demonstrated a strong track record in deep tech companies focusing on industrial applications. We are proud to join this important investor in Quantum technologies to support young up-and-coming companies in this exciting field.”

Quantonation will also support companies at later stage through another vehicle dedicated to companies raising larger financing rounds.

Olivier Tonneau, Partner Quantonation, said “After the success of Quantonation 1, there is a fantastic opportunity for Quantonation Ventures to complete its offering of investment vehicles to LPs and consolidate its position as the leading investor for the emerging quantum economy. That’s why we are launching Quantonation Ventures’ Quantum Opportunity Fund to support scale-ups of European Quantum startups.”

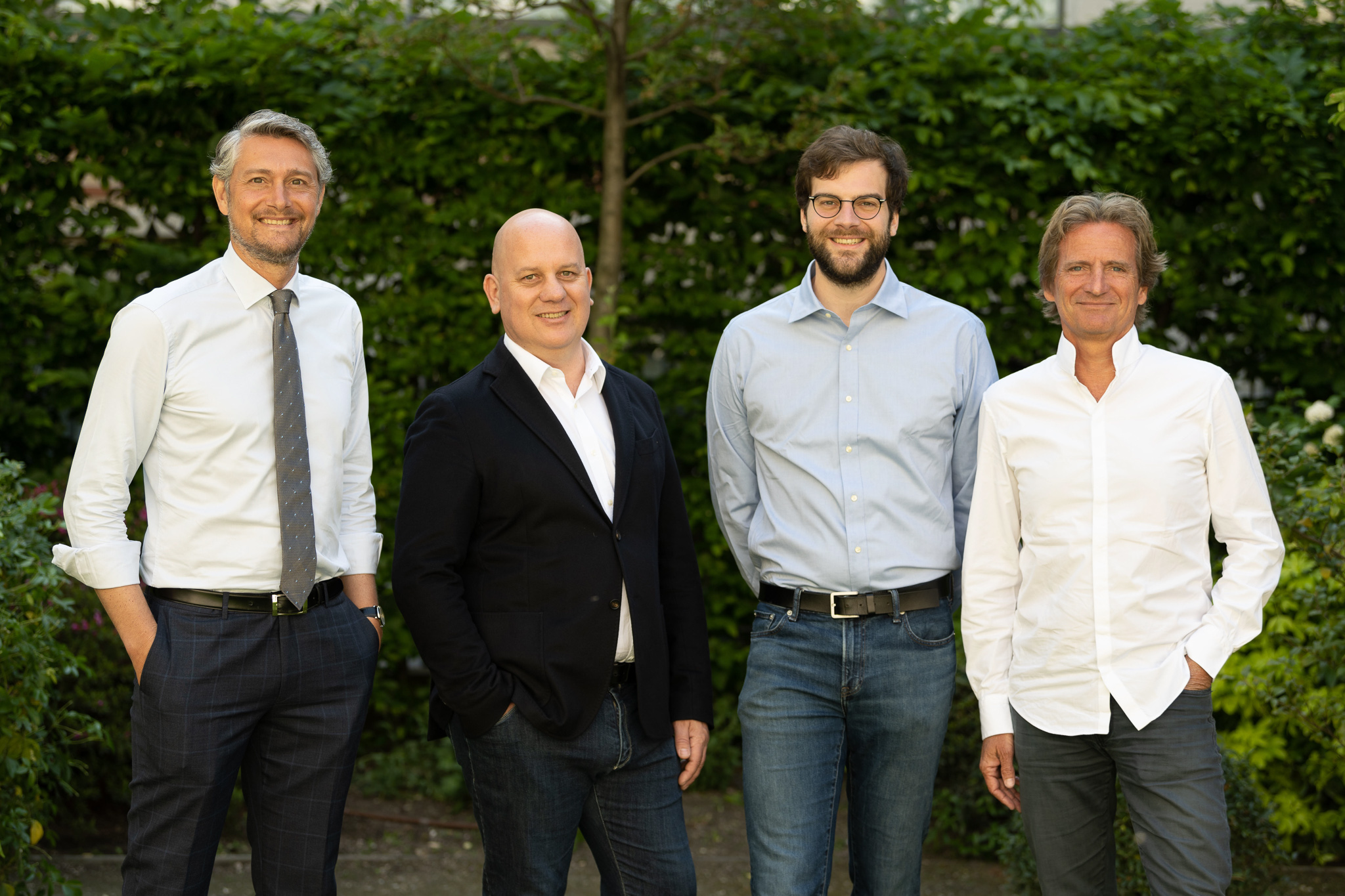

The fund Quantonation 1 is managed by Quantonation Ventures, headquartered in Paris, investing globally, and counts on the expertise of its team composed of Christophe Jurczak, PhD, Charles Beigbeder, Olivier Tonneau and Jean-Gabriel Boinot-Tramoni. We welcome unique backgrounds and are very focused on the diversity within our portfolio.

For more market insights, check out our latest quantum computing news here.