A scathing short report on IonQ was released yesterday by Scorpion Capital, helping drive a 10% decline in the IONQ stock price. Scorpion have accused IonQ, the developer of Ion Trap based Quantum Computers (QCs) of being a hoax.

In a sharp rebuke of the company, allegedly based on interviews with former employees and executives, the financial services company that specializes in finding companies to short said in a report that IonQ’s much-touted latest iteration of its technology, essentially, did not exist.

Scorpion has previously put out reports on Ginkgo Bioworks (biotech), Berkeley Lights (biotech)and Quantumscape (batteries), among others.

The report claims that the company’s 32-qubit computer is a toy and not capable of useful calculations. Scorpion also criticized the company’s executives, saying the company was a “side-hustle” to their academic careers.

We think the 183-page report is interesting for several reasons, which we cover below. We will let our readers make their own judgements on the efficacy of the statements pertaining to IonQ and the management team, but there are a few cautionary areas to flag that are relevant for the industry as a whole.

Ioniq Scorpion Capital’s Report – Cautionary Areas

-

Opinion is still divided on the achievability of commercial scale quantum computing:

One of the most egregious things we found in the Scorpion report was the presentation of a limited set of opinion pieces proposing quantum computing as a “mathematical impossibility”. It cannot be stressed enough that there are many individuals and organizations across the world who do not believe this and are working hard to solve the myriad engineering challenges to make useful devices.

-

Adding 1+1 is not a quantum computer’s core competency:

Much of the Scorpion report goes into the claim that IonQs devices are effectively hacked together experimental toys. It is well understood by most in the industry that QCs are not solving real-world problems at any scale currently. Putting aside exact error rates of the IonQ devices, it will come as no surprise that running a simple 1+1 calculation is not the way to effectively use future quantum computers. It has been made abundantly clear by many reports and articles that future quantum computers will not be appropriate as replacements to classical computers and will instead likely be used to help significantly accelerate a specific set of computational tasks. Whilst we recognize this was shown to challenge IonQ’s claims of having any degree of technological superiority, its not a particularly helpful analysis.

-

Quantum goes public:

The existence of such a report shows that there is a growing interest in the listed quantum companies. An industry which has previously been sitting in research labs and bolstered by grants and VC money is now subject to the same exposures as other public companies. We expect that many who contributed to the expert calls that investment funds rely on to make their decisions were not expecting their quotes to appear so starkly in a report attacking a specific company.

-

Public markets come with pressures:

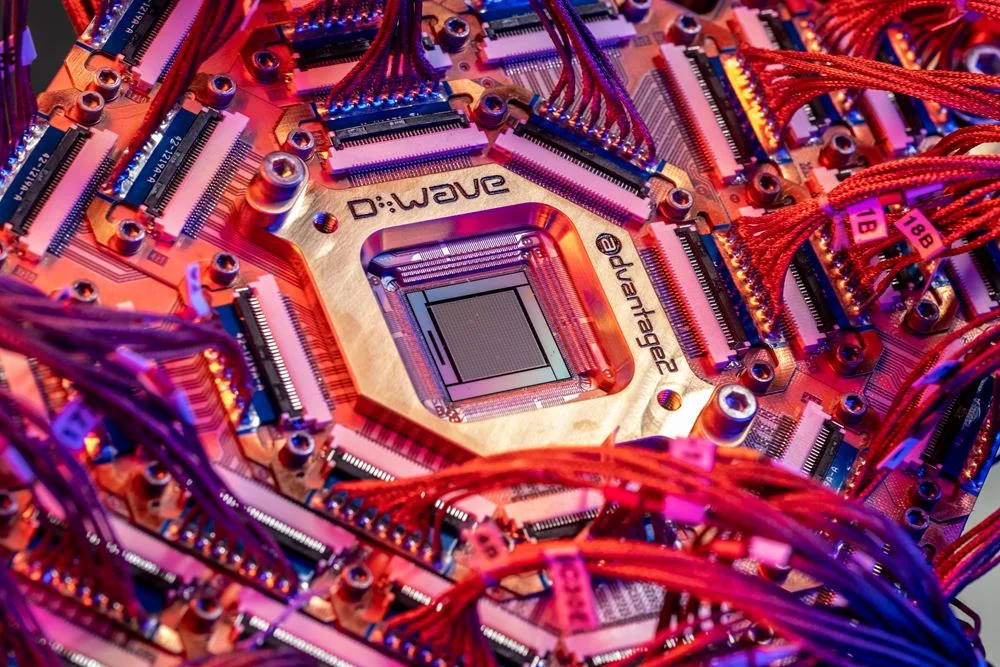

the last few months have seen Arqit, Rigetti, IonQ go public through a SPAC process (with D-Wave anticipated next), joining other existing quantum computing stocks. As part of the listing process companies need to issue a prospectus and investor presentation (amongst other less commercially interesting documents) which include many of the forward-looking statements pertaining to technology readiness and revenue. Companies must strike a fine balance between explaining the investment thesis and painting the future potential of the business without straying into hype and misinformation. Much of what is covered in the Scorpion report is an attack on where IonQ have been alleged to go too far in this regard. This is going to be an area of critical importance to get right going forward.

-

Revenue should be reviewed:

One area that stands out is the recognition of revenue, an area where IonQ has been accused of “round tripping”. Whilst a headline income statement will not call this out, there is a profound operational difference between initial consulting revenue from test customers (which is where most of the quantum computing hardware is today) and recurring “as a Service” revenue from daily, embedded workflows. Like in any industry, investors should treat revenue in early-stage businesses with a skeptical eye and be even more careful about projections put out by companies.

It’s the second big shot-across-the-bow for quantum companies that used special purpose acquisition company — or SPAC — approaches to going public. Last month a Wall Street Journal article on Arqit referred to the British quantum encryption start up as overstating its prospects. Quantum companies were not the only SPACs that have been targeted by Wall Street watchdogs. The SEC, itself, has proposed changes to SPACs to put them more in line with initial public offerings. With the vast increase in capital flowing into the industry (see our quantum industry data) we expect we will start to see more such pieces.

Many industry stakeholders are concerned that news such as this will bring along the much feared Quantum Winter – a period where a “loss of faith” in quantum technology could dry up financial interest and investment but also – critically – risk pulling money out of important research institutions and labs.

This is of course a concern for everyone in the industry but at The Quantum Insider we are cautiously optimistic. After a period of over-excitement in 2019 after the Google Quantum Supremacy announcement the industry has mostly coalesced around a more balanced assessment on the state of the market. This sees most organizations wary of hype, and pursuing fundamental research that could – in the future – profoundly change how we approach certain important problems across many industry sectors. We hope that the influx of investment dollars continues to come with the disclaimer that companies are pursuing deep technical research into an unproven technology.

If you found this article to be informative, you can explore more current quantum news here, exclusives, interviews, and podcasts.