The Wall Street Journal is reporting that ex-employees are among the critics questioning the technological effectiveness and readiness of Arqit Quantum, a U.K. quantum cybersecurity startup.

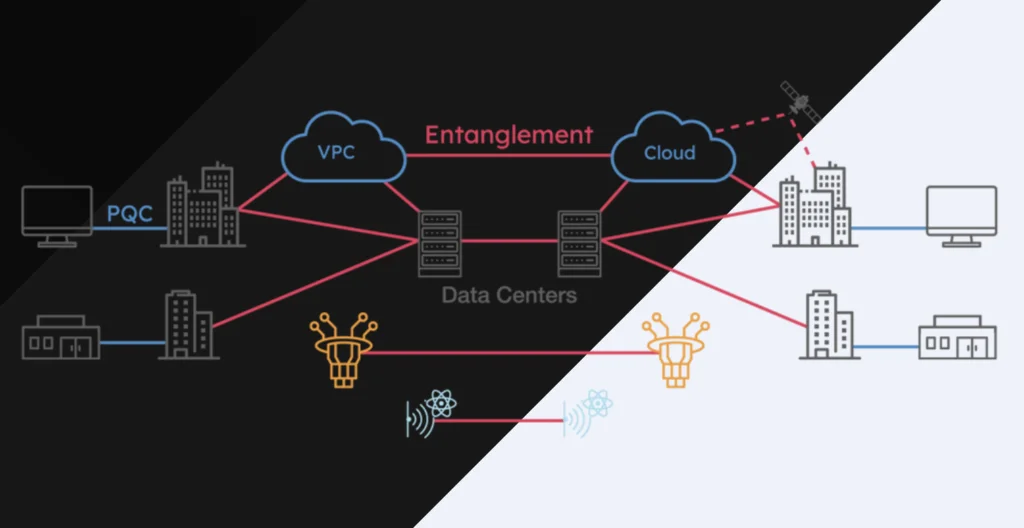

According to the WSJ, government cybersecurity experts in the U.S. and the U.K. doubt the relevance of Arqit’s system, called QuantumCloud. The paper also added that it has reviewed documents and interviewed former employees who say Arqit is overly optimistic about its future revenue and suggested the company’s encryption system was at the prototype stage.

The WSJ also reported that Arqit’s chief revenue officer resigned last year after raising concerns about overstating contracts and unrealistic revenue projection. Several other former employees said they shared those concerns about the business model and technological maturity, the WSJ added.

Last year, Arqit announced that it would be going public through a special purpose acquisition company, or SPAC. The deal implied a $1.4 billion market cap. In September, the company began to trade on NASDAQ.

A company representative disputed the allegations, telling WSJ: “This was a live production software release and not a demonstration or trial. It was being used by enterprise customers on that day and subsequently for testing and integration purposes, because they need to build Arqit’s software into their products.”

In announcing the SPAC, David Williams, Arqit CEO, said “After four years of innovation in stealth mode by a world leading multi- disciplinary teams of scientists and engineers, we are ready to go to market. This technology is important and we need to take it to hyperscale as quickly as possible, because the problems we solve are problems for everyone.”

The critics of the company allege that the technology could only be used for niche customers, the WSJ reported.

The company listed its customers as UK Government, the European Space Agency, BT plc, and Sumitomo Corporation and reported that Verizon, BP, Northrop Grumman and Iridium were testing its technology.

Arqit’s stock price reached a high of $38.06 in November, but has since fallen to a trading range in the $15 a share range, although tech stocks, in general have pulled back from pandemic highs. Currently, the stock has fallen over 15 percent to settle around $12 per share.

Cybersecurity is a key use case for quantum computing. Quantum computers, at a certain level of maturity, could crack the most common cryptographic techniques used to protect current networks and devices making them vulnerable to hackers. National security, similarly, would be exposed to cyber attacks through quantum computers.

For more market insights, check out our latest quantum computing news here.